Real estate for senior citizens - 26,000 units missing annually

Anyone who has been in the situation of having to quickly accommodate a relative knows about the dramatic shortage of places. By 2040, over 26,000 new units in service living will be needed - additionally, per year. There is no doubt that more capacity is needed - but in the right places.

Getting a full inpatient care place close to home or a flat in service living for seniors in the desired facility is usually only possible for seniors via - usually very long - waiting lists. Seniors and their relatives are therefore on the lookout: for a short-term solution in an acute case, or for a desired solution that meets the needs of active, independent seniors for a barrier-free flat with social life. When the baby boomer generation enters retirement age in the coming decade, the need for a differentiated supply of care and housing will increase enormously. By 2040, demographic factors alone will require an additional 20,700 care places or 26,100 residential units in service living per year. Since 2019, however, only about 7,500 care places have been completed in 90 care facilities and 4,000 residential units in service living in about 200 residential complexes on average per year. Filling this gap of about 13,000 care places and about 22,000 service flats per year does not seem feasible given the current break in new construction activity.

Focus on high-income regions - but who builds in the countryside?

Especially since the creation of supply is highly selective regionally: New facilities are not necessarily built where demand is highest, but where building is simply still profitable. Agglomeration areas and high-income regions are the focus of project developments. Especially rural areas with a high proportion of senior citizens remain "blank spots" on the map, which will sooner or later lead to a worrying supply gap in peripheral areas.

The capacities in new construction must be massively expanded in all segments so that care and living for seniors does not become an exclusive product and the responsibility of society as a whole for "our elderly" is not reduced to absurdity. But who puts the properties on the market? Who are the developers and how can they be categorised, for example, according to their exit strategy? Who is on the investor side?

Only every second new property goes into sales

As part of a study for Carestone Group GmbH in June 2022, bulwiengesa evaluated and analysed the provider market in the new construction of inpatient care facilities and service living for senior citizens. A total of around 1,300 facilities with construction dates from 2019 to 2022 were verified and evaluated from the bulwiengesa RIWIS database and categorised with regard to the sales and investment strategy of the project developers and investors.

On the one hand, the initiators of the projects were grouped under "developers". These are divided into classic project developers with an intended exit (trading development) and portfolio holders as investors or also as operating companies (investor development). On the other hand, there is the group of investors who take or hold the properties in their portfolio. Here a distinction was made between institutional investors, operating companies, private investors (WEG), municipal housing companies and cooperatives.

In the case of new construction projects in both inpatient care and service living for senior citizens, only every second property completed or under construction since 2019 has been sold. On the buyer side are institutional investors (22%), but also private investors (27%). For a long time, the division of care facilities into part-ownership units and their individual sales was considered a niche product. However, with a market share of 27% of all new-build properties since 2019, a market-relevant investment product has grown up here.

Portfolio holders and, in particular, operating companies are actively involved in the creation of supply of properties for the elderly. Around 20 % of inpatient care facilities are realised by operating companies such as Evangelische Heimstiftung GmbH or Korian Deutschland AG, which initially hold the properties in their own portfolio. Operating companies only appear as a buyer group in isolated cases. In addition, not only investor companies, but also cooperatives and municipal housing companies are among the portfolio holders.

Conclusion

The low market share of municipal housing companies and cooperatives in new construction activities shows: The market urgently needs private capital to expand supply capacities. Domestic and foreign investors are waiting in the wings to acquire properties, but due to the lack of supply of new construction projects on the investment market, they are turning to existing properties. Above all, however, senior citizens often have to move out: If they cannot afford to wait for the "desired solution" due to their health, their only option is to move into a facility that has free capacity at the moment - regardless of whether this means a change of residence or even the unwanted move into a double room.

Note: The text first appeared in a slightly amended version in CARE INVEST 6-2023

Contact: Sabine Hirtreiter, Senior Consultant at bulwiengesa, hirtreiter@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

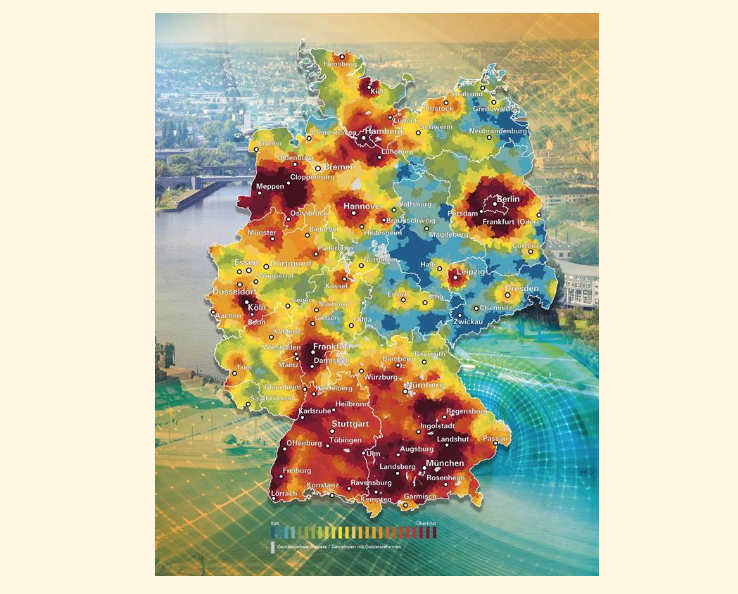

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeHow hot are the housing markets?

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map"Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.