BF.quarterly barometer Q3/2024

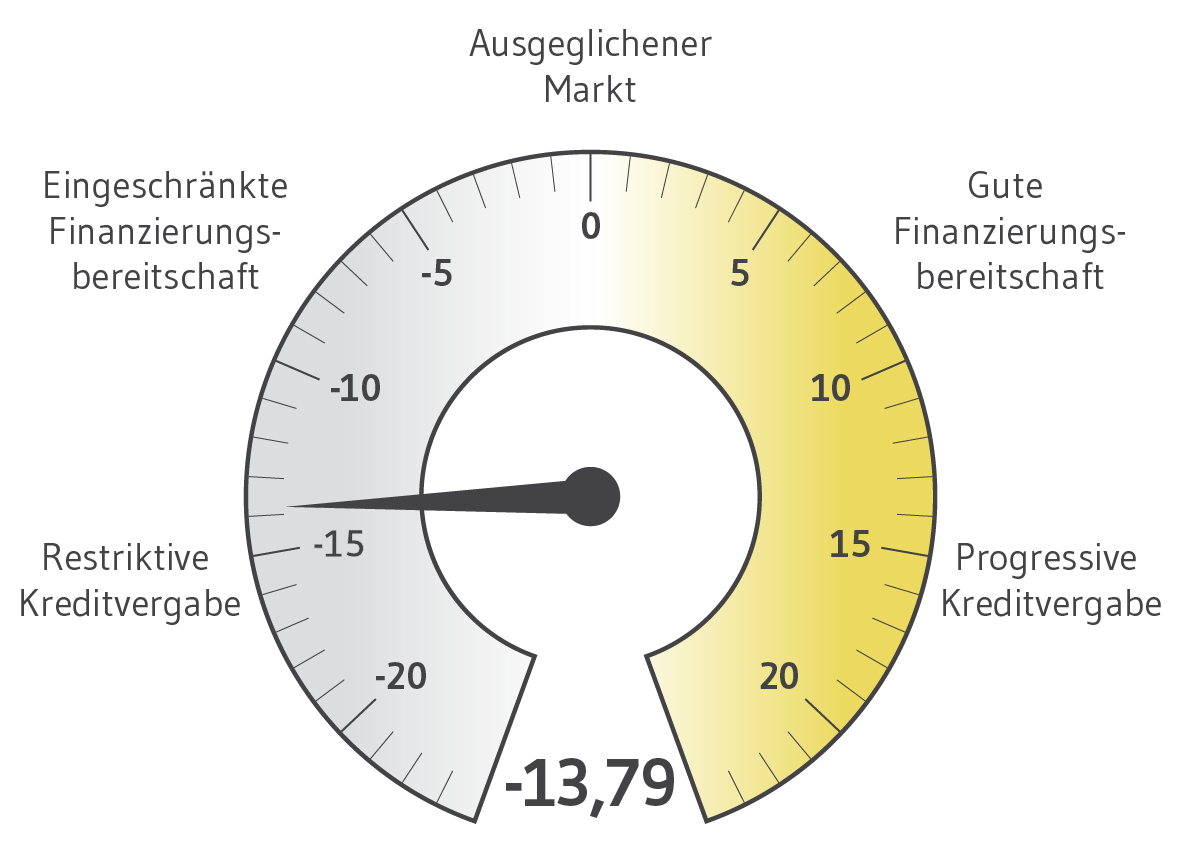

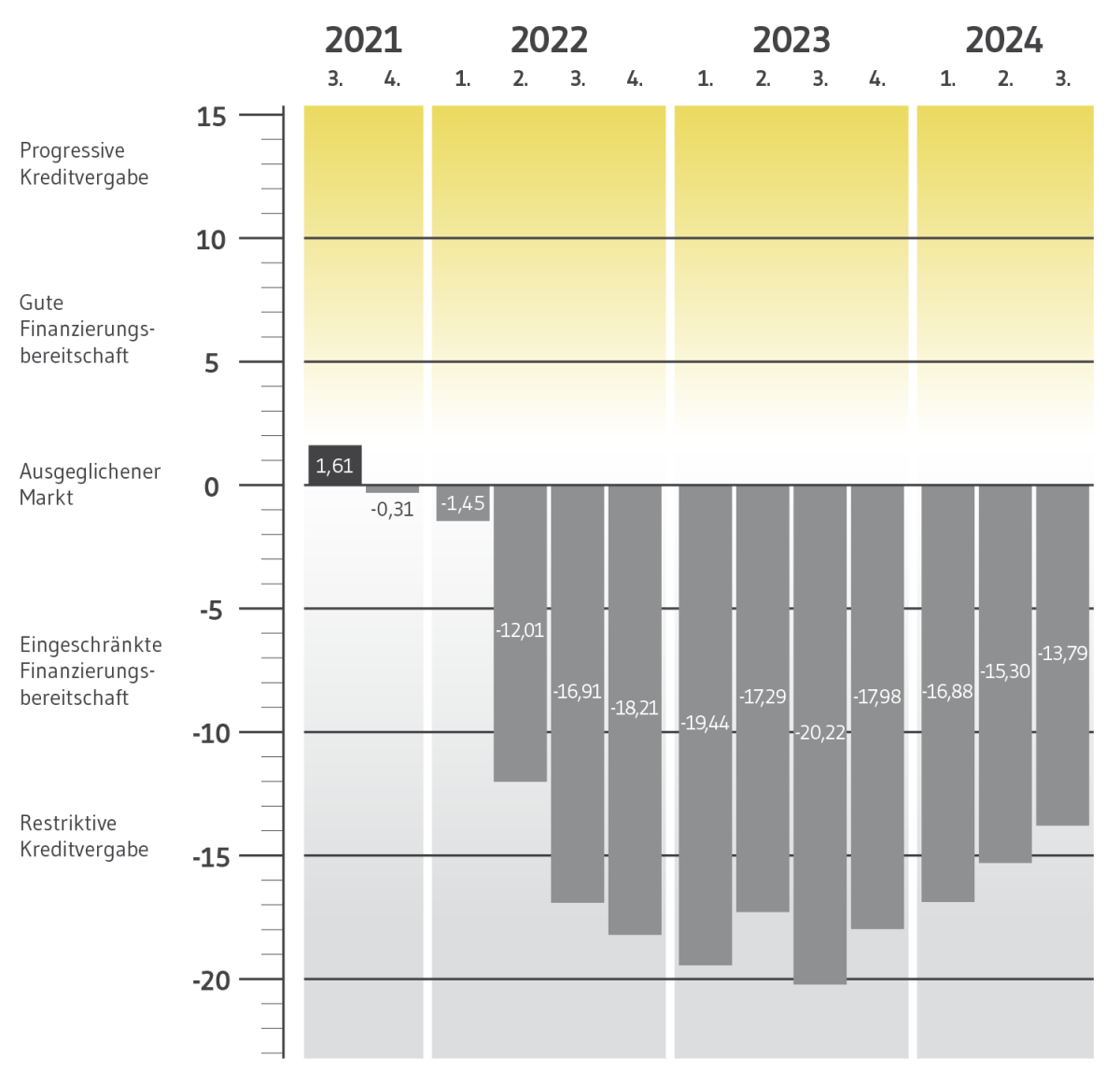

The recovery of the BF.quarterly barometer continues in Q3/2024. The barometer reached a value of -13.79.

Transaction activity remains subdued and the crisis is particularly noticeable among project developers. A certain degree of caution remains in the financing environment.

The recovery in new business and the continued positive development of liquidity costs are among the drivers of the barometer result. However, financing conditions are generally seen as restrictive.

In Q1/2015, the barometer value was at its highest level to date of 8.11 points; in Q3/2023, the lowest level of -20.22 was reached.

Background to the survey

The uncertainties on the financial markets and regulatory changes have led to a significant change in lending policy for commercial property financing in recent years. As a result, the topic of lending has also become much more important in the property industry, the media and politics. The topic will remain important, especially in light of the ongoing volatility on the financing market.

In order to create the necessary transparency and an optimal professional platform, the BF.quarterly barometer determines the current mood on the market for commercial property financing through the assessments and opinions of experts from the lender side for bulwiengesa's financing specialist BF.direkt. The BF.quarterly barometer is a methodological continuation of the FAP barometer launched in 2012.

Based on the two input variables - financing basics on the one hand and market expertise on the other - the BF.quarterly barometer provides answers on a quarterly basis:

‘What is the current state of commercial property financiers' lending practices?’

In contrast to other sources, the opinion of selected experts on the lending side is taken into account to a greater extent in order to depict the specific climate in lending policy.

Are you a property financier and would like to take part in the BF.quarterly barometer? We would be happy to include you. Simply send a short e-mail to tietze@bulwiengesa.de. We will get back to you shortly.

Contact:

Nicole Tietze

tietze@bulwiengesa.de

Phone +49 30 27 87 68 27

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Light Industrial Markt erholt sich deutlich

A transaction volume of €830 million, a 21 per cent increase in space turnover and a new regional leading position: the market for light industrial real estate showed a clear recovery in the first half of 2025, according to the half-year report from our Light Industrial InitiativeLittle movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffRetailers need to rethink - but in which direction?

The Hahn Group's new ‘Retail Real Estate Report’ has been published - a classic for anyone involved in retail property. We have been working on it since 2018 and have once again presented the most important retail sectors, economic developments and forecasts as well as trendsInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.