How hot are the housing markets?

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map".

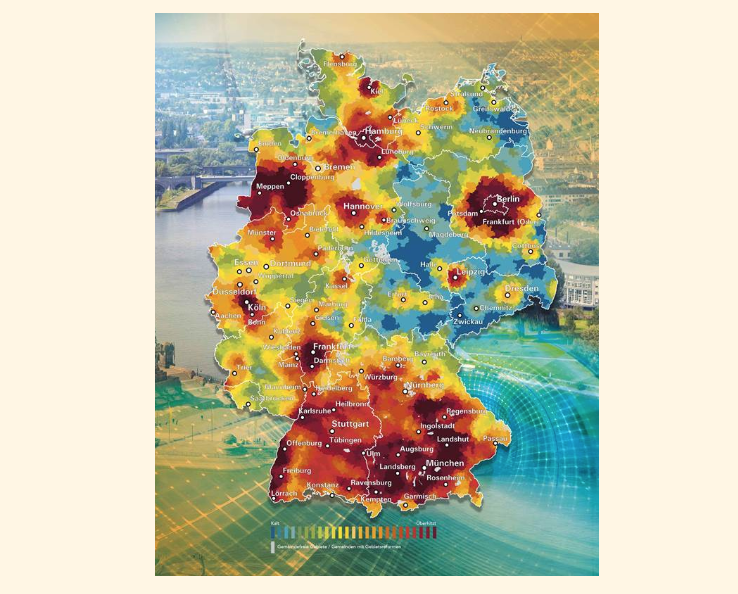

The residential weather map shows the local weather conditions in all regions of Germany. It illustrates the current situation in terms of supply and demand, shows where there is a lack of new construction and provides an outlook for the situation over the next three to five years. As in previous years, 25 colour shades are assigned from the coldest to the warmest municipality - this is the only way to provide detailed spatial information. Cold means that there is little or no demand for flats or that too much is being built in relation to this. Incidentally, the hottest municipalities are not those that "simply" have a high demand for housing. It is those cities and municipalities where very high demand meets very low construction activity. However, interest rates, construction costs and immigration affect the whole country in principle - so things have become much hotter overall compared to 2022. The housing market is tighter. This may be good news for some previously cold regions - but for the majority of regions, it means unmet demand, rising rents and more difficult housing searches. The housing weather map is intended to sensitise decision-makers at both national and local level to the current challenges facing the housing market.

Over the next five years, we expect an average of 226,800 residential completions per year. This includes flats that will be completed in 2023 and were started before the rise in interest rates. At the same time, demand for housing has continued to rise as a result of the war in Ukraine - and will remain high due to the impending retirement of baby boomers and the resulting need for skilled immigration. A total of 561,000 flats are needed here every year - this already takes into account the fact that the backlog demand accumulated in the past is only gradually being reduced.

Particularly hot: Cloppenburg

For the first time this year, the hottest municipality is no longer in Bavaria, but in Lower Saxony: the city of Cloppenburg has the highest percentage housing demand in the state. On the other hand, in the very "cold" municipalities, weak demand is compounded by excessive construction activity - although the number of such municipalities has decreased significantly compared to previous years.

Despite all the trends and their plausible explanations, there are always surprises in the residential weather map: three major cities on the Baltic coast, Flensburg, Kiel and Rostock, are particularly affected by increasing heat. At the same time, all major cities in eastern Germany along the A4 motorway between Erfurt in the west and Dresden in the east have not become warmer. In principle, however, all of these cities are in the moderate centre of Germany. Like the country as a whole, they are affected by fewer predicted completions and rising demand.

Note: You can find all the information and the interactive map at wohnwetterkarte.de.

Contact persons: Felix Embacher, Chief Representative, embacher@bulwiengesa.de and Robin Cunningham, Economist at bulwiengesa, cunningham@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.