Run on terraced houses

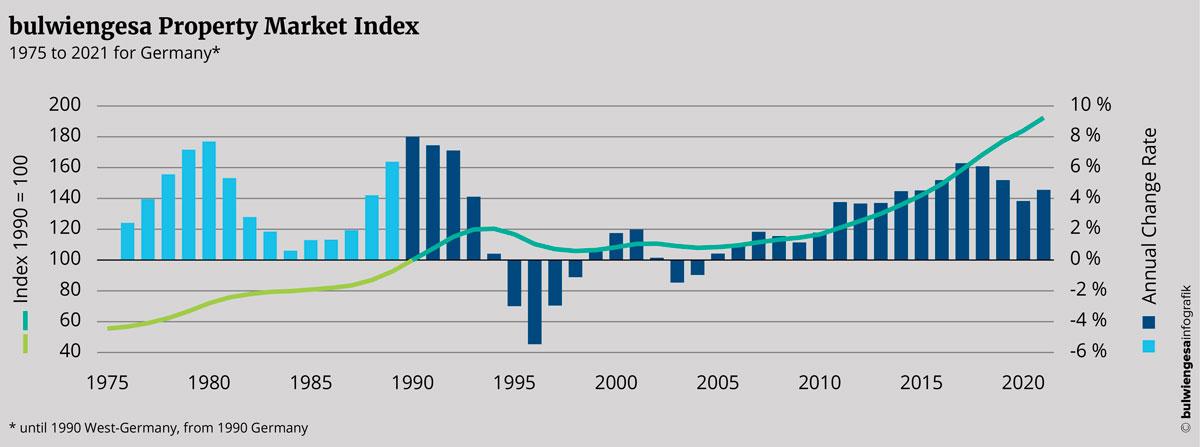

The 46th bulwiengesa Property Market Index shows: Prices have been rising for 17 years. Compared to 2021, at 4.6 %, they are even up by one percentage point. Terraced houses are particularly popular, and commercial properties have also become massively more expensive.

Even the corona-induced ups and downs in the economy over the past two years have only led to a partial decline in prices. In 2021, the plus in the residential segment has increased once again. In the commercial sector, two divergent developments can be seen: On the one hand, retail rents are coming under pressure, on the other hand, rents and land prices are rising for office and logistics uses. Overall, the rates of change in the real estate index are comparable to those from 2014 and 2015, but do not reach the top years of 2016 to 2019. And what's next? The goal of climate neutrality will require cost-intensive new buildings and transformations in the existing stock. Together with high demand for real estate, bulwiengesa expects prices to continue to rise in the coming years.

The bulwiengesa Property Market Indexx 2022 describes the development of real estate prices in Germany for the 46th time in a row. The data is incorporated into the price indices of the Deutsche Bundesbank, among others. The most important findings:

- The rates of change of the Property Market Index rise again to the level of 2014/2015, but remain behind the top years 2016 to 2019.

- All housing market variables show partly significant mark-ups, especially for purchase properties.

- 1a retail rents down for four years, commercial properties continue strong upward trend.

- The gap between the property index and inflation has narrowed to 1.4%.

Note: In the PDF "Property Market Index 2022" you will find in-depth information for office and other commercial properties.

Renaissance of the terraced house?

In general, the German housing market remains characterised by high demand that cannot be met with the existing supply. Above all, there is massive demand for properties for sale. Purchase prices for terraced houses, for example, are rising by 7.8%, land prices for single-family houses by 7.6% and newly built condominiums by 6.4%. In contrast, the average rent increase for flats in new construction (3.6 %) and existing buildings (2.2 %) is comparatively moderate.

As in previous years, the high price increases for terraced houses are striking. In contrast to condominiums, buyers here get a small garden, more living space, a parking space and ground-level access for a comparable price (albeit in a suburban location). This is just about affordable, especially for families, despite the high price of land. Detached single-family houses require significantly higher budgets. The construction costs are lower for terraced houses compared to multi-storey housing because the construction is less complex and there are no costs for common areas such as staircases.

Terraced houses, as we have seen for some years now, have become popular again. Perhaps they are the answer to current social issues: They are located in the countryside, but commuting is usually not necessary; they use less space than single-family houses, yet have a small garden; energy consumption and maintenance costs are also lower than for detached houses on large plots.

The housing market in Germany remains in motion. Year after year, however, it fails to meet the politically set completion targets, so that an enormous backlog of permits has built up. In view of the tight housing markets, especially in the metropolises, it would be necessary to build more and, above all, in a target-group-specific and sustainable manner in order to meet future challenges.

Note: More detailed information is available in the PDF. For the purchase of individual evaluations and time series, e.g. of individual locations and asset classes, please contact us.

Contact: Jan Finke, Branch Manager Essen and Project Manager Property Market Index, finke@bulwiengesa.de and André Adami, Head of Residential, adami@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeValuation for corporate insolvencies

In turbulent times, more companies than ever are facing insolvency. According to our data alone, this affects around 400 project developments and countless existing properties. Ideally, valuations for insolvency administrations show more than the actual valueInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.