There would be enough money

There is a lack of administrative and functional buildings, day-care centres, schools or nursing homes; in addition, the refurbishment backlog and investment arrears add up to billions. On the other hand, investors are looking for sustainable investment opportunities. With the short study "Public Infrastructure Real Estate", we have investigated the demand for various types of real estate for the Barton Group and Audere Gesellschaftsimmobilien.

International crises, disrupted supply chains, stricter regulations on resource and energy consumption and a new social relevance - against the backdrop of new challenges for the real estate sector, there is an increasing search for sustainable investment opportunities with high resilience to exogenous influencing factors and stable cash flows. At the same time, the public sector in the real estate sector faces special challenges in the coming years. This applies not only to new construction of publicly required space, but also to the existing stock. Increasing requirements in the area of ESG, further demand for office space as well as the provision of daycare places, including for children under three years of age, or educational institutions are only a few of the many tasks that must be managed in the interest of the common good.

In this context, public infrastructure real estate is increasingly in the spotlight and the question arises whether it can represent suitable investment alternatives. The topic of "public infrastructure" is very multifaceted and still represents a niche topic in the real estate industry. On behalf of the Barton Group and Audere Gesellschaftsimmobilien, we have approached this field with the short study "Public Infrastructure Real Estate" and attempted to increase the understanding of this asset class, especially with regard to its investability. The study focuses on administrative real estate, public safety real estate and educational real estate.

Too few, too old: daycare centres, schools, office space

There is currently a shortage of around 342,000 places in early childhood care. The legal entitlement to care for children under the age of three will further increase this gap. The school sector must prepare for an increase in the number of pupils by one million by 2030 and also organise legally compulsory all-day care for primary school children. In addition, there is the need for more office space for the administration. These major tasks present the public sector with challenges that it will not be able to solve on its own. On the one hand, there is a lack of capital: the municipalities, some of which are heavily in debt, bear the main burden of building and maintaining public infrastructure. On the other hand, there is also a lack of know-how and personnel. The tight budget situation makes it difficult for a large number of municipalities to maintain local infrastructure services and facilities. But in terms of economic growth and future urban development, administrations are practically doomed to spend. Over the years, a huge mountain of debt has accumulated, amounting to some 133 billion euros. Added to this is an investment backlog estimated at around 150 billion euros.

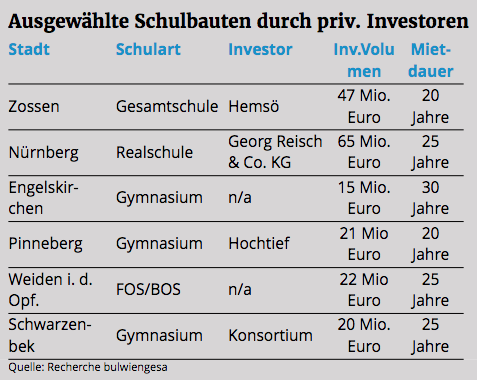

Exemplary? School construction by private investors

What has long been common practice in other countries is now to be introduced in Germany: improving the educational infrastructure with the help of private funds, thus ensuring good facilities and long-term planning security. Examples of this are becoming more and more common. The result is that an investor with his own funds takes on the construction of a new school or its renovation and the municipality rents it back on a long-term basis (over a period of about 20 to 30 years). In particular, the municipality receives cost security, since the rent already covers maintenance and renovation costs. Educational real estate is usually realised in the form of PPP/ÖPP projects, whereby the public sector still retains a certain say and often has a pre-emptive right to purchase the property. The partnership structures between the public sector and the private investor usually vary and are the result of protracted and political discussions. Statements on return expectations or other investment ratios cannot be made in this context. The available data is too sparse and the respective projects are organised too differently. However, it can be stated in summary that both contracting parties gain planning security through a long-term lease agreement. On the part of the municipality, there is planning security through fixed rent payments for the school, and the investor receives a crisis- and default-proof cash flow in return.

It can be stated: As a perceptible asset class, public infrastructure real estate is still at the beginning of the establishment process. Studies like this one attempt to increase transparency in this still diffuse field. At the same time, they serve as a data basis for an overview needed in particular by institutional investors such as insurance companies, pension funds, savings banks, funds and others. In the real estate sector, the public sector as well as social institutions face major challenges that can be tackled in partnership with the private sector.

Contact:

Sven Carstensen

Member of the board at bulwiengesa

carstensen@bulwiengesa.de and

Jakob Heilek

Consultant

heilek@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.