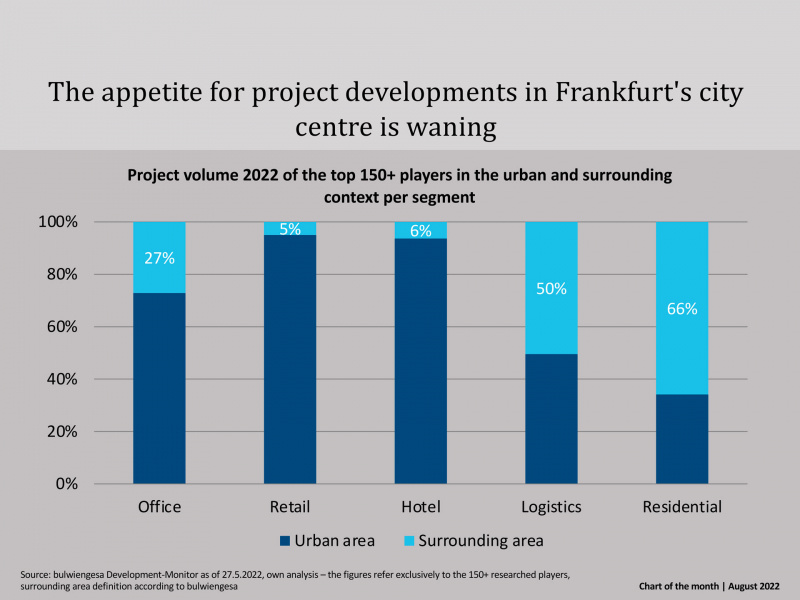

Chart of the Month - August: Trending towards the suburbs

It has become crowded in the metropolises, building land is scarce and expensive. No wonder that construction activities have increasingly shifted to the surrounding areas. In Frankfurt, almost every second square metre is built outside of the centre; at the same time, plans for flats have declined by 26 % since 2021. This is shown by the current assessment of the Development Monitor.

The Development Monitor is a continuously updated database within RIWIS that evaluates the project development market in Germany as a whole and shows the activity of more than 150 companies in the surrounding area. According to the monitor, market activity in Frankfurt's vicinity is particularly pronounced compared to the other A-cities. This is mainly due to two segments: Logistics properties are naturally not planned and built in the centres, but in the surrounding areas. And in the residential segment, 66 percent of all space constructed and in planning up to 2026 are being built in the areas outside of the city centre. In all metropolises, more and more private investors are withdrawing from the big cities, increasing the influence of municipal property owners on shaping the market activity there. Overall, project completions are down slightly, while plannings have decreased massively, especially in the residential segment - where the decline is around 26 % compared to the previous year. A real slump.

A special feature in Frankfurt is the sharp decline in the planning of high-rise residential buildings. Many projects that were still in the pipeline two years ago have been postponed or called into question. As a result of sharply rising interest rates and construction costs, it is no longer a profitable affair for private and institutional investors.

Frankfurt is and remains particularly a city of commuters - since 2011, the number of commuters has risen by 24.4%. This is in part a consequence of the very large increase in the number of inhabitants of the surrounding municipalities; the front-runner is Kelsterbach, with an increase of around 22% more inhabitants in the first half of 2021. As a result, the purchase prices for condominiums are exploding in some places, and rents for new flats have also risen significantly in the past ten years, for example by 50% in the Darmstadt-Dieburg district.

Note: RIWIS customers automatically have access to the Development Monitor. All others can register here for a test access.

Contact person: Sven Carstensen, Board of Directors at bulwiengesa, carstensen@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

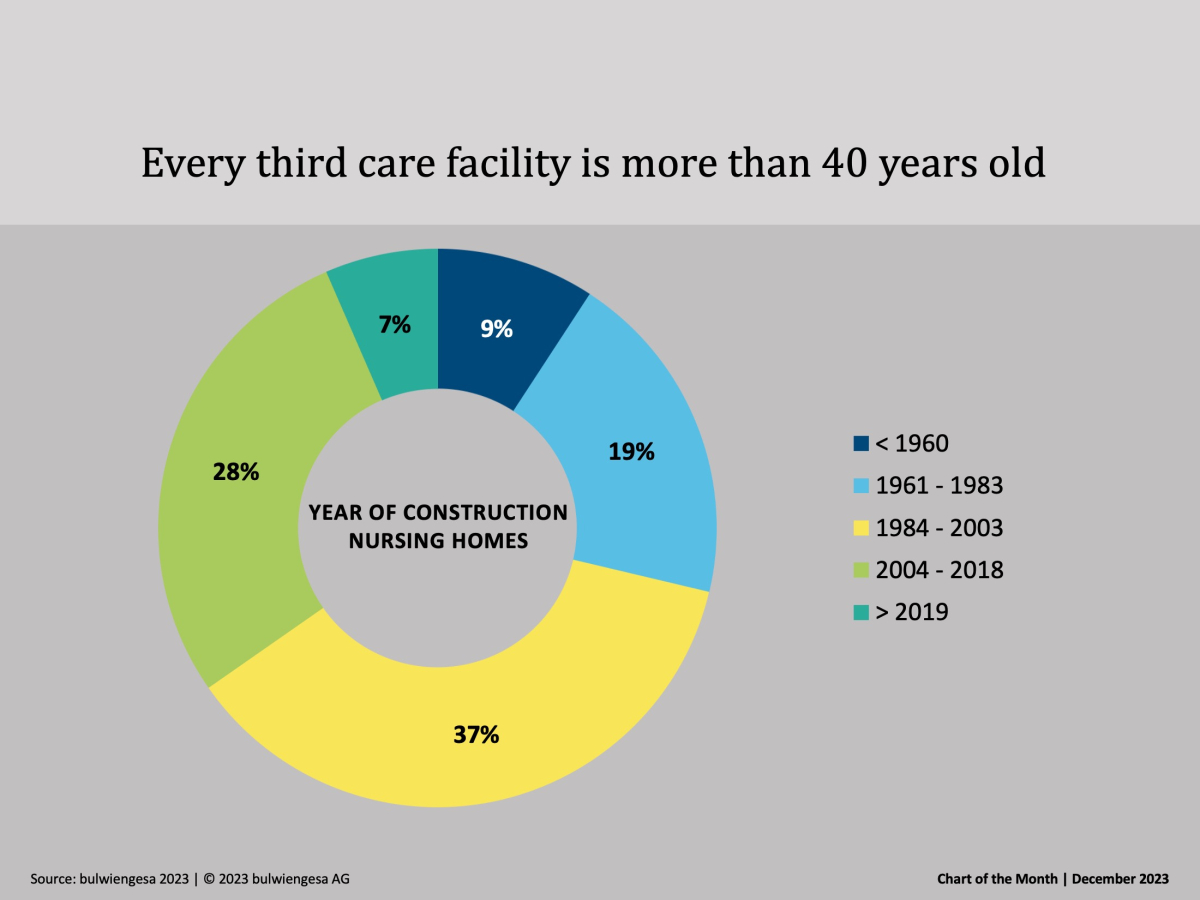

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

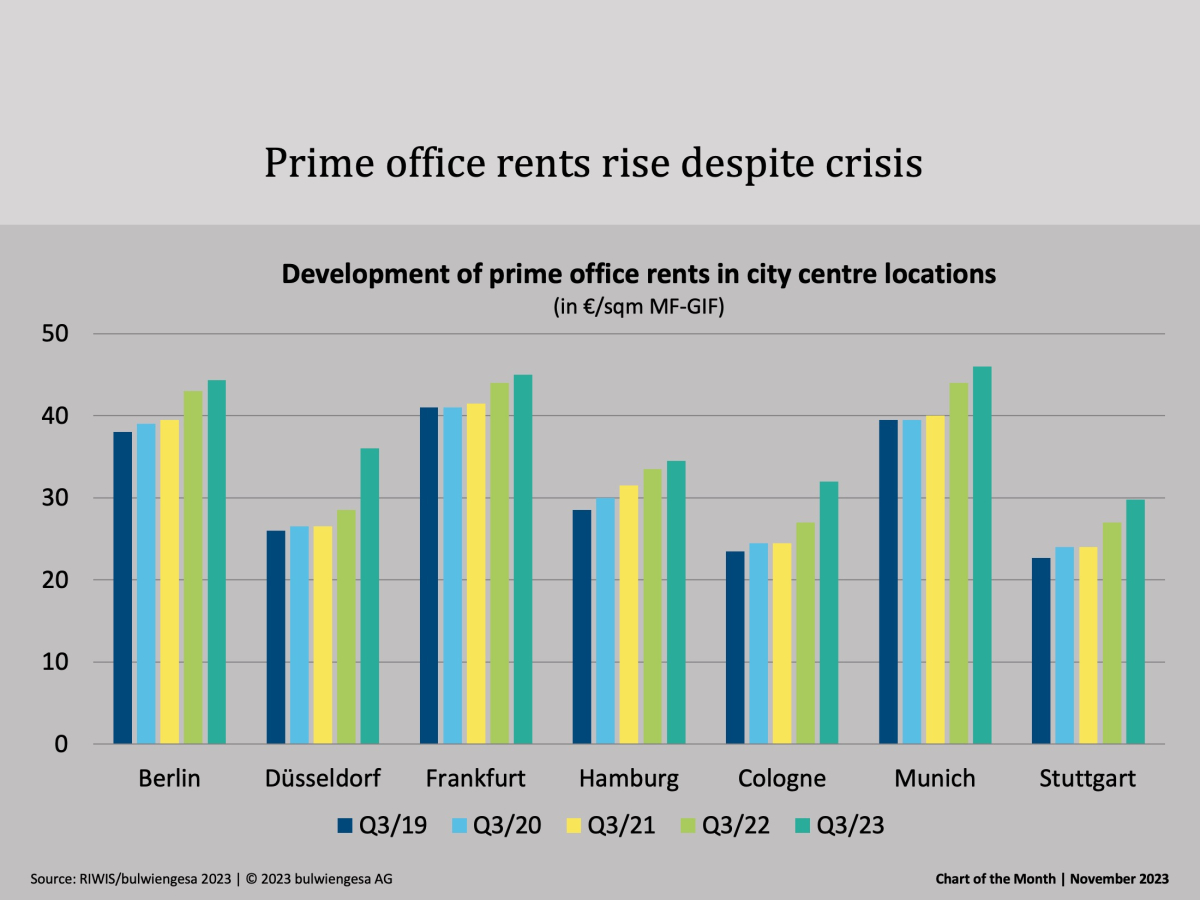

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

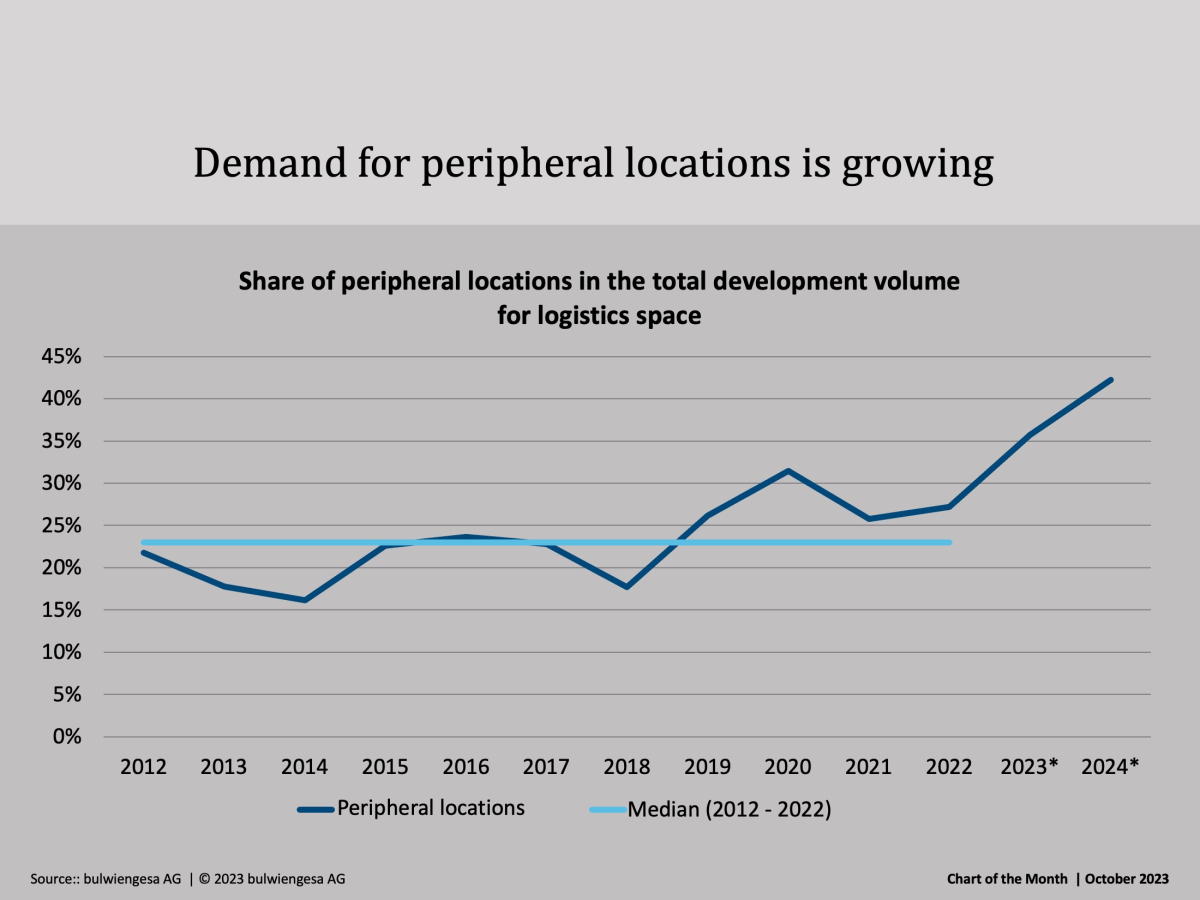

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.