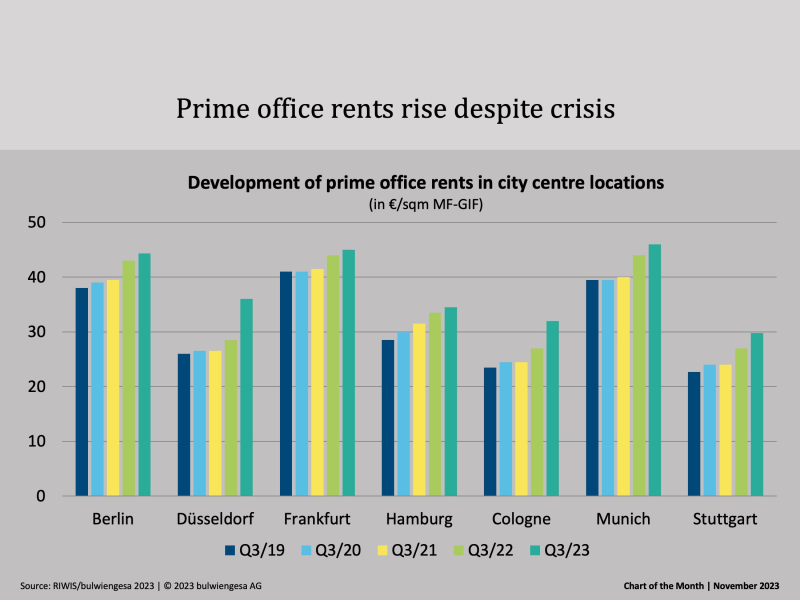

Chart of the month November: Top offices are still in demand

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still rising.

In RIWIS aktualisieren wir quartalsweise unsere Daten zu den Büromärkten. Inmitten der Krise, die ja auch stark den Büromarkt trifft, haben wir für das Magazin eine kleine, optimistisch stimmende Auswertung gemacht.

In RIWIS, we update our data on the office markets on a quarterly basis. In the midst of the crisis, which is also hitting the office market hard, we have produced a small, optimistic analysis for the magazine. Despite rising vacancy rates in the A markets, prime rents are still increasing. Small, high-priced office space in the top locations of the seven German A cities is currently enjoying great popularity among users. Why? Good properties in central locations increasingly represent a success factor in the competition for highly qualified employees. Companies are prepared to pay the high prices.

Looking back to the pre-coronavirus year of 2019, it is striking that prime rents have not fallen significantly in any German A-city since then. On the contrary, they have actually risen significantly; there were only brief stagnations due to the pandemic. The biggest increases over the four years under review here are in Düsseldorf and Cologne (both up by more than 36 %), whereas prime rents in Frankfurt have "only" risen by around 9.8 %.

Why do Munich, Frankfurt and Berlin in particular stand out from the other cities with high prime office rents? Munich is home to six DAX companies and numerous other large corporations. Frankfurt is a major European financial center with numerous high-priced skyscrapers. As the capital, Berlin is a must for many companies, authorities, embassies and start-ups.

Important to know: The prime rent of the office market covers the top price segment with a market share of three percent of rental turnover and represents the median rent. It includes properties in top locations, with the best fittings and in top condition.

Contact person: Alexander Fieback, Division Manager Office Real Estate at bulwiengesa, fieback@bulwiengesa.de.

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

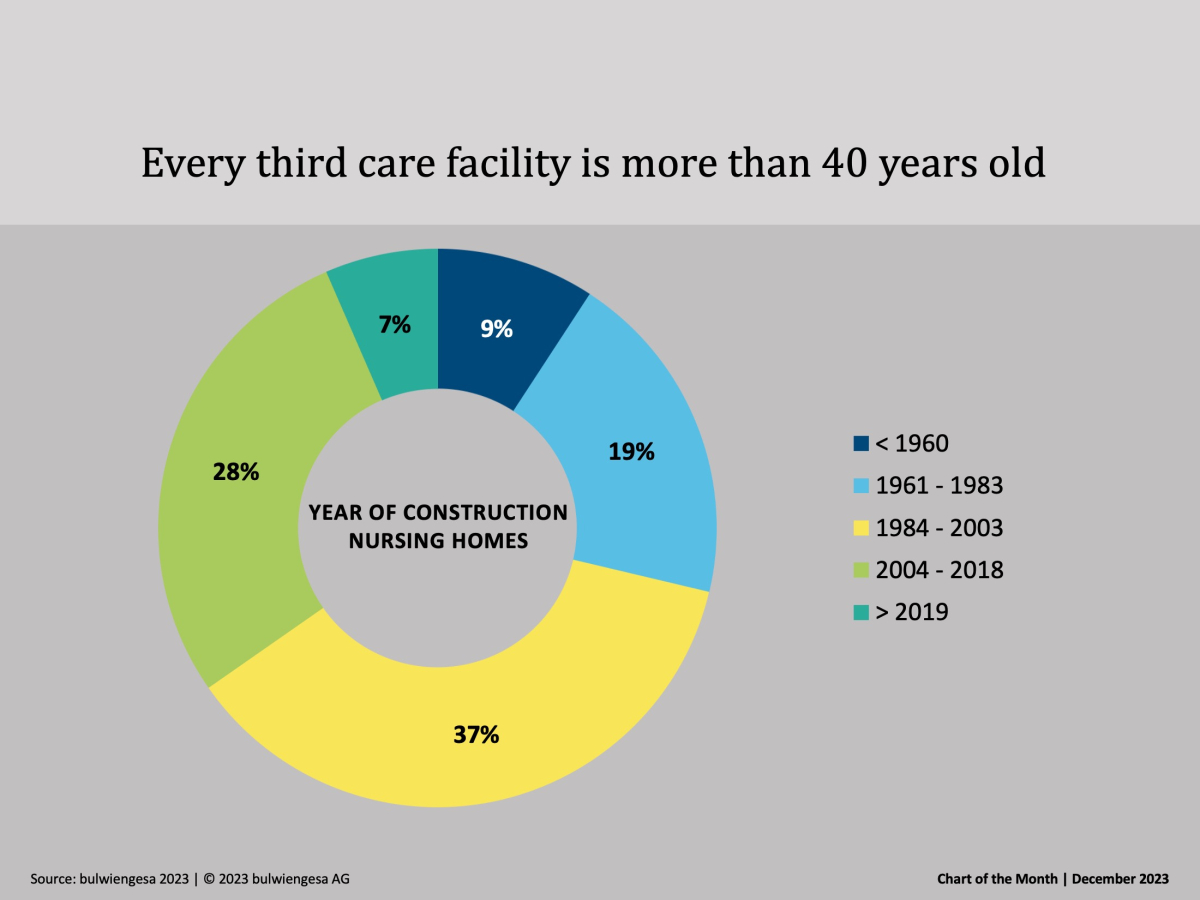

Chart of the month December: The country needs new care properties

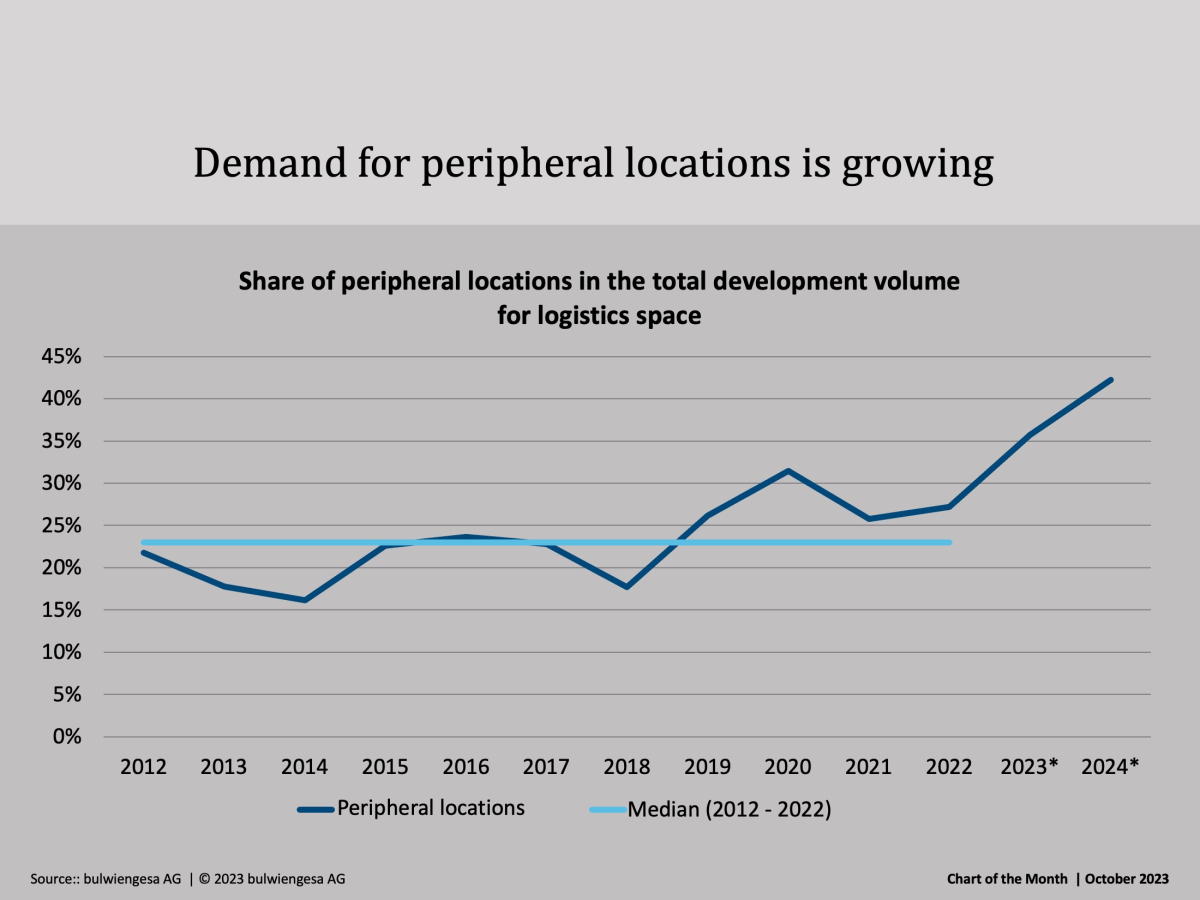

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the Month October: Boom in the peripheral locations

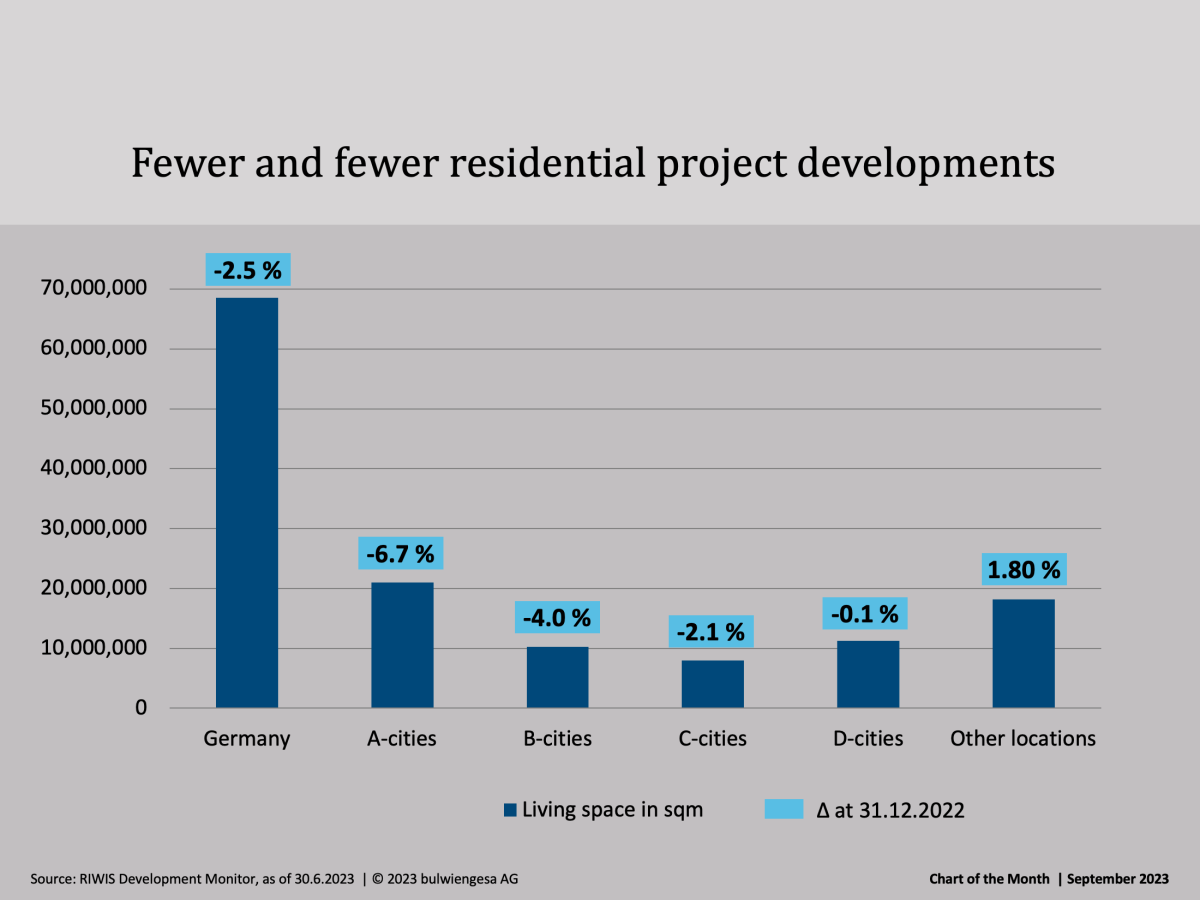

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingChart of the Month September: Residential Project Area Continues to Decline

The insolvencies of large and small project developers illustrate the extremely tense market situation. And the number of residential projects planned and under construction is falling - most sharply in the metropolises, of all places, where the housing shortage is greatestInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.