How does ESG impact the affordability of housing stock?

The current environment remains difficult for financiers. This is what the experts surveyed for the BF.Quarterly Barometer say, even though the bottom now seems to have been reached. They have different opinions on the above question.

The impact of ESG (environmental, social, governance) on the financial viability of housing stocks in the future is diverse and is perceived differently by our experts. Some are of the opinion that these effects will hardly be noticeable. However, ESG is seen as a strong selection criterion that will play a role in financing stock.

Some experts state that higher management costs will have to be taken into account, which could have a negative impact on financing. Nevertheless, work is being done to integrate ESG criteria, suggesting that the situation could change in the future. The determination of mortgage lending value already plays a role in financing and has implications for the affordability of housing stock. Critical reviews of energy criteria are already part of the lending decision and compliance with ESG criteria will play a significant role in affordability in the future.

The energy efficiency of a building is seen as a particularly important factor. Buildings with poor energy performance are expected to lose value and affect financing options. However, it is also noted that ESG can have a positive impact on market value and financability.

Inefficient buildings in the "F-H" category could be excluded from the financing process. Some experts already see an increasing reliance on ESG criteria, particularly with regard to building energy efficiency.

It is expected that compliance with ESG criteria will have a significant impact on the availability of debt capital in the future. Some financial institutions intend to critically review the strategic orientation of owners and energy retrofits of properties and incorporate these findings into their ratings and lending decisions. One expert from the survey already emphasizes the importance of social action and does not expect any significant changes in their orientation.

It is predicted that financing without taking ESG criteria into account will become much more difficult in the future. Currently, however, the topic is not yet present among all customers and does not yet have any relevant significance.

Overall, it should be noted that the impact of ESG on the financeability of residential portfolios is receiving increasing attention and is expected to play a decisive role in the future.

About the BF.Quarterly Barometer

Uncertainties in the financial markets and regulatory changes have brought about a significant change in lending policies for commercial real estate financing in recent years. As a result, the topic of lending has also become much more important in the real estate industry, the media as well as in politics. In order to create the necessary transparency and an optimal professional platform, the BF.quarterly barometer determines the current mood on the market for commercial real estate financing through the assessments and opinions of experts on the lender side for the financing specialist BF.direkt from bulwiengesa. Here, the opinions of selected experts on the lender side are taken into account in order to depict the specific climate in lending policy.

Note: Read the current quarterly report here (in German language).

Contact person: Felix Oedekoven, Consultant at bulwiengesa, oedekoven@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

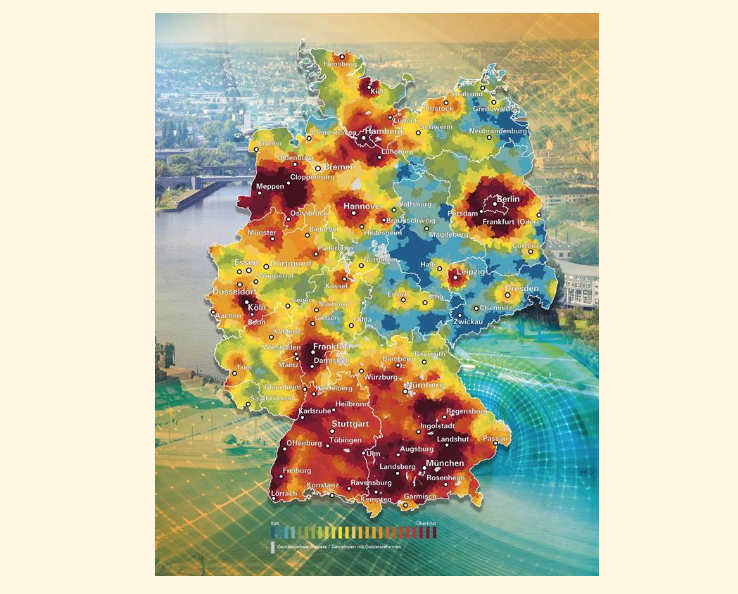

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeHow hot are the housing markets?

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map"Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.