Refurbishment of offices - what is the status?

Around a third of office space in the seven A cities is in need of refurbishment. But things are happening - especially where rents are high. This is shown by the first apoprojekt stock compass.

Around 70 % of office space in Germany's A-cities was built before 2000 and often no longer meets current ecological and social requirements. For apoprojekt, we analysed office properties and projects that were or will be completely refurbished between 2019 and 2026. The result is the first edition of the apoprojekt portfolio compass, which from now on will present refurbishment activities in the office markets of A-cities every six months.

Despite the crisis, prime rents in the centres of the A-locations are currently decoupling from the rental price trends in other locations. They are rising or remain at a high level and are consistently above the EUR 30/sqm mark. The most expensive city centres are Munich at EUR 51.50/sqm, followed by Frankfurt/Main (EUR 46.50/sqm) and Berlin (EUR 44.50/sqm). It is therefore not surprising that central locations are the first choice for refurbishments - this is where most space is currently being refurbished at 1.7 million sqm (67%).

In general, things are not looking bad: While only 10 % of all project developments in 2019 were refurbishments of existing buildings, this figure is currently around 19 %, with a share of over 30 % expected in both 2025 and 2026 according to the current analysis. Between 2019 and 2026, around 2.5 million sqm of office space was or will be refurbished in the A cities; 1.25 million sqm of this has already been completed.

Interestingly, almost 40% of the refurbishment volume is currently under construction, including major projects such as the 55,000 m² refurbishment of the Deutsche Bundesbank headquarters in Frankfurt.

Due to postponed new construction projects and the growing focus on existing properties, an increase in refurbishments is expected for 2025 and 2026 - particularly in central locations and for owner-occupied buildings. In the long term, ‘manage-to-green strategies’ will continue to drive refurbishment activity.

Note: You can download the press release and the study free of charge from the apoprojekt website.

Contact: Nicole Tietze, Senior Consultant in the office property sector at bulwiengesa, tietze@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

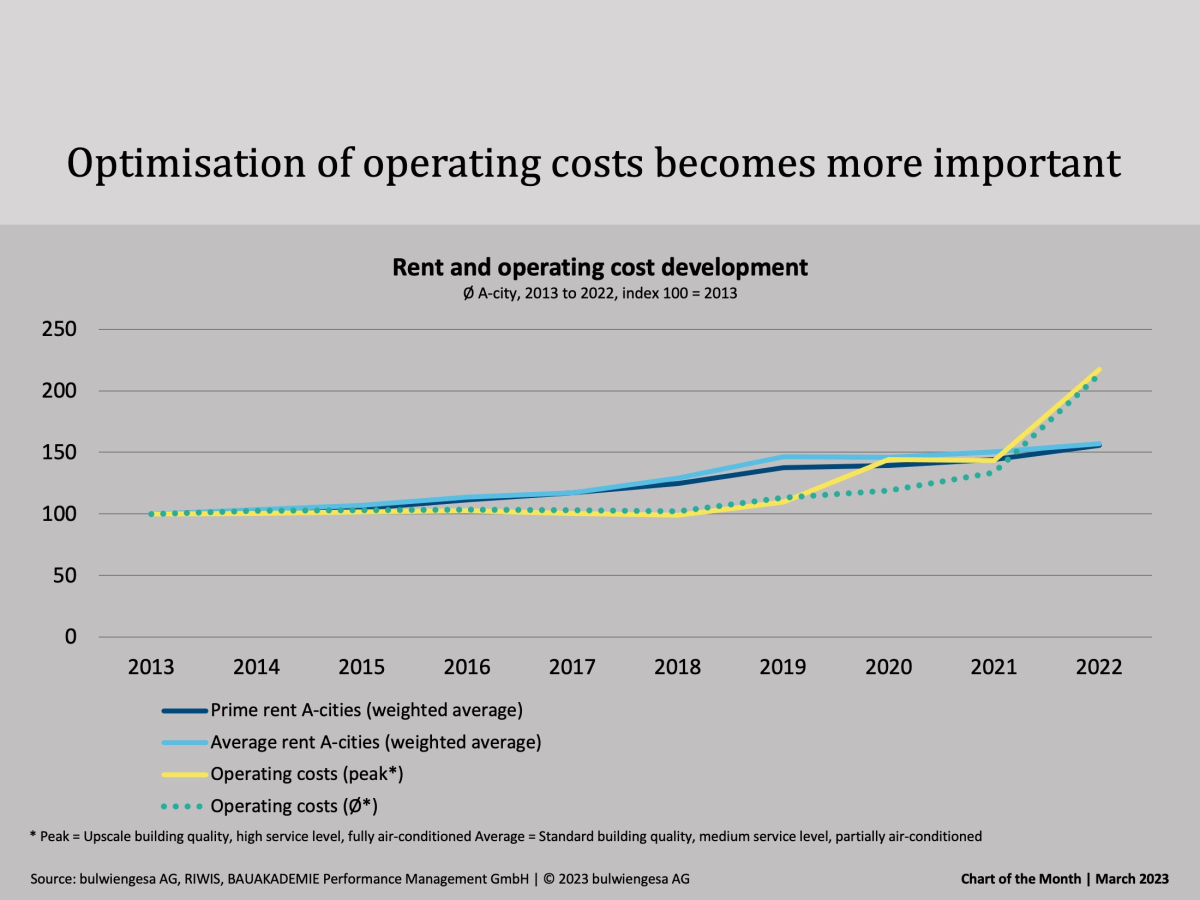

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeClone of Chart of the Month March: Increased rents and operating costs burden office tenants

The increase in rents and operating costs affects all real estate segments. For example, the operating costs for offices in A-cities alone have increased by 63 % since 2021. This is the result of the first joint study "Overall Rental Analysis - Office Market Germany" with BAUAKADEMIE.Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.