Chart of the Month November: Waiting for better weather

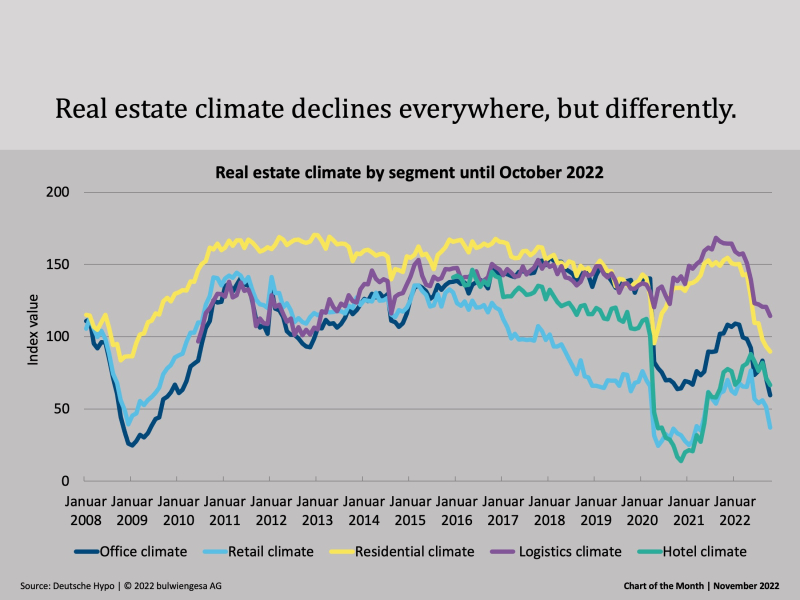

The 1,200 market experts who are surveyed by us monthly as part of the Deutsche Hypo Real Estate Climate paint a gloomy picture. Above all, the residential and investment climate is collapsing. The market players are taking a wait-and-see approach.

The real estate climate serves as an early indicator that can be used to make short-term economic forecasts and to identify economic turning points more easily. Over 1,200 market-relevant decision-makers are surveyed monthly in an online poll.

The negative sentiment of the respondents from the previous month continues in the 178th monthly survey. Overall, the Deutsche Hypo Real Estate Climate slumped by 13.1 % to 64.8 points. The Investment Climate in particular made a significant contribution to this development, falling by 17.2% to 48.0 points. The Investment Climate measures the investment interest of real estate investors and thus the price and value development. But the Rental Climate - which measures the market's demand for space as well as the pressure on rental price development - also suffered a significant loss of 10.3% to 82.7 points compared to the previous month.

The sentiment in the individual asset classes is also deteriorating increasingly - all the segments surveyed have to accept setbacks, some of them significant. The loss of confidence is particularly great in the retail climate - the retail property market is assessed as the weakest in the October survey, plummeting by a significant 28.0% to 37.1 points. With a drop of 16.4% to 59.6 points, the Office Climate recorded a two-digit loss for the second month in a row. The hotel climate (-6.7% to 66.5 points) and the residential climate (-3.8%) also continue to decline. At 89.6 points, the Residential Climate falls below 90 points for the first time since January 2009. Despite a decline (-5.2% to 114.4 points), the logistics real estate market continues to have the highest value.

About the Deutsche Hypo Real Estate Climate

Like any human being, decision-makers in the real estate sector cannot act in a purely economically oriented or rationalised way. The perceived business situation is therefore of great relevance. The perceived business situation, the real estate climate, is measured with a broad-based survey on the real estate climate. The Deutsche Hypo Real Estate Climate thus enables an overall economic analysis of the German real estate industry on a monthly basis.

The aim of the online survey is to quickly determine an accurate picture of the mood in the real estate sector with a deliberately small number of questions. The survey asks for opinions on the developments of the five established real estate asset classes: office, retail, residential, logistics and hotel. The respondents include project developers, investors, banks, insurance companies, operators, service and consulting companies from all typological sub-sectors of the real estate market.

Note: You can find the current report on the Deutsche Hypo website.

Contact: Laura Hahn, Consultant at bulwiengesa, hahn@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

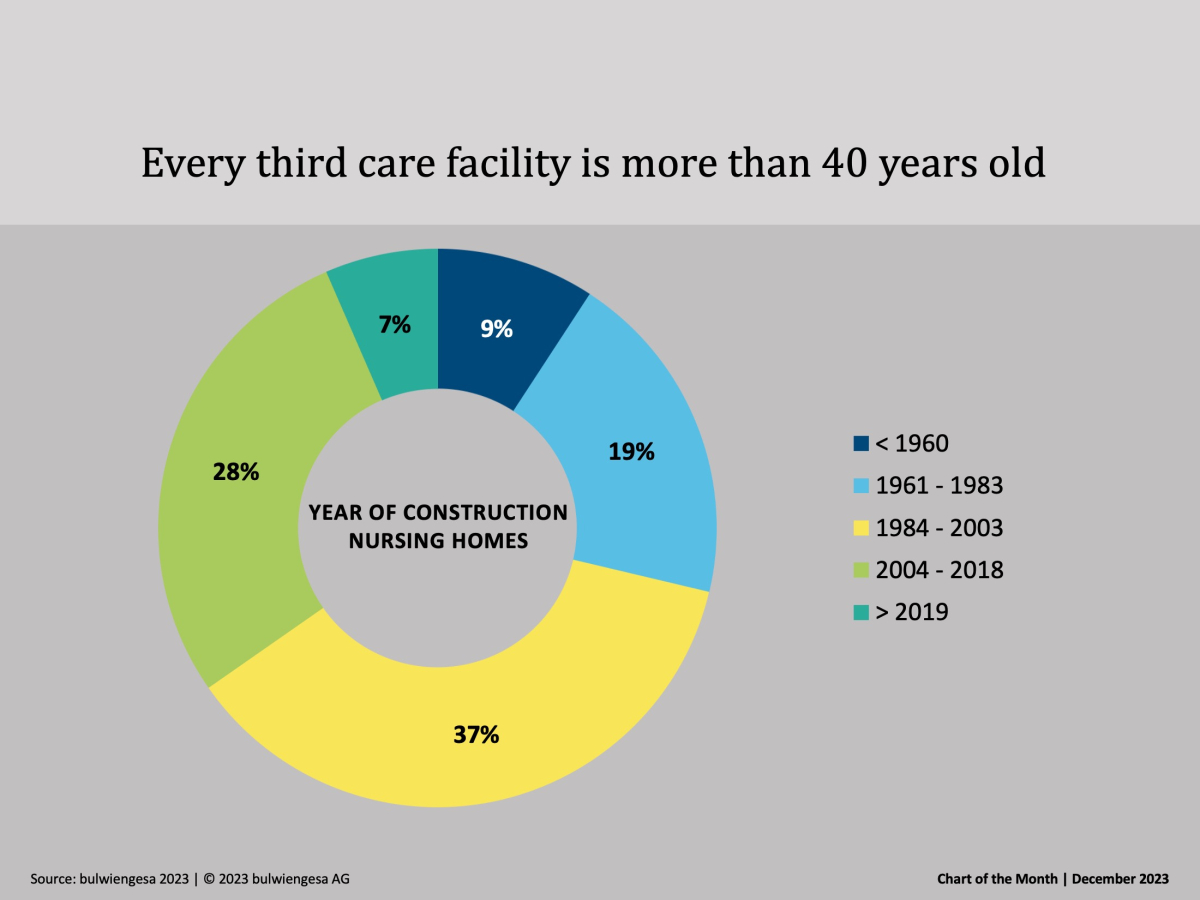

Chart of the month December: The country needs new care properties

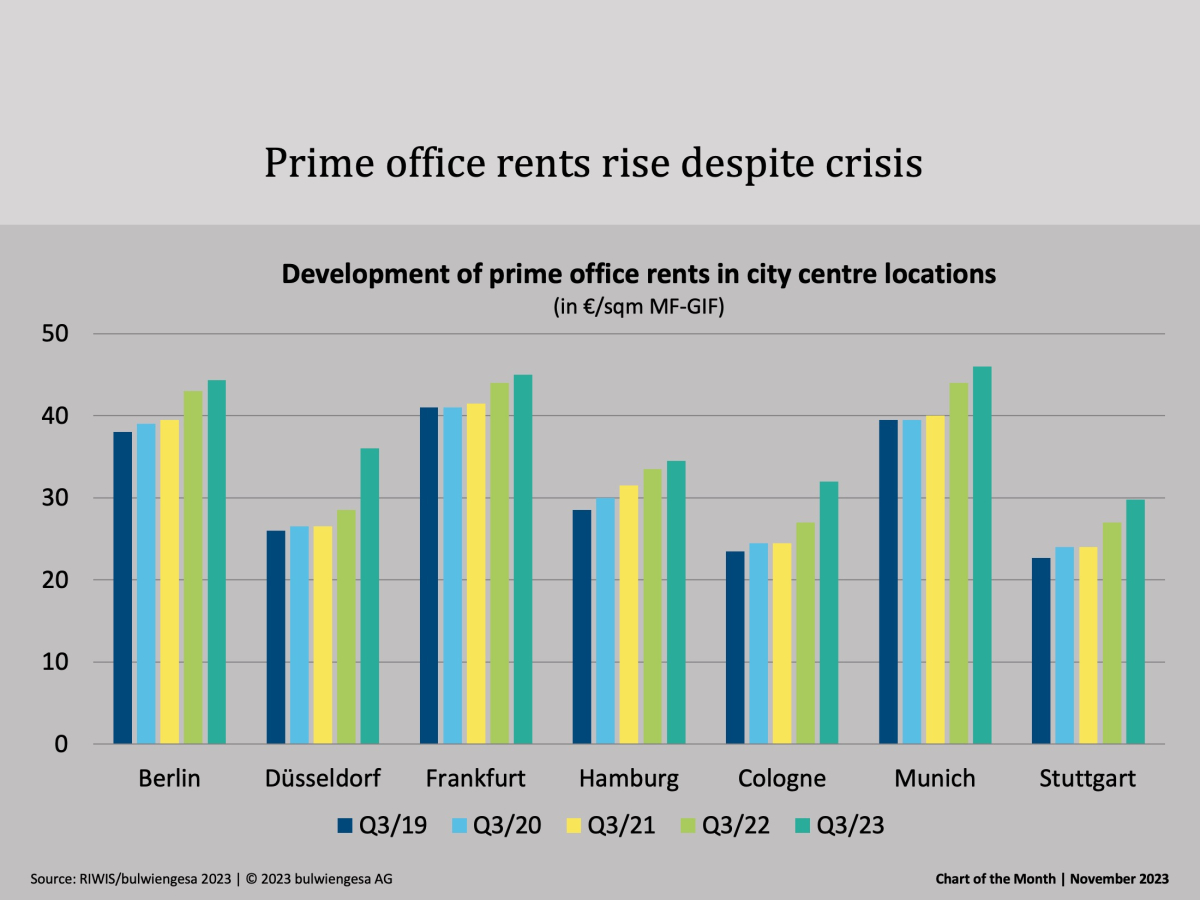

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

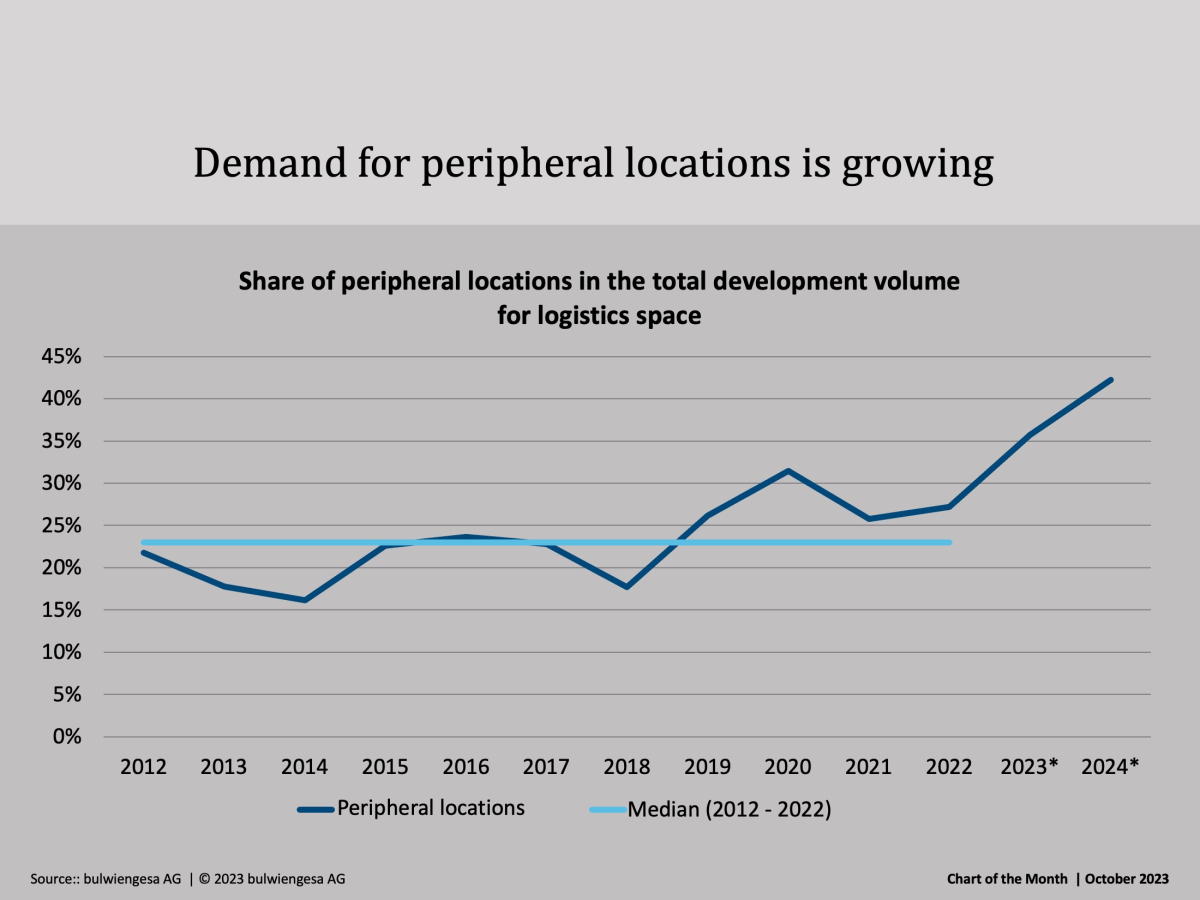

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.