Market study transformation real estate

The topic of "transformation real estate" has become more explosive due to major upheavals in retail. Shopping centres, department stores and commercial buildings have been severely affected by digitalisation, including online retail, and the resulting changes in customer preferences in terms of their utilisation structure. bulwiengesa and Union Investment have taken this circumstance and the increasing ESG requirements as an opportunity to prepare a joint study on this topic.

In this study, the market for transformational real estate is examined and, based on numerous interviews with market participants, conclusions are drawn about planning processes, types of use, communication and costs. Case studies illustrate numerous statements at the end of the study. In addition to a definition, the study also elaborates causes and backgrounds, the relevance to the real estate industry as well as challenges and opportunities of transformation properties.

The study (PDF) can be requested free of charge via the Union Investment website.

Contact:

Ralf-Peter Koschny

koschny@bulwiengesa.de

Ph. +49 40 42 32 22 0

and

Felix Schrader

schrader@bulwiengesa.de

Ph. +49 40 42 32 22 27

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

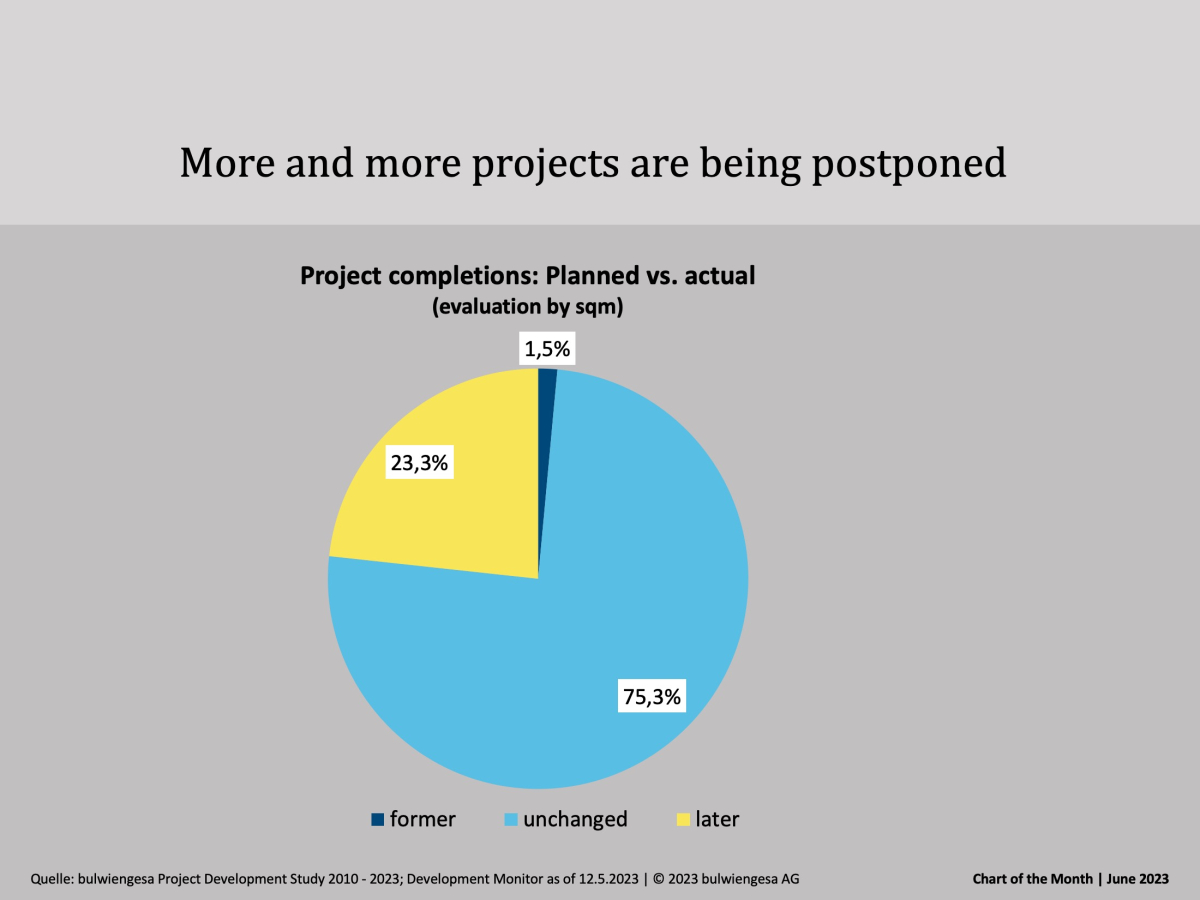

Chart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedProject developments: Few in planning, many postponed

The crisis is now clearly visible among project developers. The market in the seven class A cities is declining, and the traditional project developers in particular are withdrawing from the market. Residential projects, of all things, are significantly affected. And: Many projects are being completed later than plannedClone of Clone of Chart of the Month March: Increased rents and operating costs burden office tenants

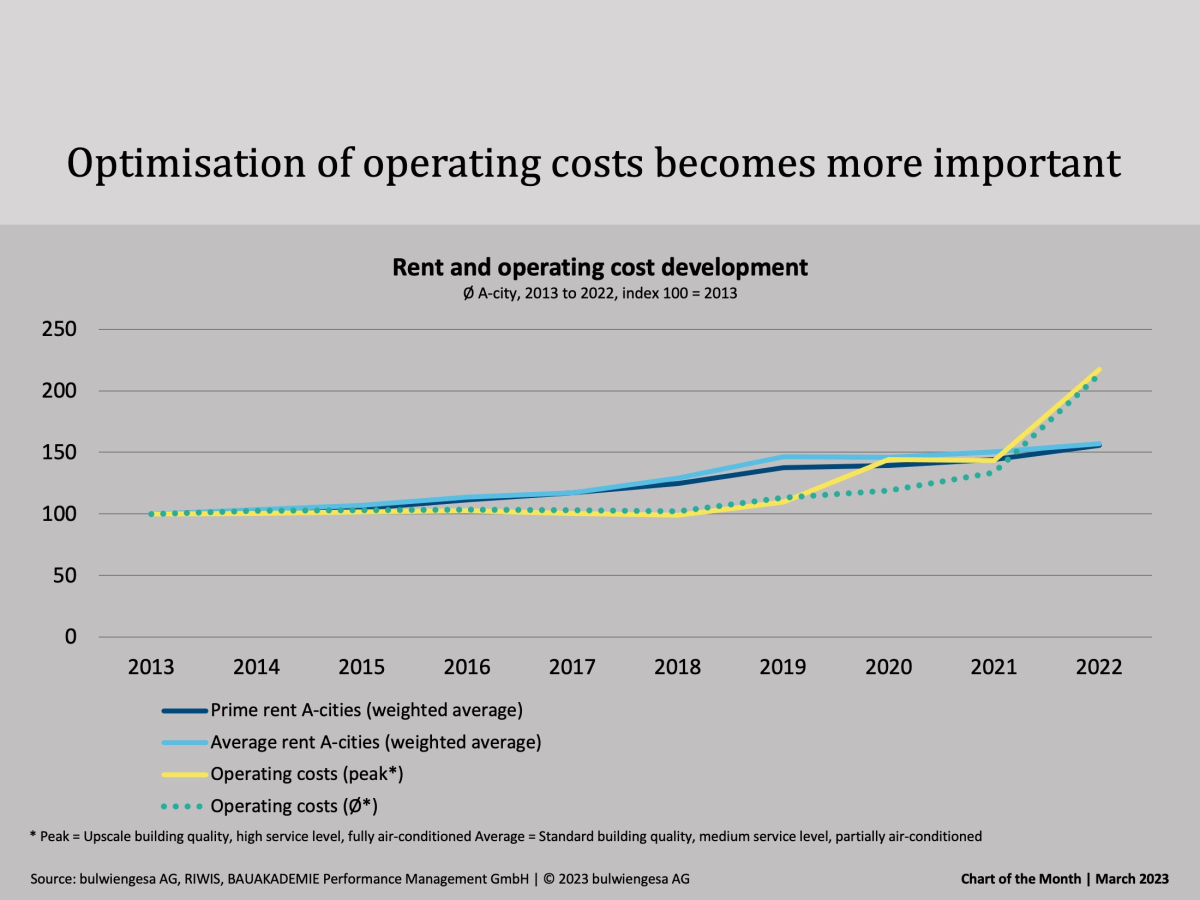

The increase in rents and operating costs affects all real estate segments. For example, the operating costs for offices in A-cities alone have increased by 63 % since 2021. This is the result of the first joint study "Overall Rental Analysis - Office Market Germany" with BAUAKADEMIE.Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.