Chart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponed.

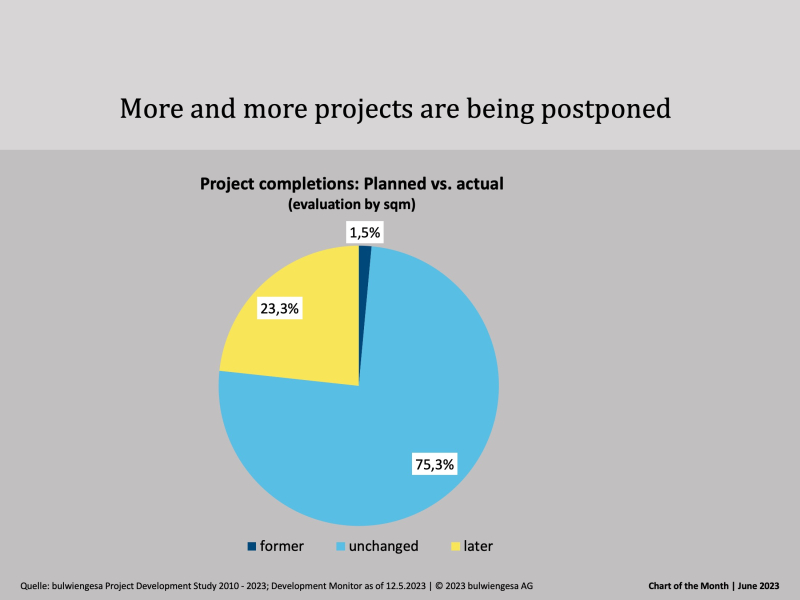

Many have already felt it, and now we have the confirmation in figures: the evaluation of projects in the Development Monitor shows that a good 23% of all space will be completed later than the originally planned date at the end of 2022. The Development Monitor 2023 evaluates 4,641 projects in the seven A-cities Berlin, Hamburg, Munich, Frankfurt, Stuttgart, Cologne and Düsseldorf with 43.5 million sqm of project space. We presented the results at a press conference in May (report here in the magazine). The analysis is a continuation of the 17-year time series that bulwiengesa began with the Project Development Study and which has now been further developed into the Development Monitor. For the current analysis, completed projects as well as projects under construction and in planning between 2020 and 2027 were evaluated.

For us, "late completion" in this evaluation means that completion is at least two quarters later than the originally planned date at the end of 2022.

We see the most delays in office projects, the fewest in logistics projects. For logistics properties, developers assume that demand will remain high in the future - only 12% of the planned square metres will be completed later - but this is apparently not the case for offices. Here it is 34% because the exit is very difficult for developers to calculate and the economic viability of a project is often unclear.

An analysis looking at business models is also interesting: in Berlin, for example, only 16% of investor development projects (project developments for the developer's own portfolio) are delayed, compared to 28% of trading developments ("classic" project developments for sale). The classic project developers are more dependent on market developments and bear a higher risk.

In addition, 12% of the space under construction was postponed. The pipeline is filled with projects with a realisation period of 2026/2027.

Contact person: Felix Embacher, Head of Research & Data Science, embacher@bulwiengesa.de, and Max Witte, Consultant, witte@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

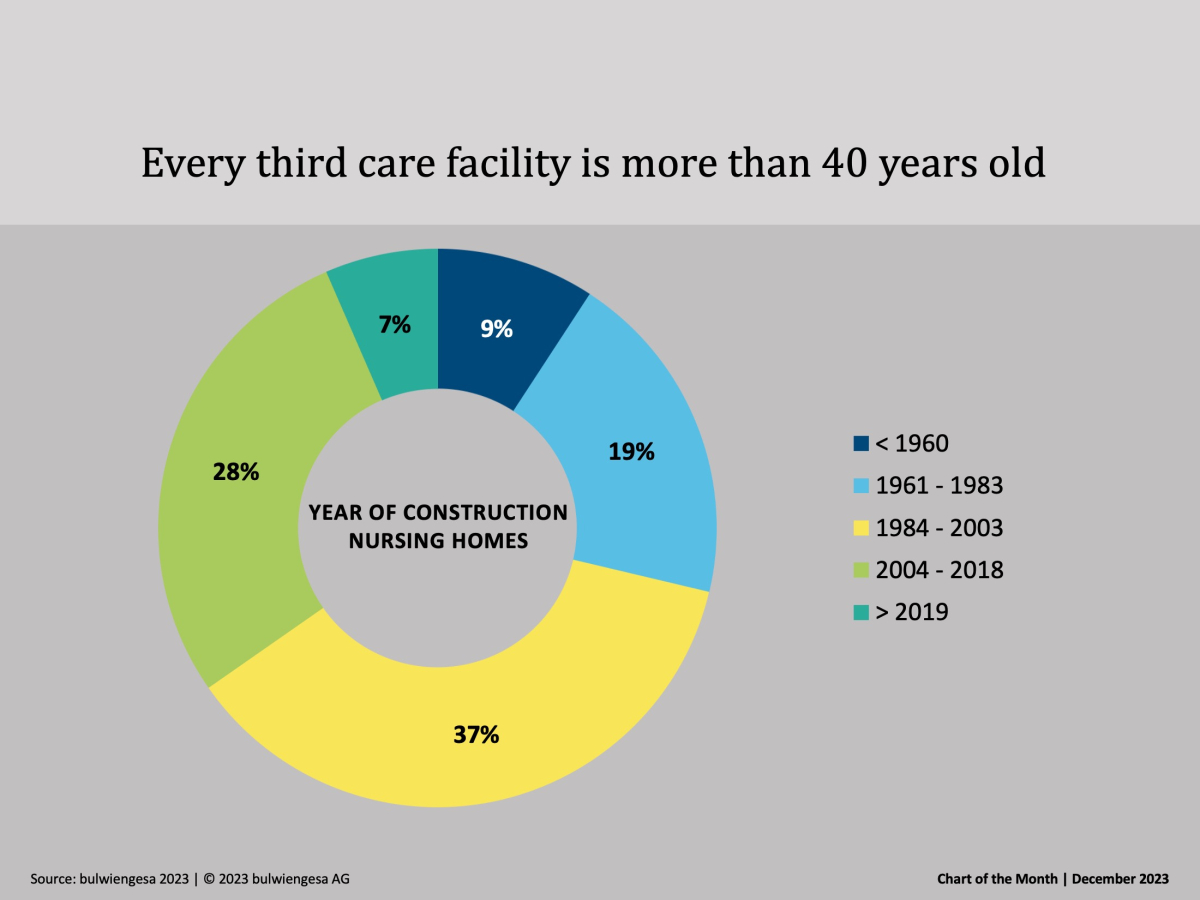

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

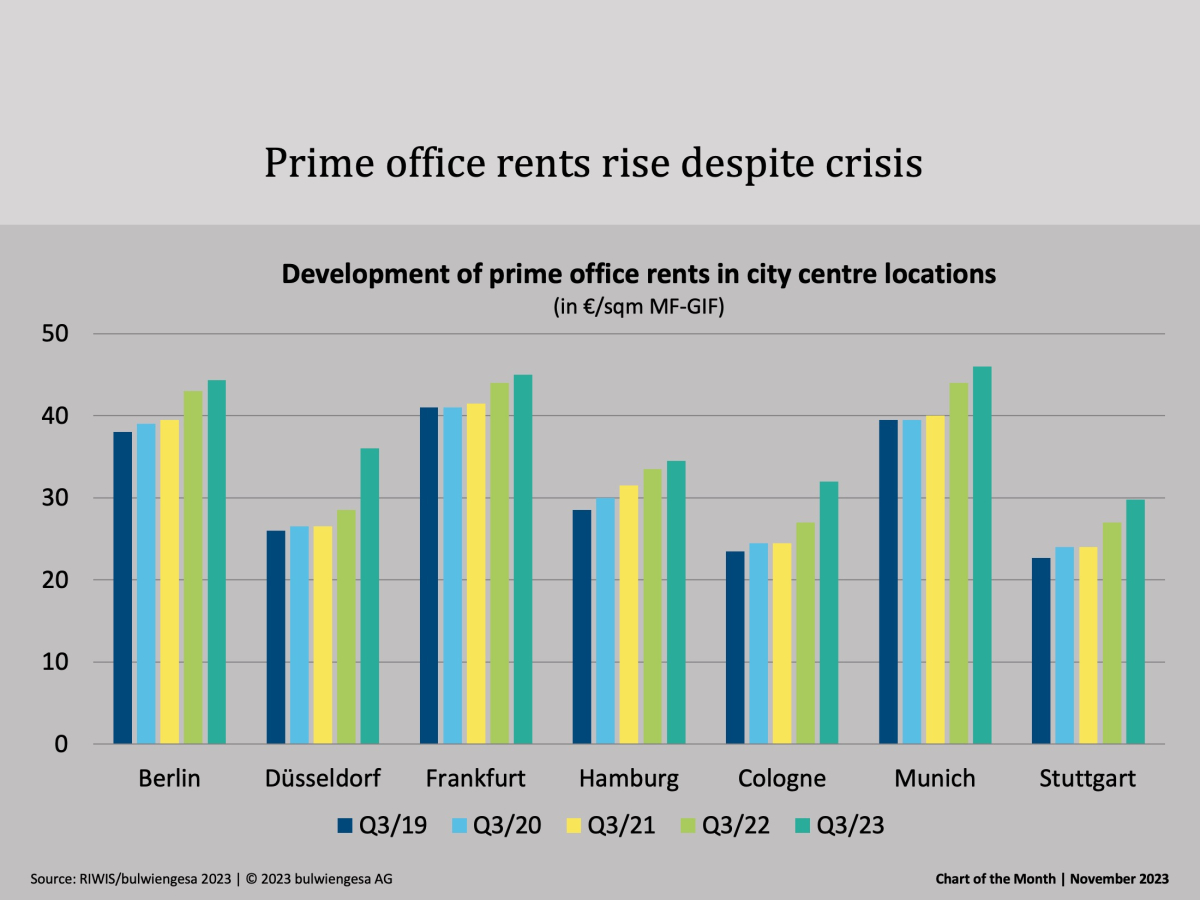

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

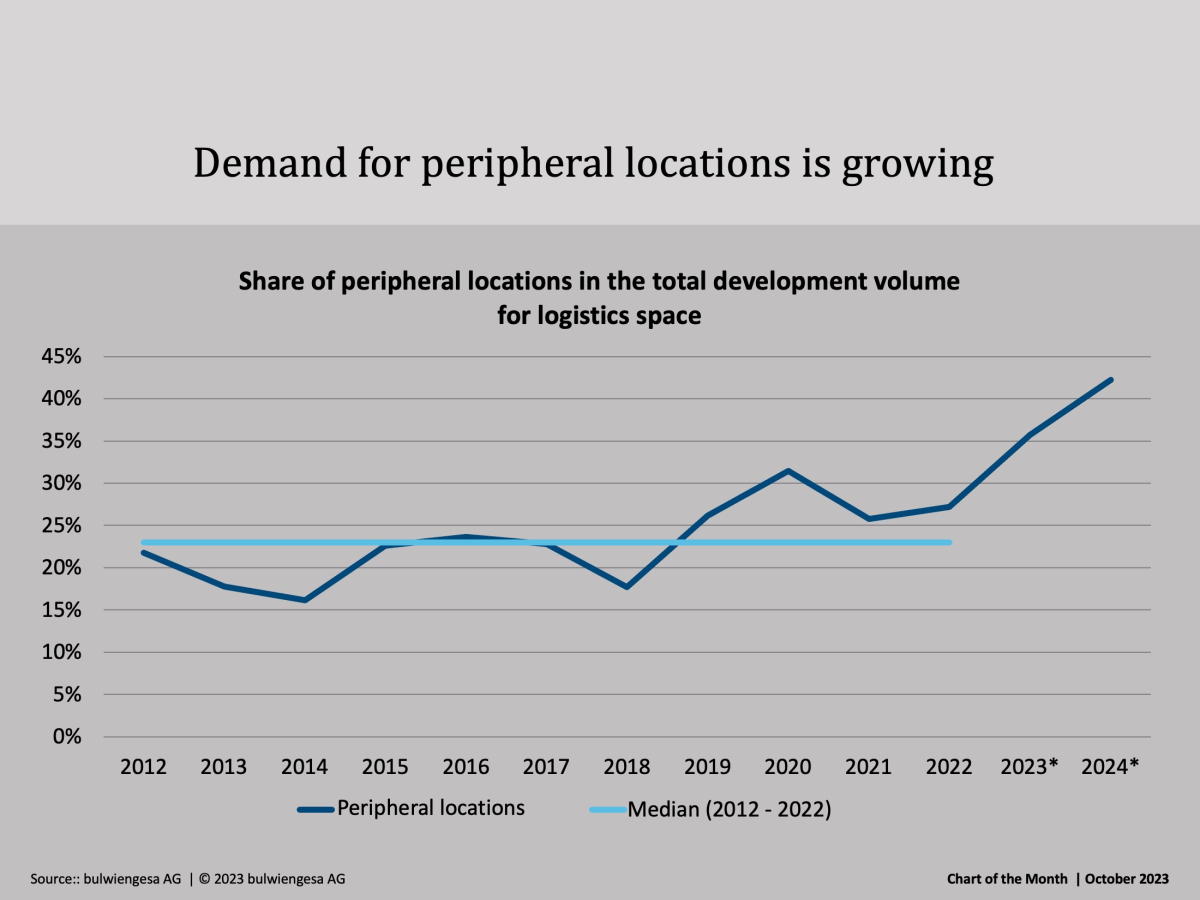

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.