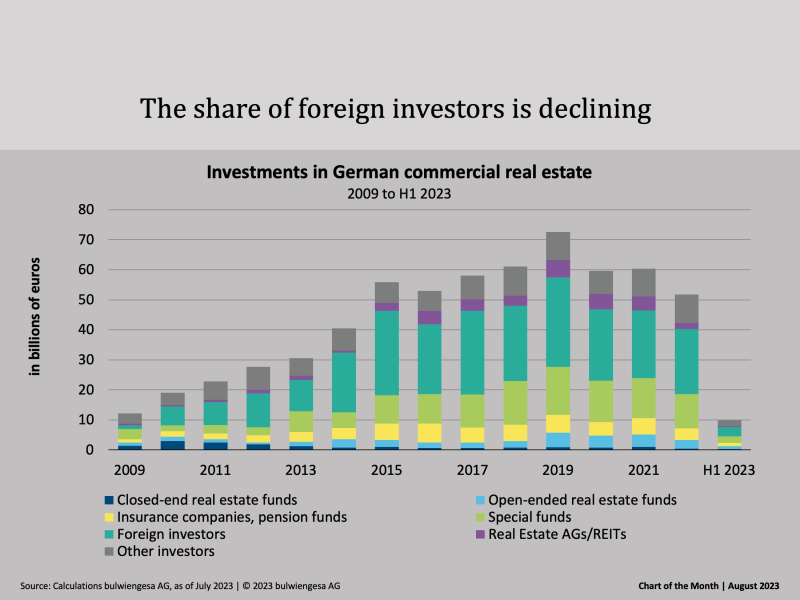

Chart of the Month August: Foreign Investors Still Holding Back

Against expectations, there has been no change in the restraint shown by foreign investors. At only around 32%, their share of the commercial real estate investment market in the first half of 2023 was significantly lower than the average for the past ten years. But challenging times also bring opportunities.

Currently, there is a high level of restraint overall: for example, domestic and foreign investors invested only around EUR 9.9 billion in commercial real estate in the first half of 2023. This means that the volume is roughly at the same level as in 2012 and corresponds to only 45% of the ten-year average for the first half of the year.

Further moderate interest rate increases announced by the European Central Bank will help determine developments on the investment market. The current difficult phase of price formation, i.e. the determination of a spread in line with the market between initial yields for new real estate investments and risk-free fixed-interest government bonds, will certainly remain with the market until at least the end of the year. Over the year, real estate yields are expected to rise even further. The expected rise in yields should be much more moderate compared with the rise between mid-2022 and today.

At only around 32%, the share of foreign players in the commercial real estate investment market in the first half of 2023 was significantly lower than the average for the past ten years (43%). However, opportunistic sources of capital are already waiting in the wings; in the medium term, there are signs of a significant increase in the share of foreign investors again. Particularly in the area of corporate investments or takeovers, we expect foreign capital to make an increased appearance.

Selling pressure due to increased refinancing costs and devaluations of portfolios, especially for project developments, will increase significantly and could stimulate the investment market. The insolvency of the Centrum Group or the difficulties of Euroboden are probably only the tip. Large financial investors such as Blackstone already announced at the beginning of the turnaround in interest rates that they would again invest more in Germany, but have not yet made an appearance. Takeover plans for commercial project developers, analogous to the plans of the Korean fund manager Shinhan and Nox Capital Holding regarding the residential privatizer Accentro, could soon be on the agenda.

Challenging times also bring opportunities, the glass is half full.

Contact person: Andreas Wiegner, Project Manager at bulwiengesa, wiegner@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

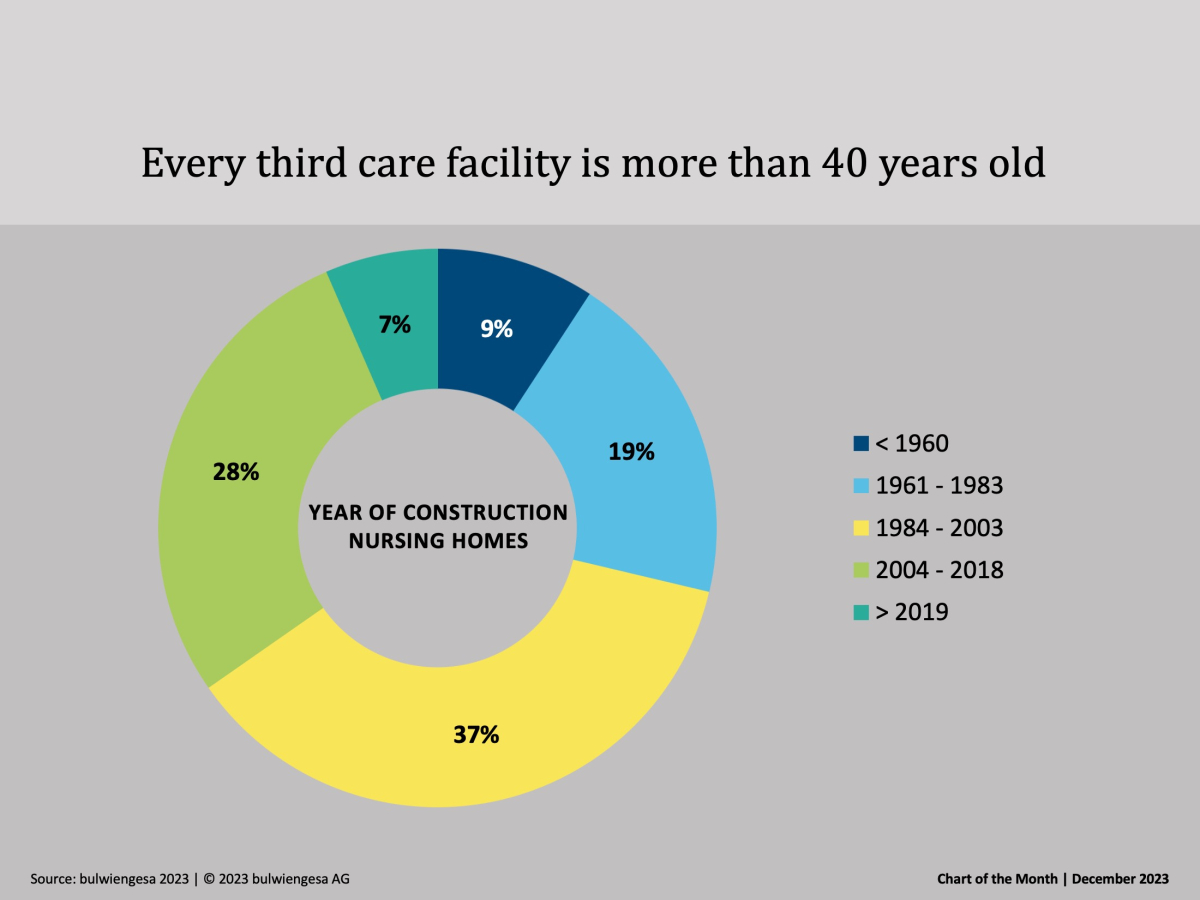

Chart of the month December: The country needs new care properties

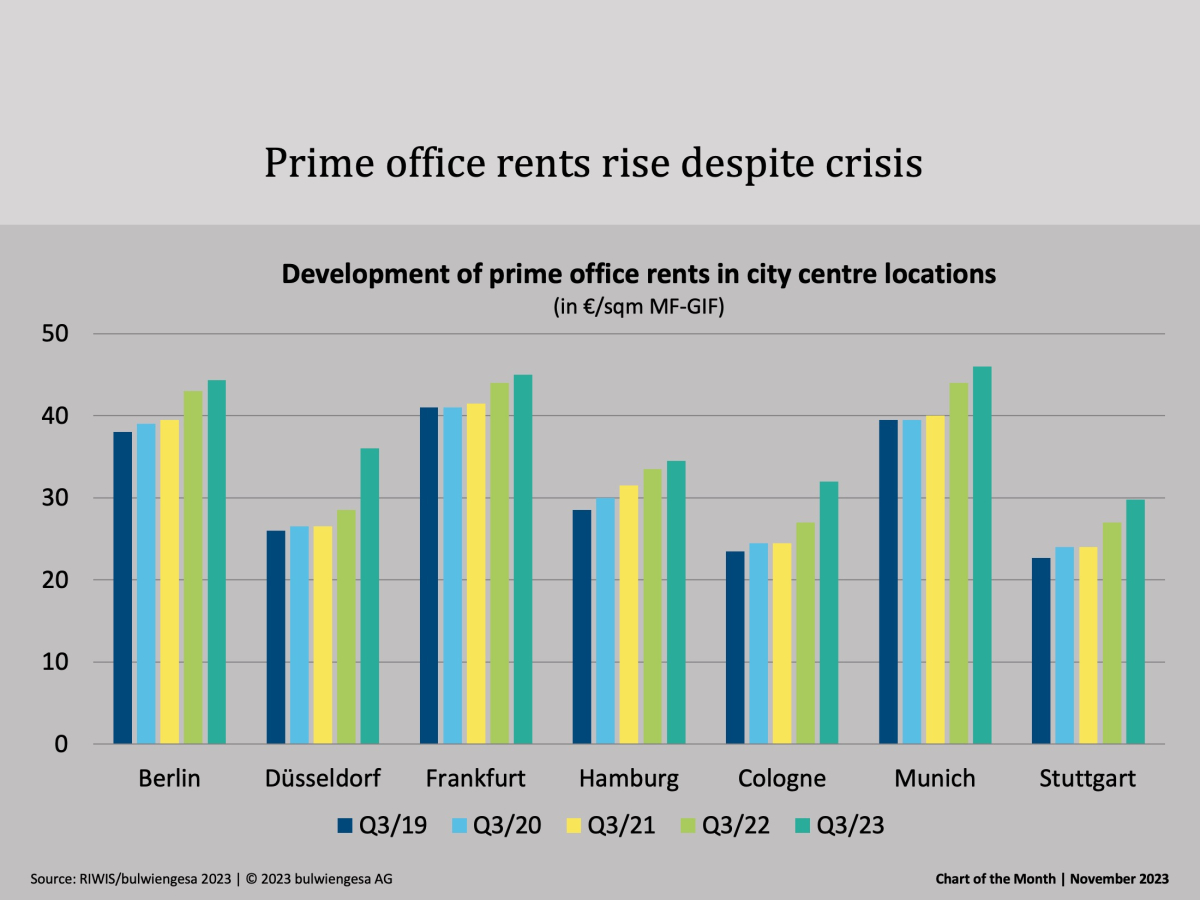

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

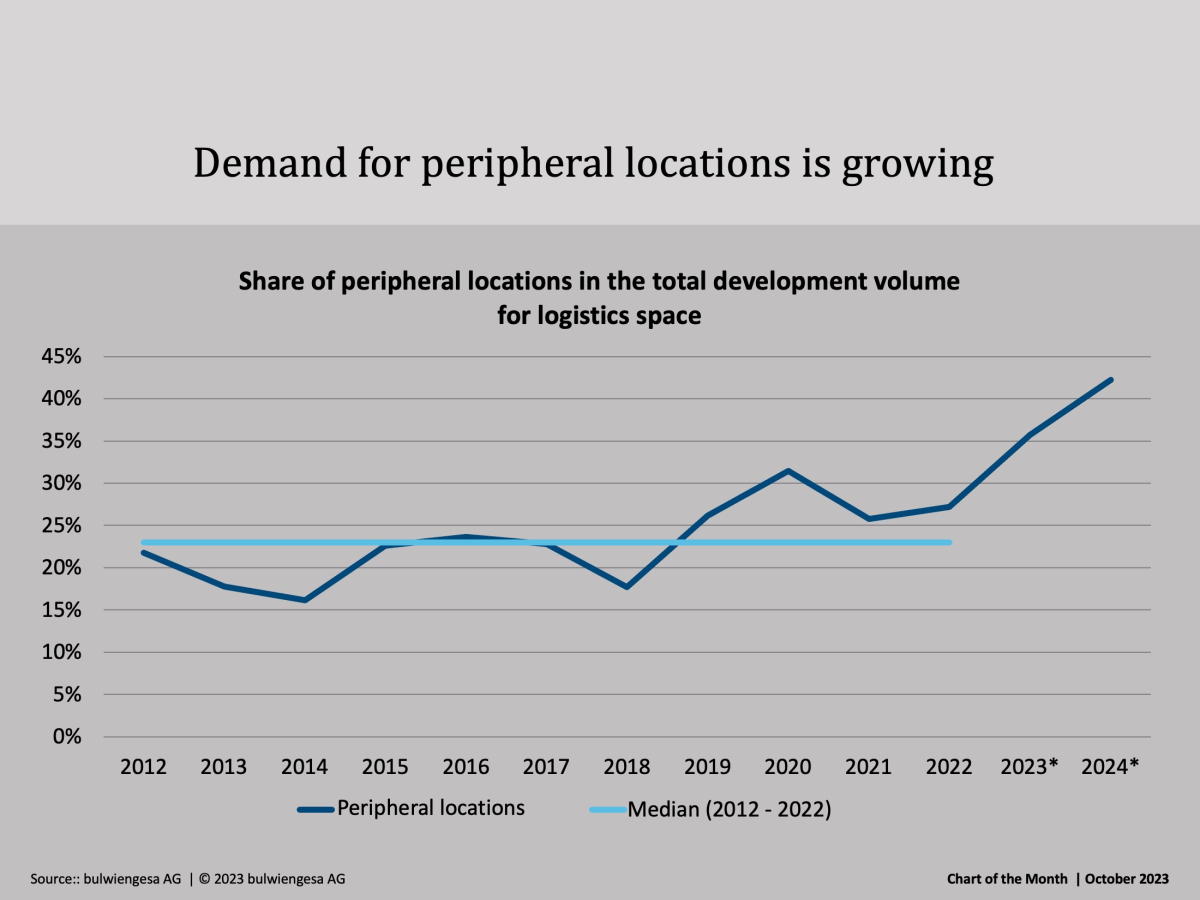

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.