Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.

What is the current situation?

29% of the facilities are 40 years old or older; although many facilities have been modernised for the most part during their life cycle, extensive measures have rarely been carried out here, especially not in terms of energy efficiency. Around one in three facilities are still "younger", up to a maximum of 20 years old, and - assuming a normal contract term with an operator - are in their first operating phase.

How has the structure of the centres changed?

The concept of the facilities has changed considerably: from the first generation (1940s to 60s) as a "custodial institution" to the residential homes of the third generation (80s/90s) to the house-sharing models (fourth generation) and the neighbourhood houses (fifth generation), which focus on the active participation of residents in small, family-like residential groups in integrated locations. This is also accompanied by changes to the layout of the facilities. But structural changes can also be recognised over the years:

- ownsizing of facilities: from an average of 95 places per facility (BJ 1960+) to the current average of 85 places/facility, whereby these trends are also partly influenced by legal regulations such as the upper limit of 100 places in Baden-Württemberg.

- Privatisation of operators: 65% of facilities built in 1960+ are run by non-profit organisations; in new builds, the ratio has reversed. Here, 66% of facilities are now run by private operating companies.

- Expansion of the offer: It has now become established to realise multi-unit facilities combining long-term care and assisted living.

What does the age of the building stock mean for the market situation?

As a rule, existing facilities do not meet the necessary construction standards, whether in terms of the number of single rooms or, in particular, energy standards; this makes it difficult to find suitable investment products in the portfolio that meet investors' requirements. As a result, the opportunities for re-letting or reselling facilities with a service life of 40 years or more are becoming increasingly limited. Comprehensive refurbishment measures would be necessary, but these are often not carried out due to the cost intensity. This would result in considerable rent increases, which the operators would not be able to refinance. As a result, old care facilities are being closed. This in turn exacerbates the lack of sufficient care places.

Conclusion: n the supply side, the care infrastructure faces not only quantitative but also qualitative challenges. When planning how to meet demand, it is therefore essential to consider not only the current and future need for additional care places, but also the need for substitution resulting from the existing structure of the facilities.

From Q1/2024, our new RIWIS module "Senior Living" will also provide all basic information on demand planning and facility-specific key facts on the care infrastructure in Germany. Please do not hesitate to contact us!

Contact: Sabine Hirtreiter, Senior Consultant in the Senior Living and Residential Property segment, hirtreiter@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

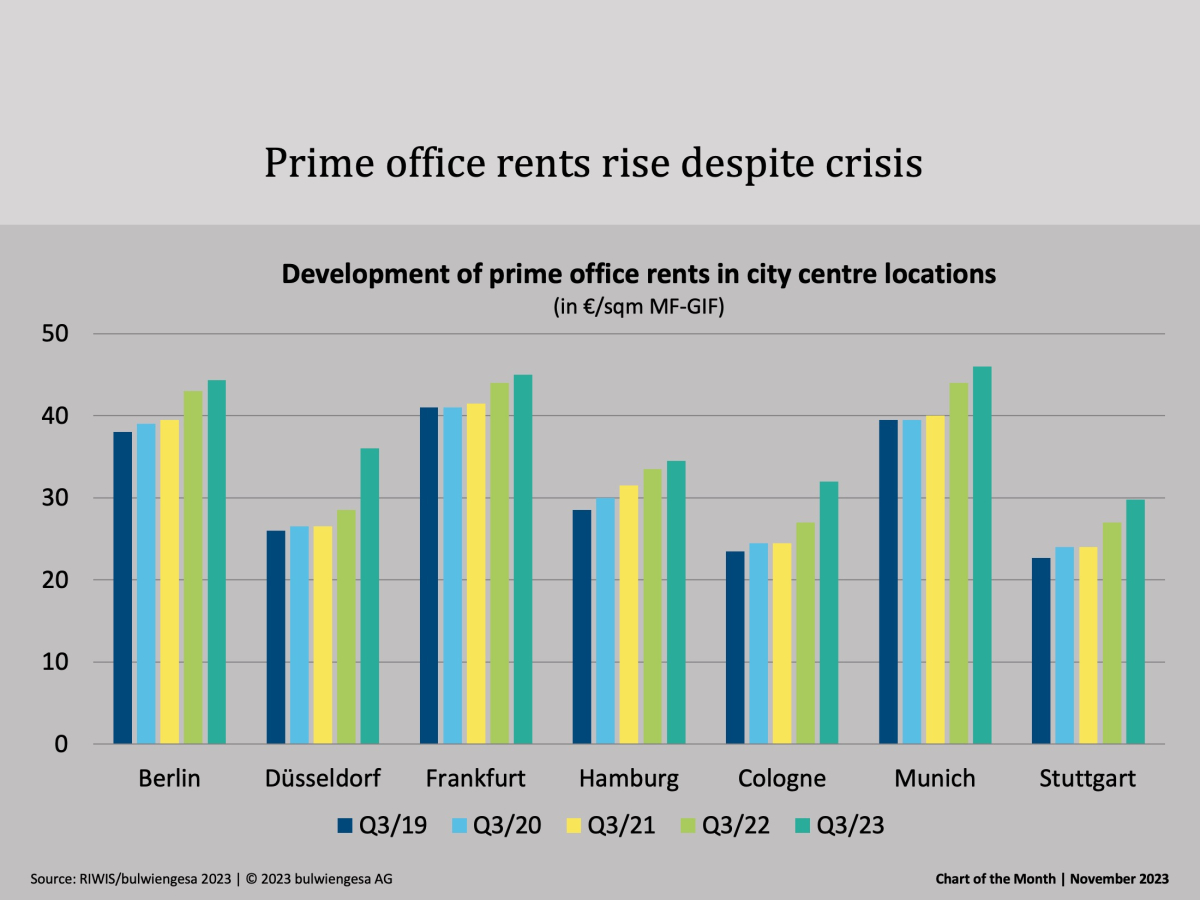

Chart of the month November: Top offices are still in demand

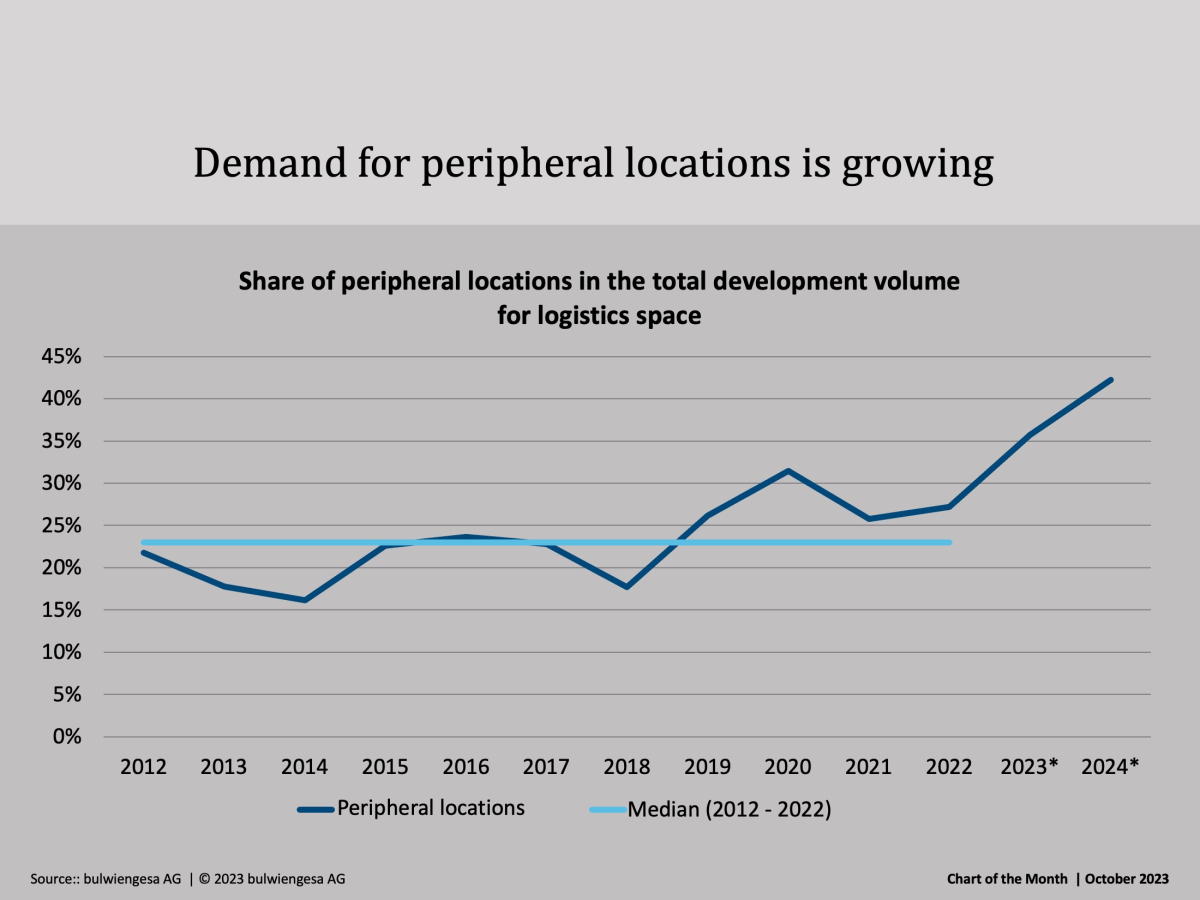

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

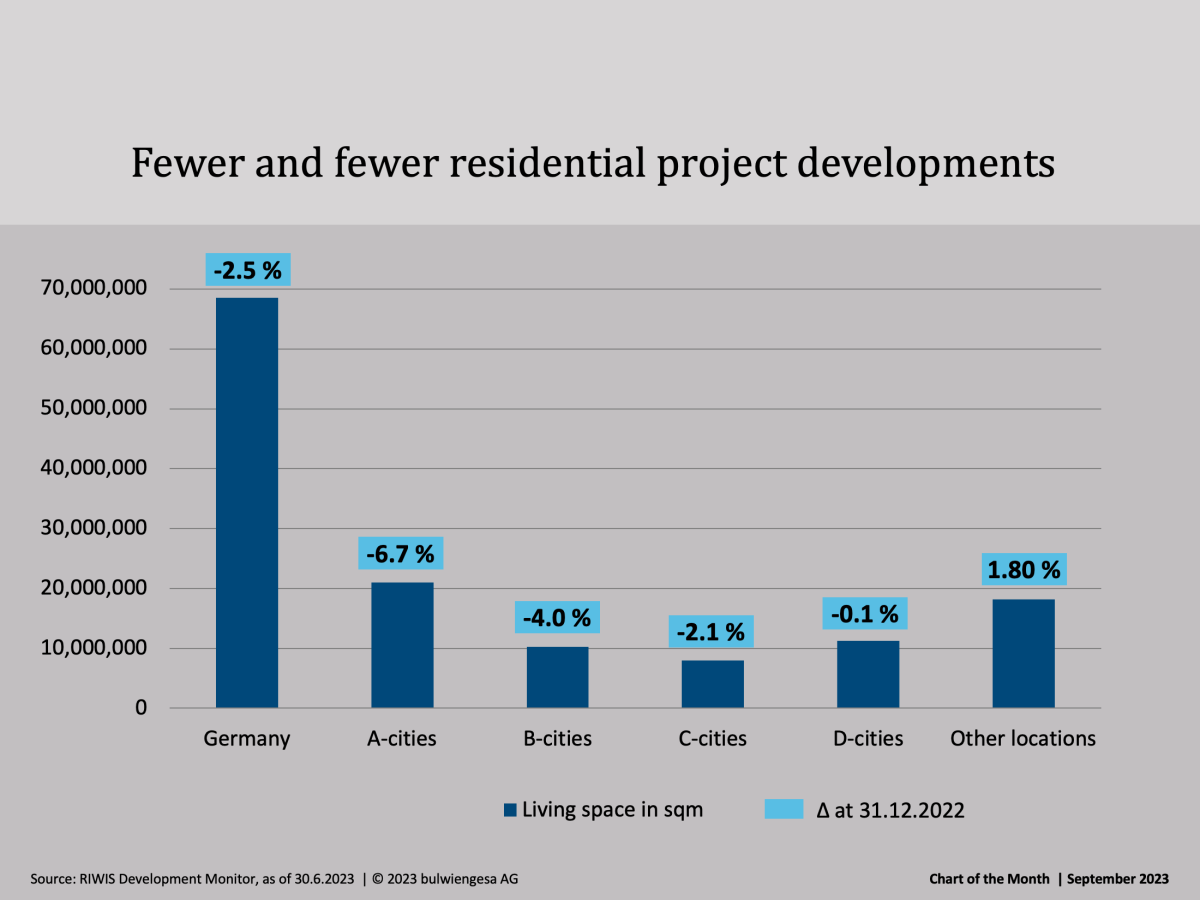

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingChart of the Month September: Residential Project Area Continues to Decline

The insolvencies of large and small project developers illustrate the extremely tense market situation. And the number of residential projects planned and under construction is falling - most sharply in the metropolises, of all places, where the housing shortage is greatestInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.