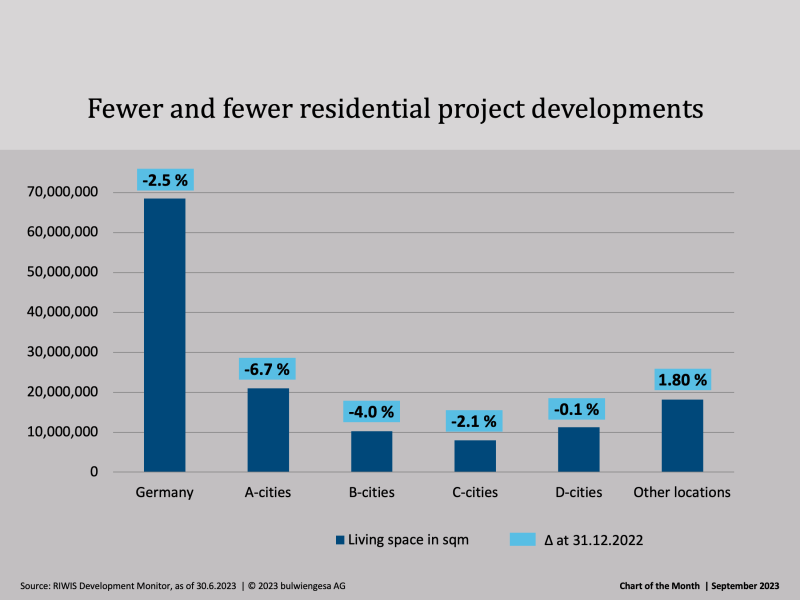

Chart of the Month September: Residential Project Area Continues to Decline

The insolvencies of large and small project developers illustrate the extremely tense market situation. And the number of residential projects planned and under construction is falling - most sharply in the metropolises, of all places, where the housing shortage is greatest.

We have been monitoring the market for project developments for many years. For a current analysis, projects completed since 2020 as well as projects under construction and in planning with a realisation horizon of 2027 from a size of 1,500 sqm of residential or rental space were evaluated and the changes as of 30.6.23 compared to 31.12.22 were documented.

The residential segment accounts for by far the most development and construction activities with a share of 37 % of the total project volume. With 69 million sqm of living space, residential is the most important type of use.

The project development volume in Germany is declining overall. Residential project developments are being hit hard. The chart of the month shows that it is mainly A-cities that are affected. But: The decline there is not a new phenomenon, but has been evident for several years. Even before Corona and the current crisis, high land prices and construction costs as well as long planning and approval procedures led to a shift to smaller cities or to the outskirts of the metropolises. The most recent increase was in the volume of residential project developments in the A-cities in 2019.

Currently, various factors are slowing down new construction across the board, which can also be clearly seen in the construction starts: in 2023, the decline compared to 2021/22 is as much as 54 %. On the one hand, condominiums are more difficult to market due to higher interest rates. On the other hand, cost and income calculations no longer add up. In new construction, rents will continue to rise, probably even at a higher rate than forecast due to the shortage and higher demand from former buyers. Without acceleration and simplification of the procedures and at least temporary financial support for housing construction, for example through the planned declining balance depreciation of buildings, the shortage problem cannot be solved in the short term.

Further informations (in german language): „Marktblick: Developments“.

Contact person: Felix Embacher, Head of Research & Data Science, embacher@bulwiengesa.de and André Adami, Head of Residential, adami@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

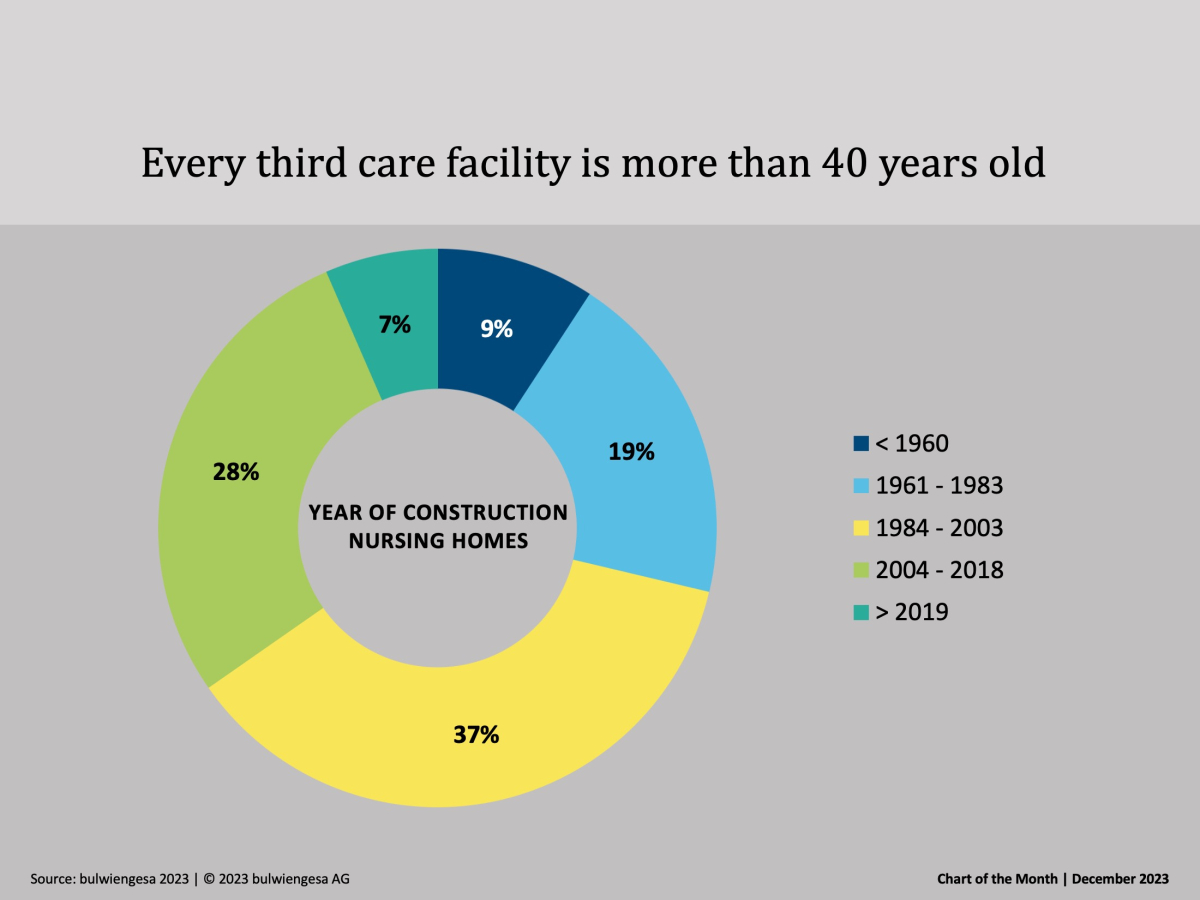

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

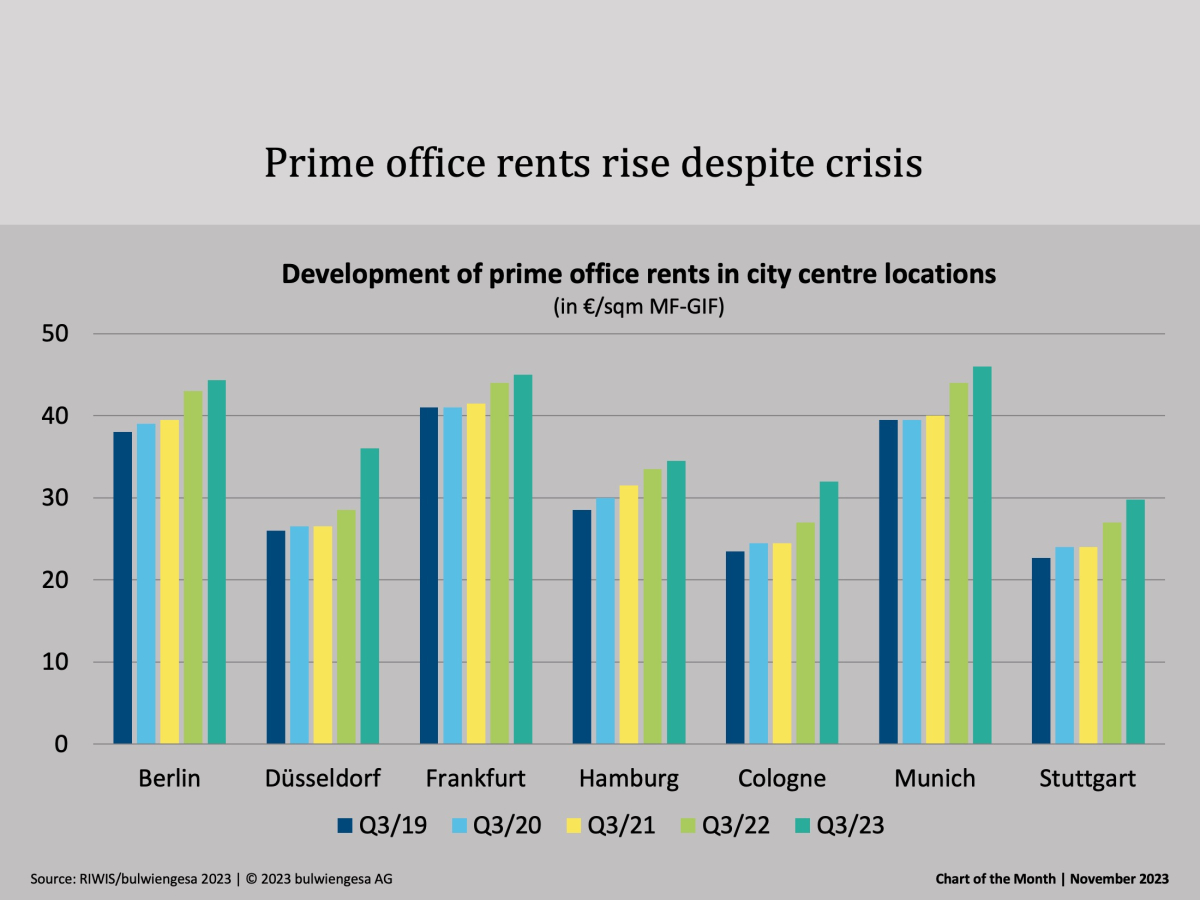

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

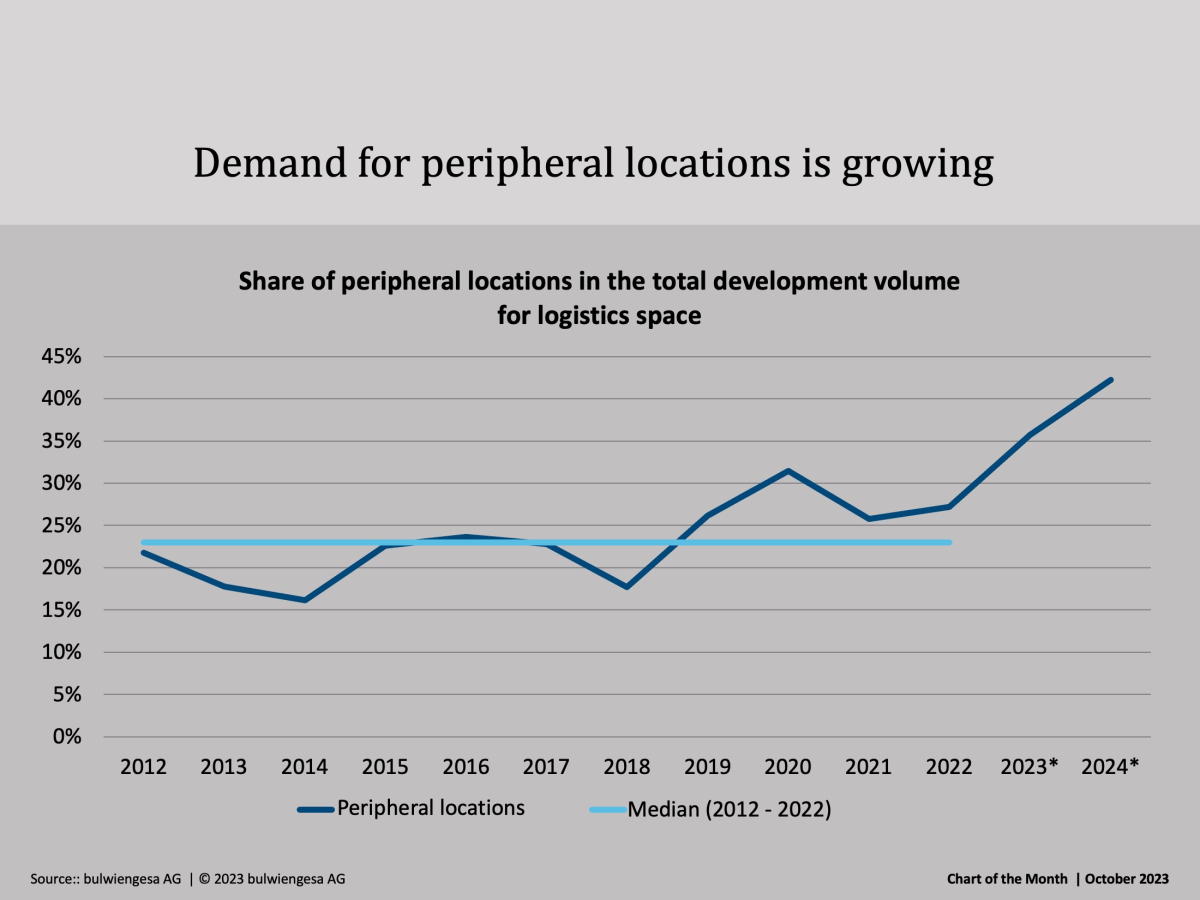

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.