Chart of the Month January: Massive Investments in Logistics Real Estate

An almost rhetorical question: Is so much being invested in logistics real estate despite or because of the current uncertainties? The answer is: both are true.

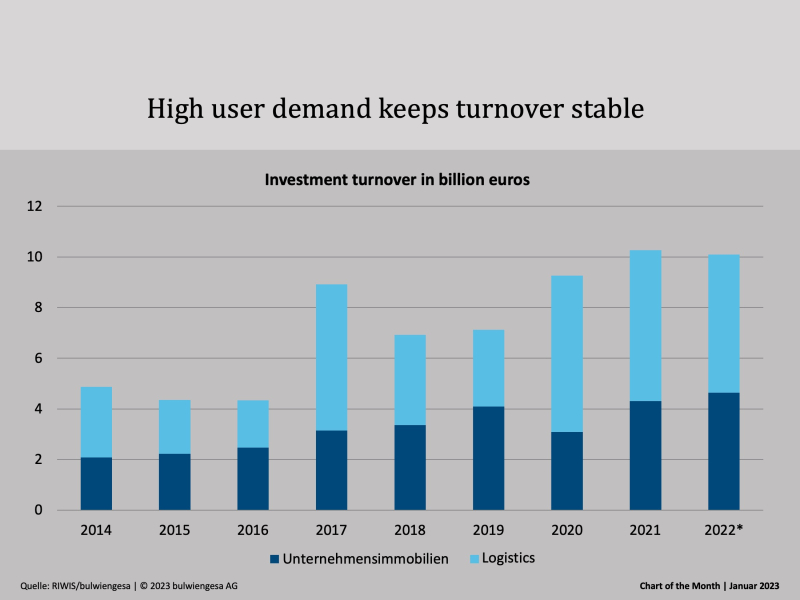

While in other asset classes there were in some cases significantly fewer players buying and selling during the second half of the year, the transaction market for logistics real estate has also seen largely stable demand over the second half of the year. The annual result is that in 2022 around 10.1 billion euros will have been transacted in logistics and corporate real estate, which is hardly less than in 2021. Apparently, logistics real estate offers investors a high degree of security in the current market phase characterised by distortions.

And this despite the yield adjustments caused by the general interest rate policy. The high user demand and the resulting cash flow security play an important role for many investors. For years there has been an enormous surplus demand, which is expected to continue in the near future due to more restrictive zoning. Macroeconomic trends, such as the return to re- and near-shoring in production, are causing additional demand pressure in the market. Also, meeting ESG criteria is becoming increasingly important. This means that demand is primarily focused on modern buildings that meet energy sustainability standards. These factors play a major role in the investor's security assessment and therefore once again result in a very strong performance on the transaction market in the completed year 2022.

As there are more subsequent notifications in the course of the first weeks of a year, the preliminary value for logistics real estate is around 5.5 billion euros investment volume and thus close to the record-breaking previous year, in which almost 6 billion euros were invested. In addition, there is an investment volume of around 4.6 billion euros for corporate real estate (estimated value based on the half-year result and empirical values from previous years), so that the total result of 10.1 billion euros investment volume in the industrial sector - logistics and corporate real estate - is only slightly below the record value from 2021, when a total volume of 10.3 billion euros was achieved.

Note: More information on corporate real estate is available on the website of the INITIATIVE UNTERNEHMENSIMMOBILIEN. The study series Logistics and Real Estate also contains many facts about the logistics real estate market.

Contact: Felix Werner, Team Leader in Logistics and Corporate Real Estate, werner@bulwiengesa.de and Daniel Sopka, Consultant in Logistics and Corporate Real Estate, sopka@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

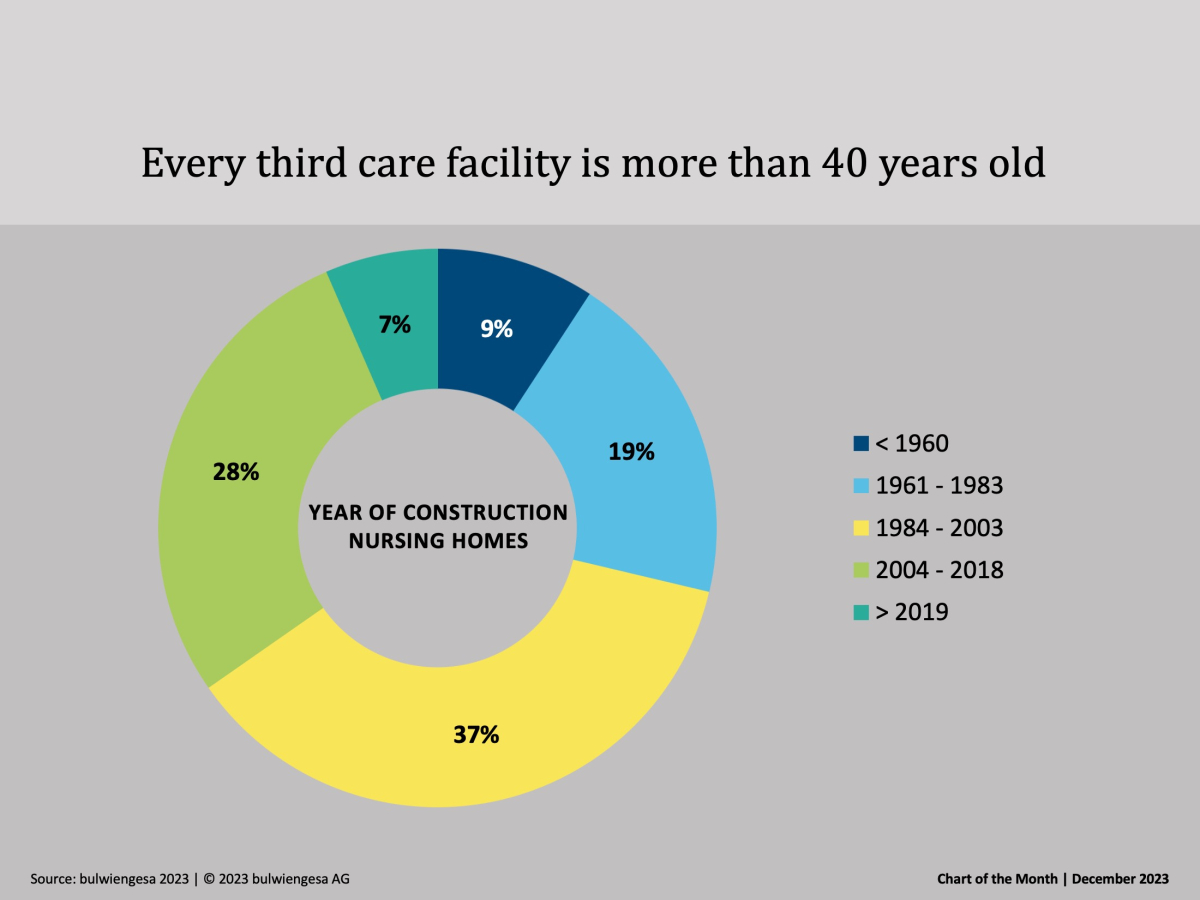

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

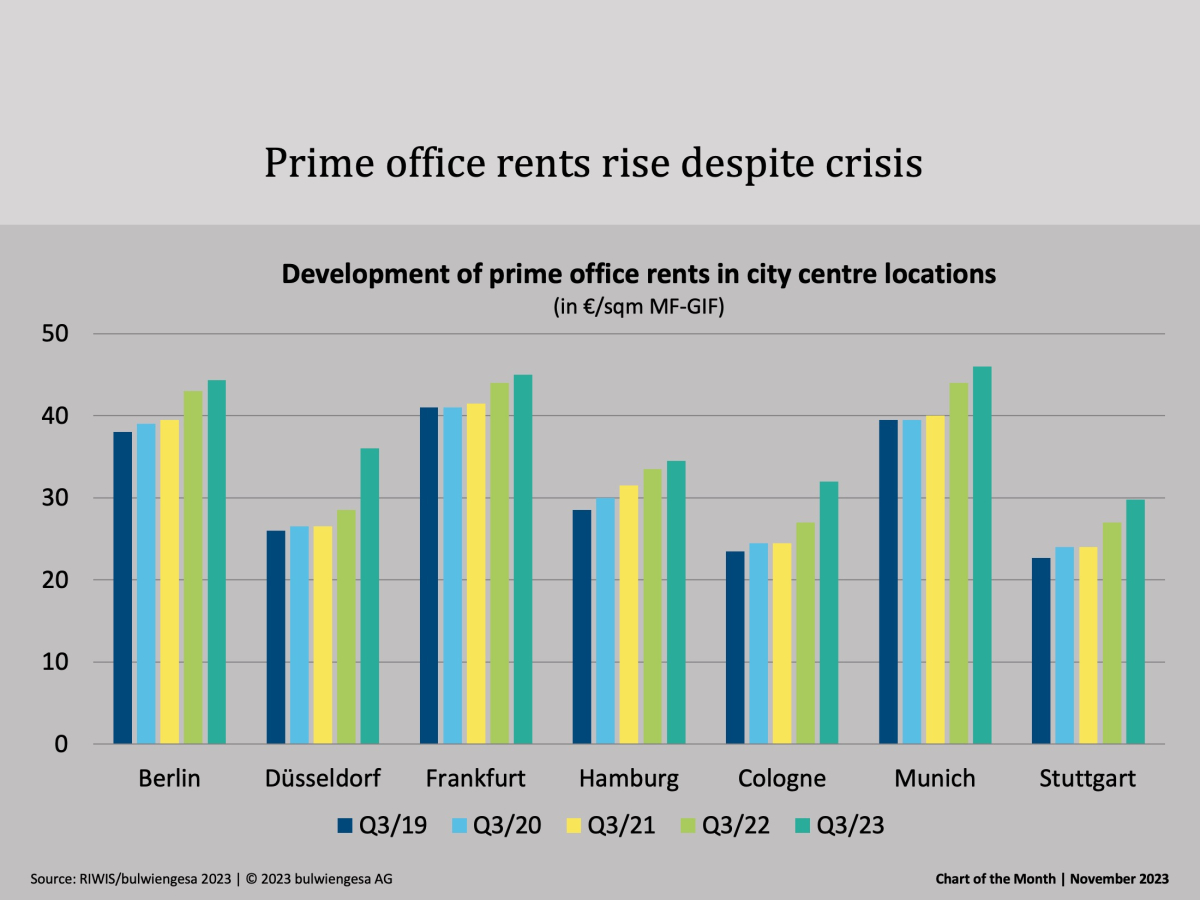

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

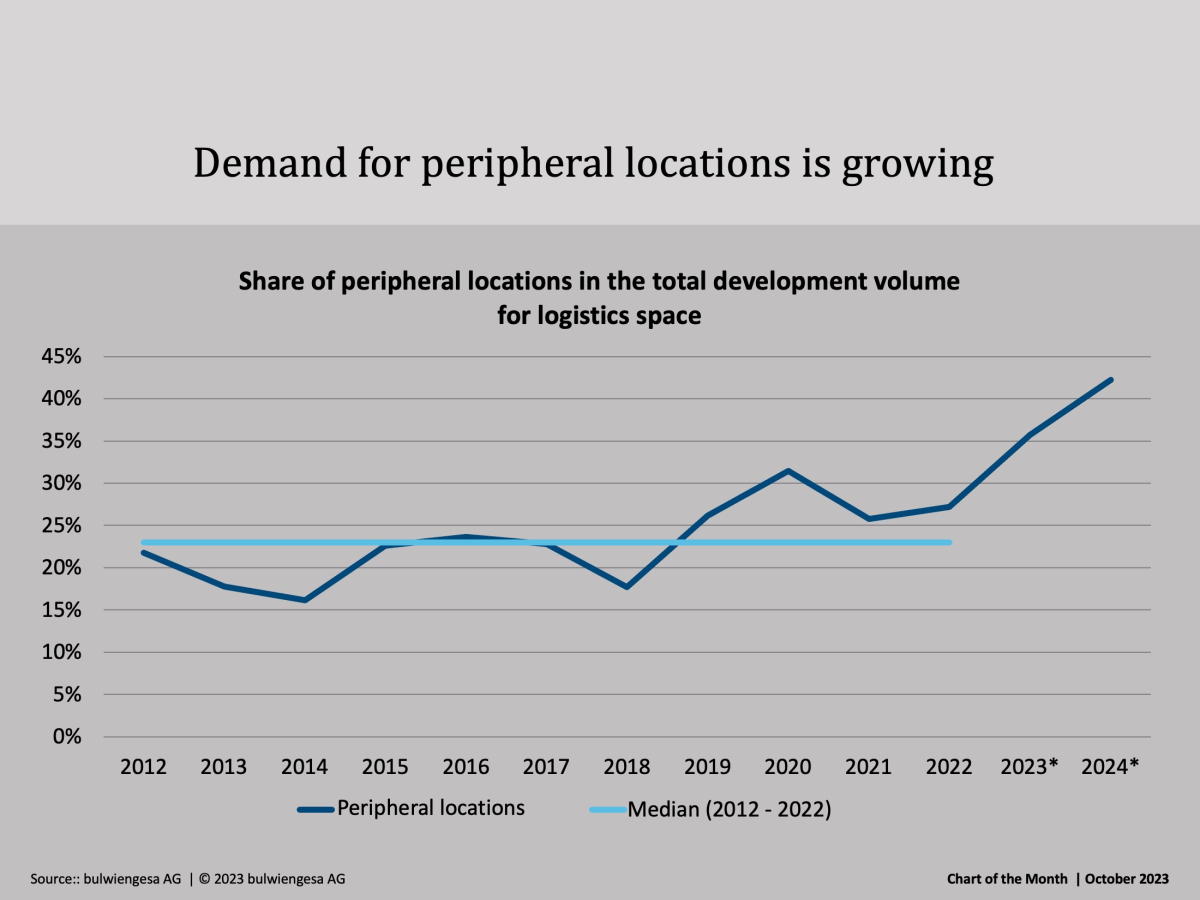

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.