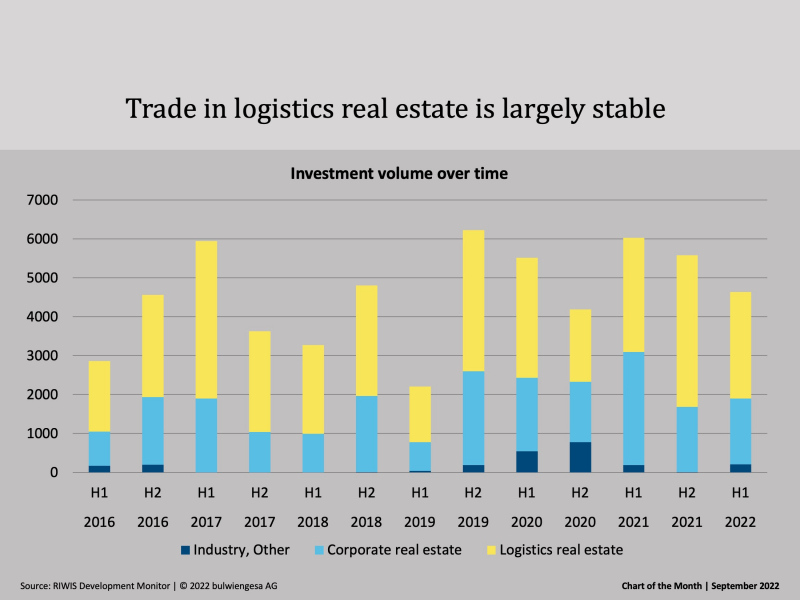

Chart of the Month September: Investment Market Logistics Real Estate

In an exclusive preview of the study "Logistics and Real Estate 2022", which will be published on October 5, we take a look at the investment market. The fact is: Turnover is outstanding - but for how much longer?

Logistics real estate continues to enjoy great popularity on the investment market. Currently, it is difficult to foresee what impact the turmoil in Europe will have on this asset class. Such ramifications usually have a delayed impact on the investment market, as the deals have several months' lead time and the players do not (or cannot) react abruptly to exogenous shocks. At present, a significant decline in investment activity in logistics real estate is not to be expected. What is certain is that the softening yields in the second quarter or the possibility of further price adjustments may make this asset class attractive for new investors.

The market will re-order itself

The investment market in the first half of 2022 confirms the outstanding previous year. EUR 4.6 billion was invested in logistics and industrial real estate, of which EUR 2.7 billion was in logistics properties. How things will develop in the second half of the year is hardly foreseeable in the current market environment. Increasing restraint on the transaction market was already noticeable in the second quarter as a result of higher financing costs and economic uncertainties. In the top logistics regions, prime yields were already rising, heralding the end of yield compression. The effects are currently particularly noticeable in the absolute core segment, where factors have regularly exceeded 30 times the annual rent in the recent past. This is barely economically feasible with current financing conditions. Now it depends on how quickly buyers and sellers will again find common ground for market-adequate purchase prices after a reassessment of the situation.

Note: On October 5, a study will be presented together with the long-standing study partners Berlin Hyp, BREMER, GARBE and Savills in an open press conference at the Expo Real (in German language). Further Informations.

Contact person: Daniel Sopka, Consultant for logistics and corporate real estate, sopka@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

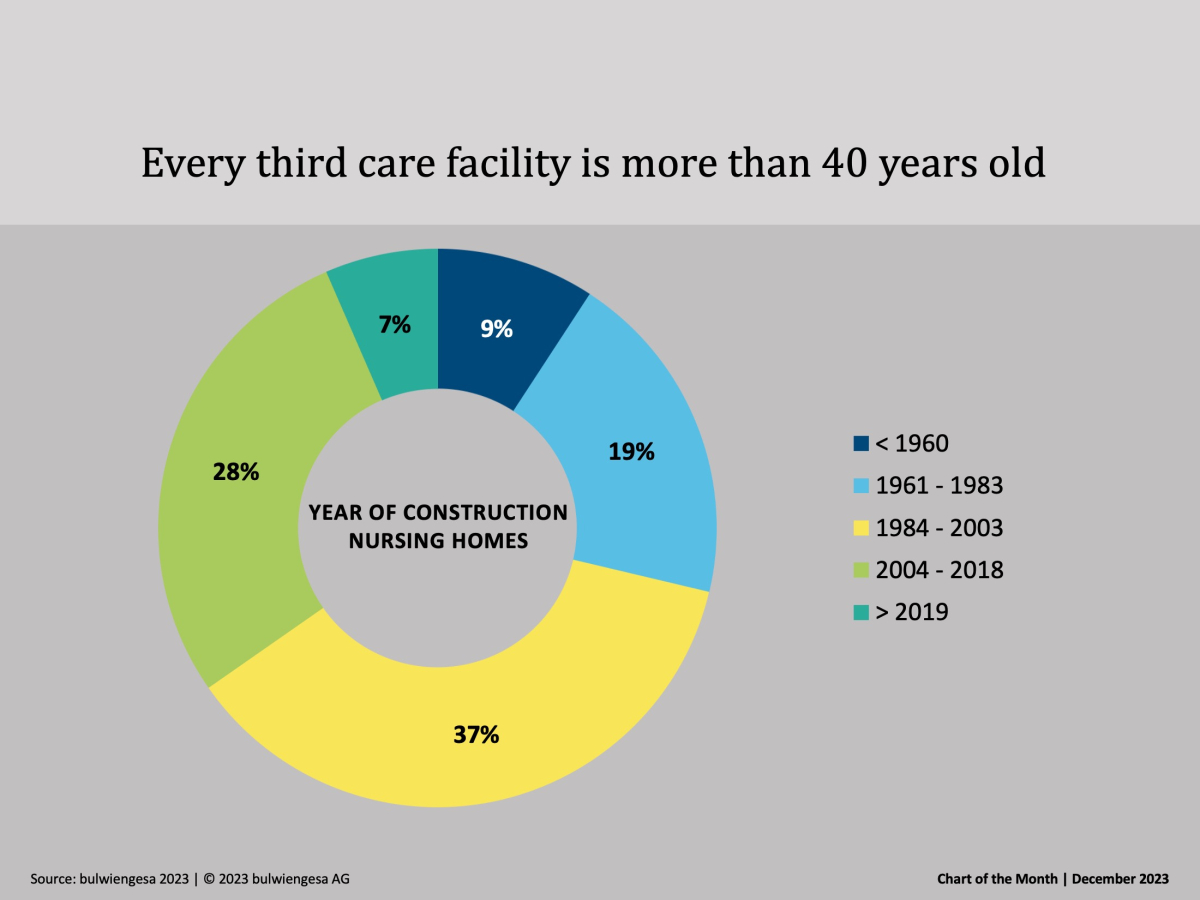

Chart of the month December: The country needs new care properties

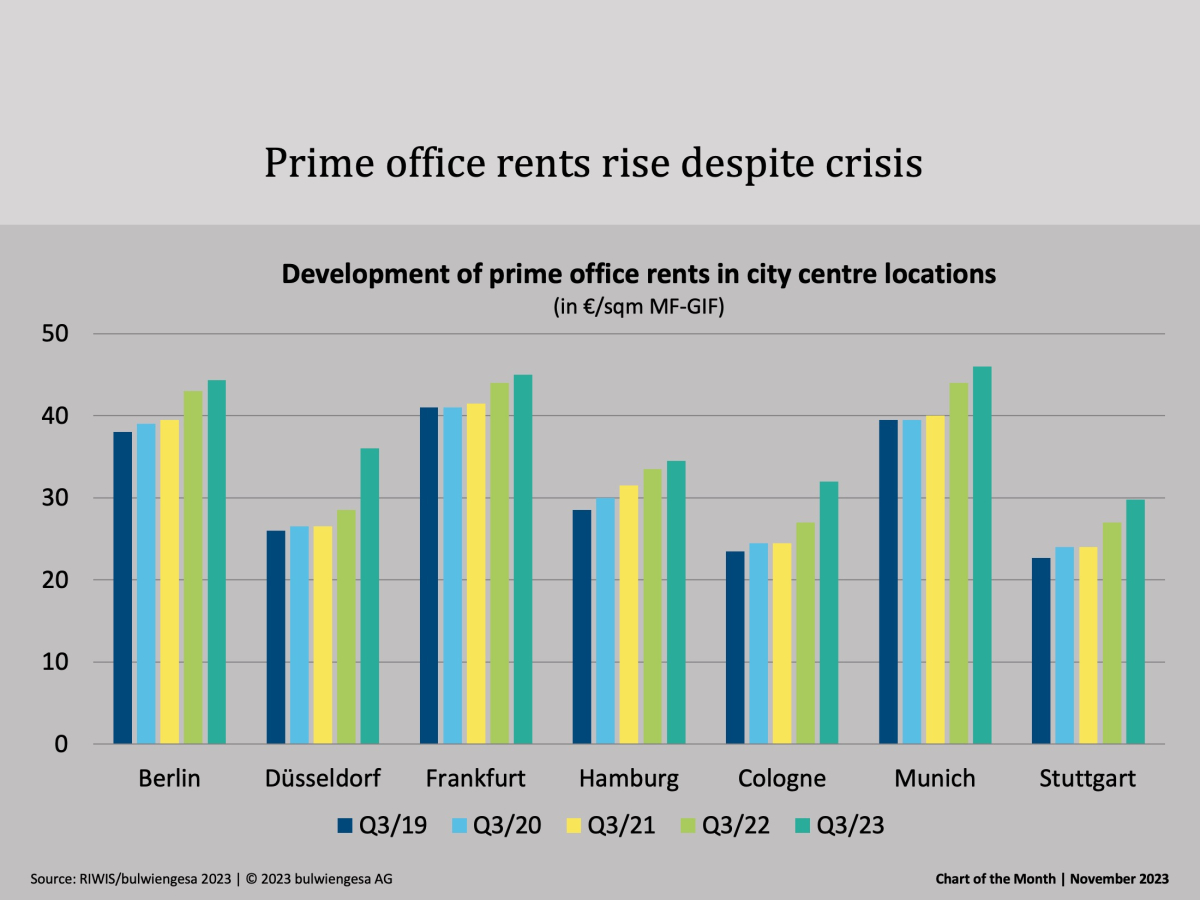

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

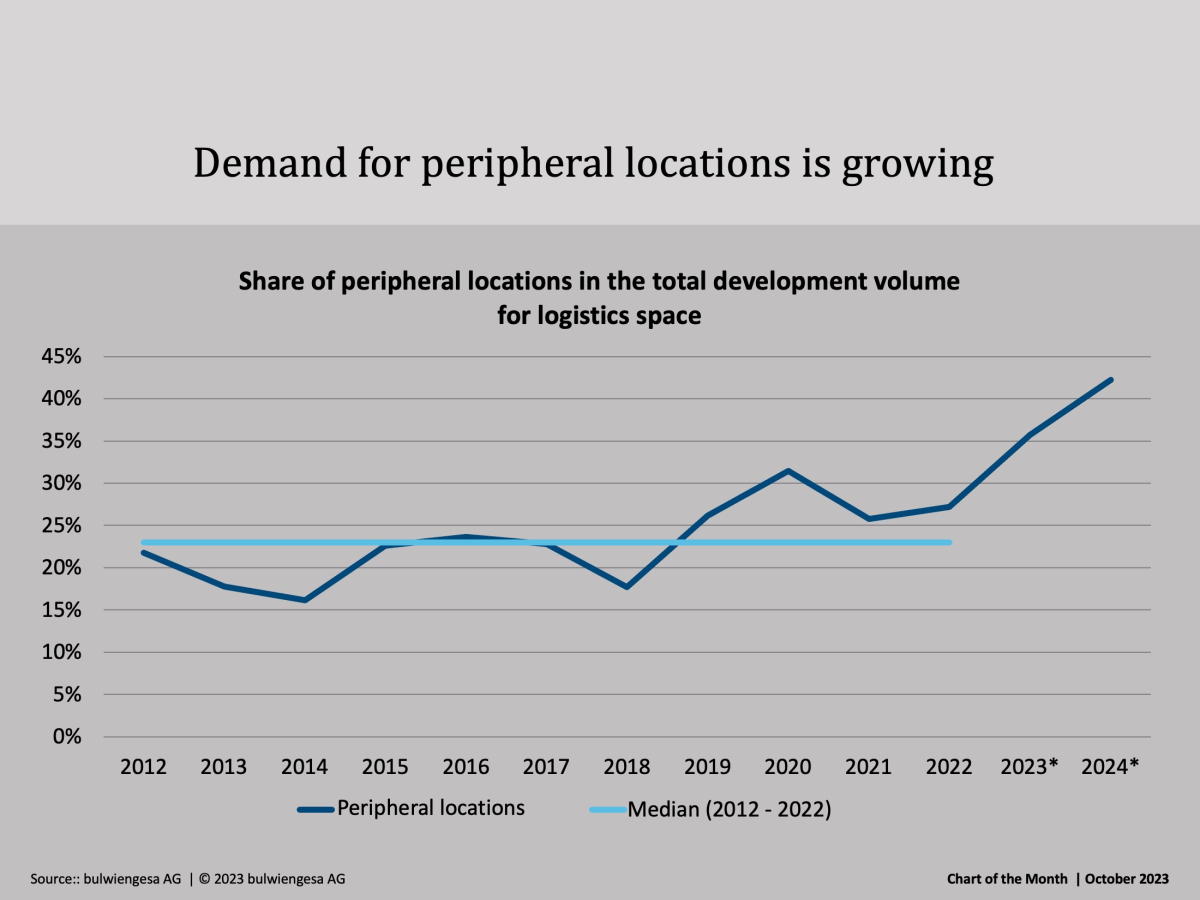

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.