The smaller, the more lucrative

For the new report of the Micro-Living Initiative, we interviewed operators: for example about the increased energy costs, their marketing efforts and the status of their business after Corona. The report also contains extensive best-practice recommendations for the operation and construction of residential flats.

To flip or not to flip? The massive increase in energy costs is causing headaches for operators of flats in the micro-living and temporary housing segment. Most of them calculate an all-in rent, which has become the standard in this segment. For the new market report of the Initiative Micro-Living (IML), we asked the operators what they plan to do - most of them want to pass on the higher costs to the tenants. The subject of energy costs is one of several topics in the survey. It is already the fifth market report. This time we evaluated about 24,000 residential units in 117 apartment buildings. The report shows how the industry is doing.

The most important results: The average monthly all-in rents are around 543 euros, ranging from around 258 to 1,140 euros and reflecting the great heterogeneity of the properties in terms of property and location qualities, flat sizes and the respective city and tenant clientele. Compared to autumn 2021, the rents of all members have risen by an average of approx. 1 %. It should be noted, however, that the portfolio composition has changed, especially compared to the last edition. The changes in value cannot therefore be explained purely by market developments. Students are an important target group for flats, accounting for about 42% of all tenants, but by no means the only one. Some apartment buildings actually do not have a single student as a tenant. Compared to autumn 2021, the proportion of students has remained stable. On a positive note, the occupancy rate has stabilised compared to autumn 2021 at an average of 85%. It is also noticeable that the range of occupancy rates per apartment building has narrowed somewhat, but still remains quite high, which indicates that not every flat concept performs well at every location. However, this occupancy rate tends to require increased marketing efforts and property management that is even more focused on target group needs.

The current survey showed that, despite all crises and caesurae, there is general optimism among participants for the future of residential apartment buildings. Nevertheless, most members do not expect "business as pre-COVID" until 2023 at the earliest. With regard to rent increase possibilities, the participants of the IML predominantly assume rates of increase slightly below the current very high inflation rate. Here, values of nominally 2 to 4 % p.a. and 4 to 6 % are the most frequently mentioned answer categories.

Best practice recommendations for the operation and construction of apartment buildings

As part of the data collection for this edition, almost all participants in the IML also took part in a survey from which best practice recommendations for the operation and construction of residential flats are formulated, for example:

- Measures to achieve permanently high occupancy rates

- Recommendations for the construction of an apartment building

- Recommendations for the construction and maintenance of common areas and furnishings

- Recommendations for services within an apartment building

- Investment costs for the flats

Note: You can download the market report of the Micro-Living Initiative free of charge here: https://initiative.bulwiengesa.de/micro-living/

Contact: Felix Embacher, Chief Representative at bulwiengesa, embacher@bulwiengesa.de

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Little movement on the German real estate market

For the eleventh time, bulwiengesa presents its comprehensive analysis of the German real estate markets. The results of this year's 5% study, conducted in collaboration with ADVANT Beiten, show that the German real estate market is characterized by widespread stagnation. At the same time, niche segments are becoming increasingly attractive. The market is increasingly rewarding professional asset management and specialist knowledge—a trend that separates the wheat from the chaffFive per cent returns no longer illusory even for core properties

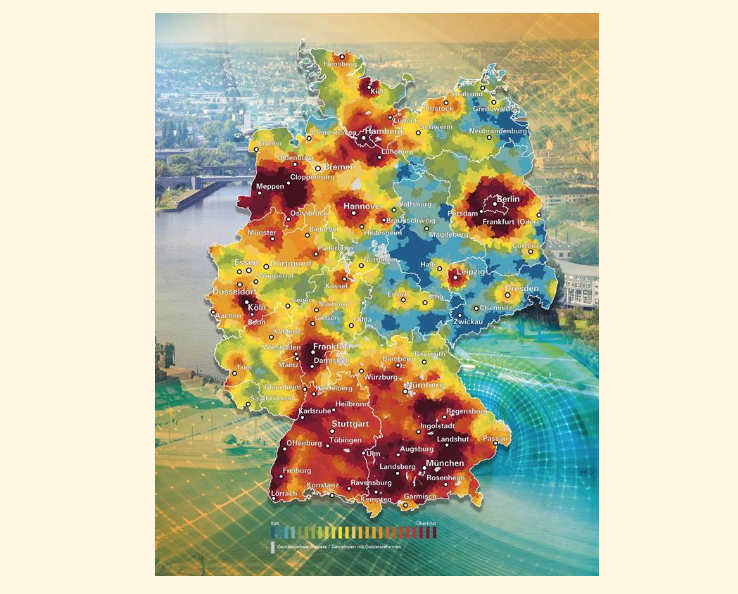

The ‘5% study - where investing is still worthwhile’ celebrates its tenth anniversary. Since the first edition was published, the German property market has tarnished its reputation as a safe investment haven. Higher yields are now within sight, even for prime properties, and even residential property is increasingly becoming a profitable asset class again. The market is more exciting than it has been for a long timeHow hot are the housing markets?

The rise in interest rates is putting a massive damper on residential construction. For the fifth time, we have analysed the relationship between supply and demand for each of the more than 11,000 German municipalities together with BPD for the "Housing Weather Map"Interesting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.