Magazine

Chart of the Month

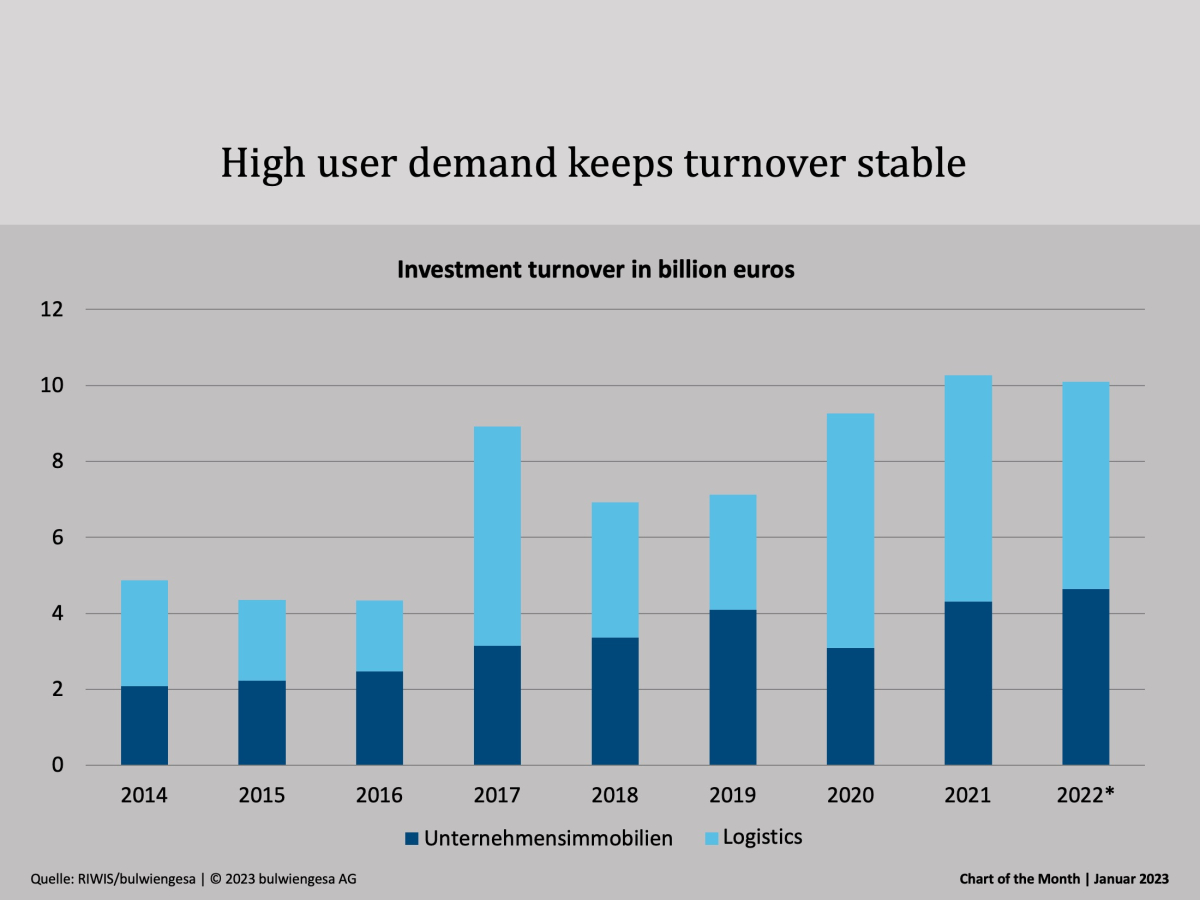

Chart of the Month January: Massive Investments in Logistics Real Estate

An almost rhetorical question: Is so much being invested in logistics real estate despite or because of the current uncertainties? The answer is: both are true

Chart of the Month

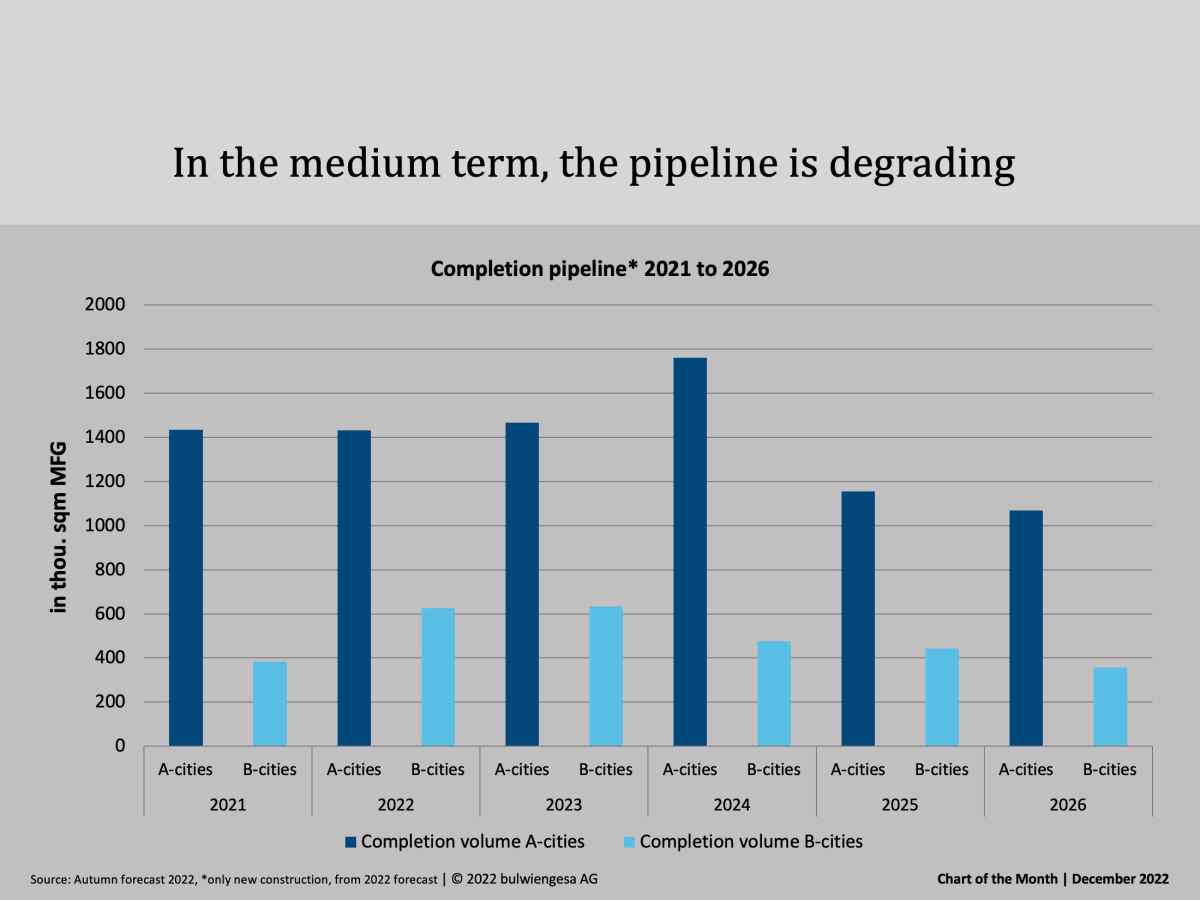

Chart of the Month December: Office market better than expected

In the coming years, high volumes of newly completed offices will again come onto the market. Vacancy rates are rising, but not to a critical extent. Landlords and tenants can negotiate at eye level again

Chart of the Month

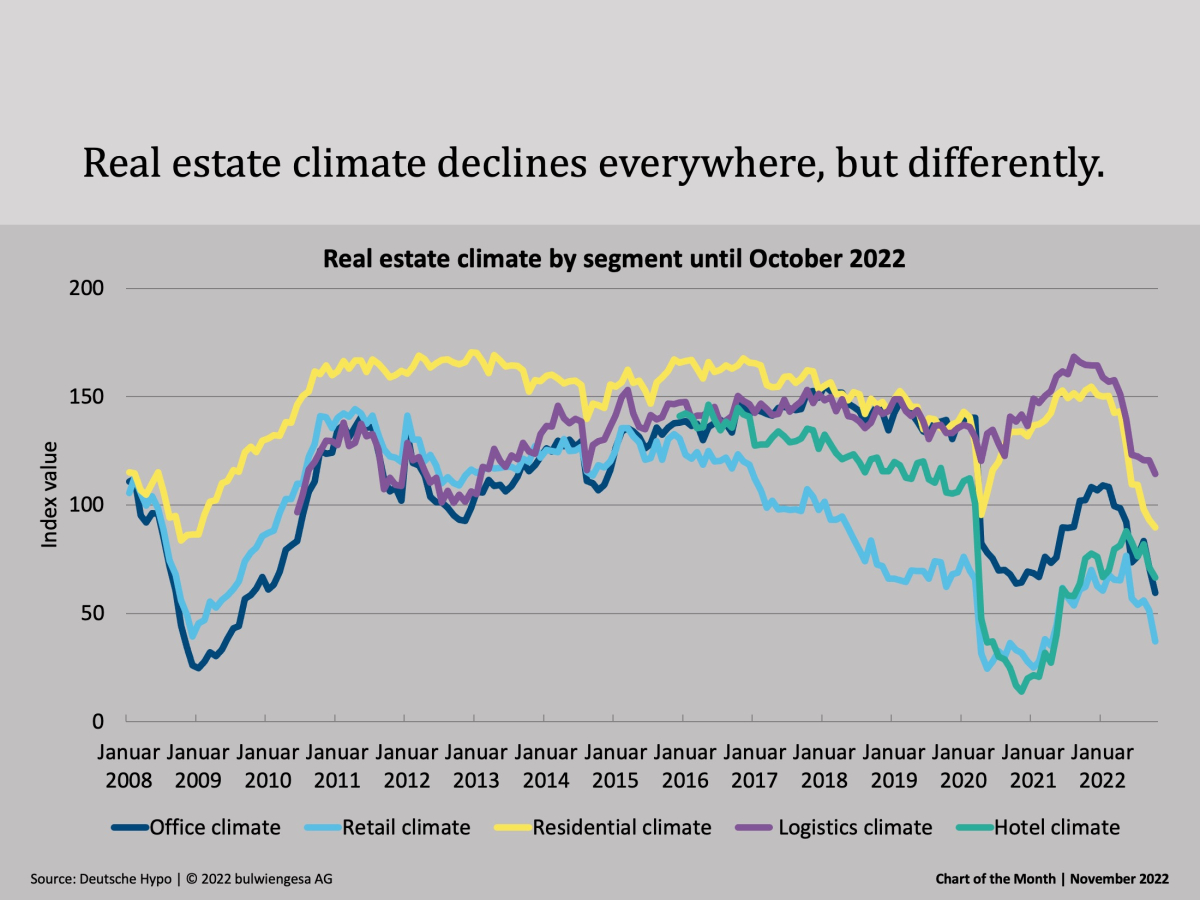

Chart of the Month November: Waiting for better weather

The 1,200 market experts we survey monthly as part of the Deutsche Hypo Real Estate Climate paint a gloomy picture. Above all, the residential and investment climate is collapsing. The market players are taking a wait-and-see approach.

Chart of the Month

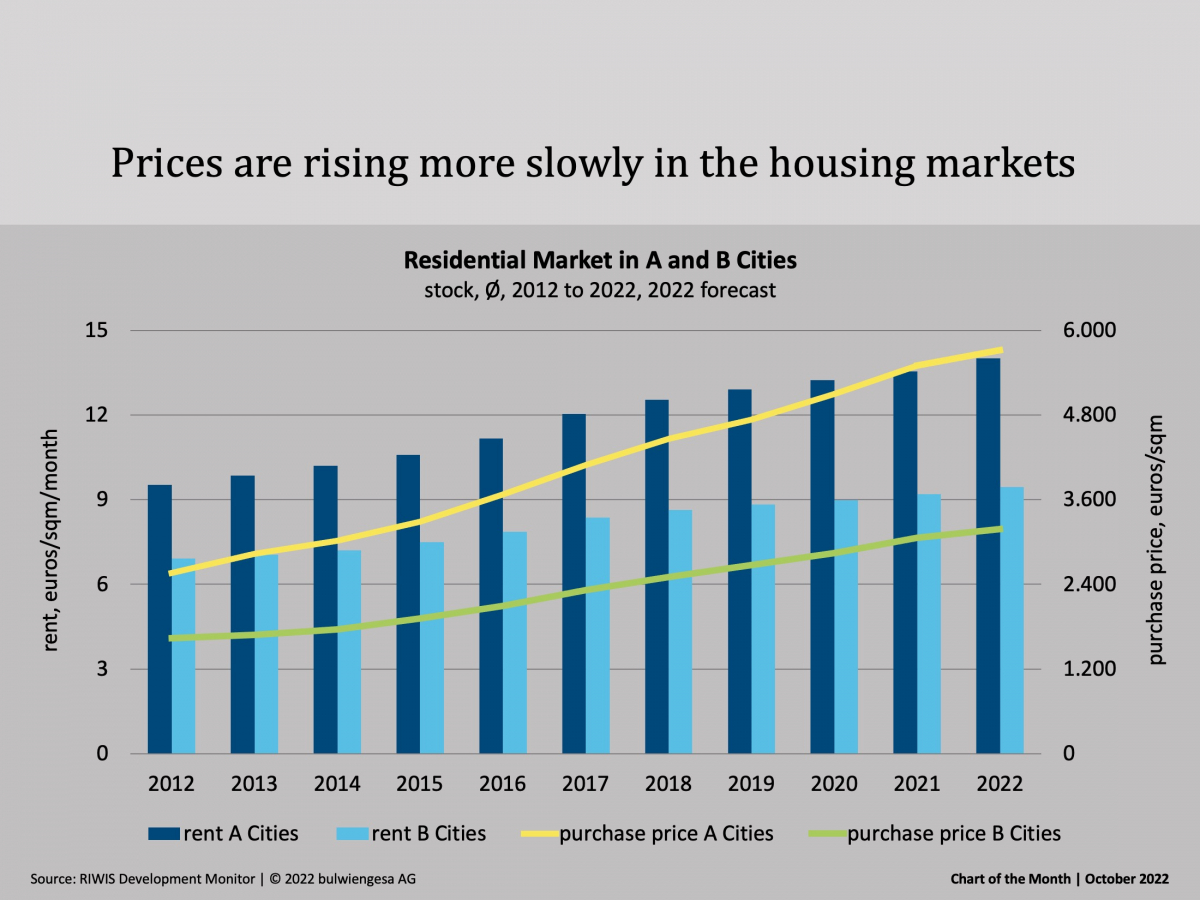

Chart of the Month October: Excess Demand and Buying Restraint

The fundamentals for the German housing market remain positive. However, it is hardly possible for investors to obtain inflation protection any more. The 5 % Study 2022 shows how different market opportunities and returns are

Chart of the Month

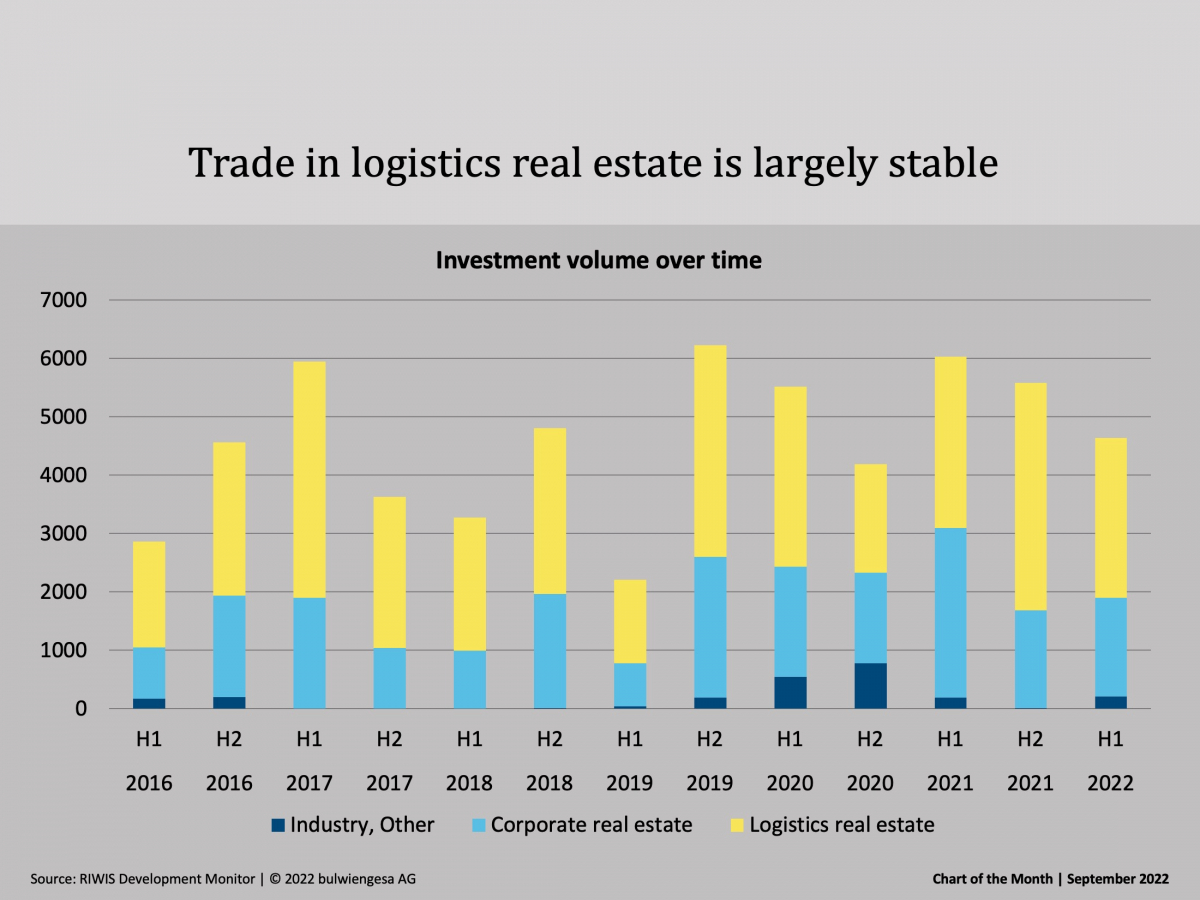

Chart of the Month September: Investment Market Logistics Real Estate

In an exclusive preview of the study "Logistics and Real Estate 2022", which will be published on October 5, we take a look at the investment market. The fact is: Turnover is outstanding - but for how much longer?

Chart of the Month

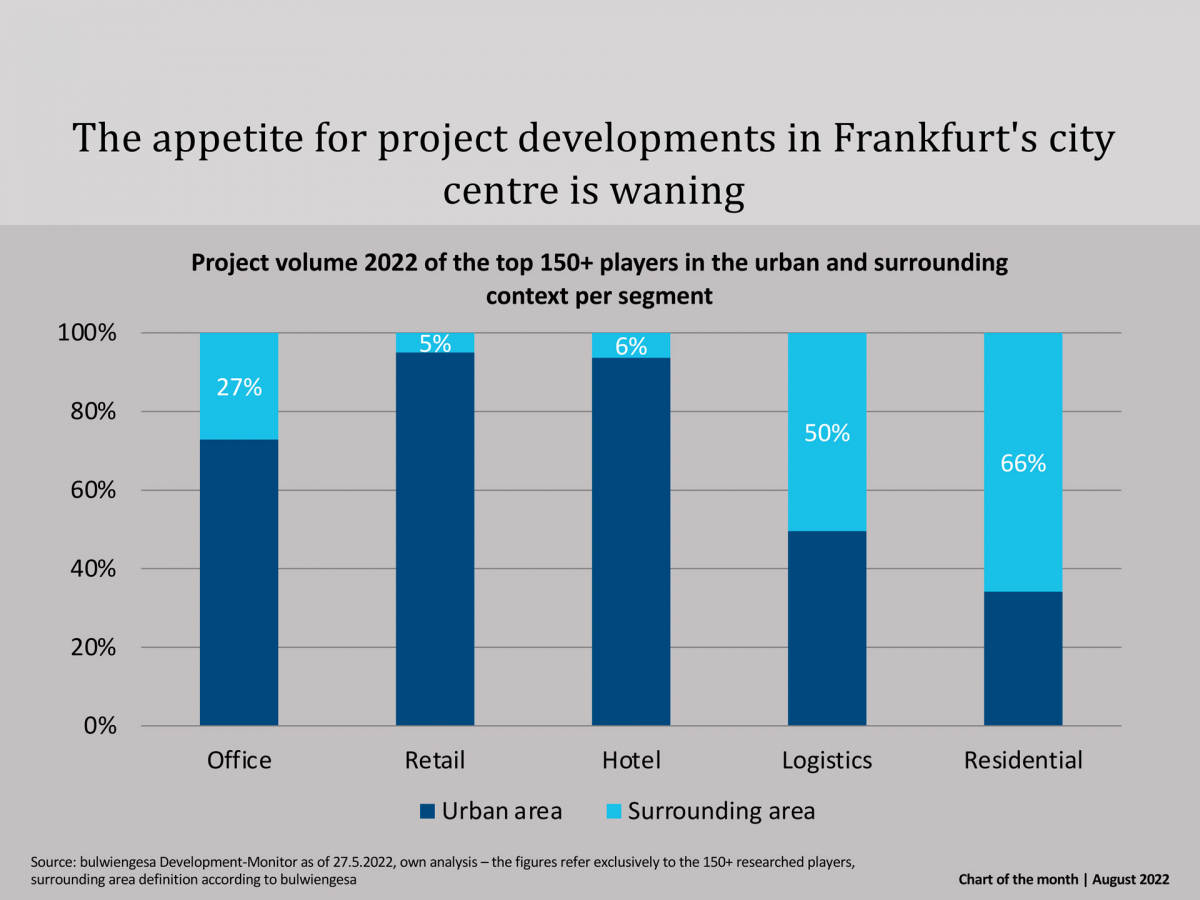

Chart of the Month - August: Trending towards the suburbs

It has become crowded in the metropolises, building land is scarce and expensive. No wonder that construction activities have increasingly shifted to the surrounding areas. In Frankfurt, almost every second square metre is built outside of the centre; at the same time, plans for flats have declined by 26 % since 2021. This is shown by the current assessment of the Development Monitor

Chart of the Month

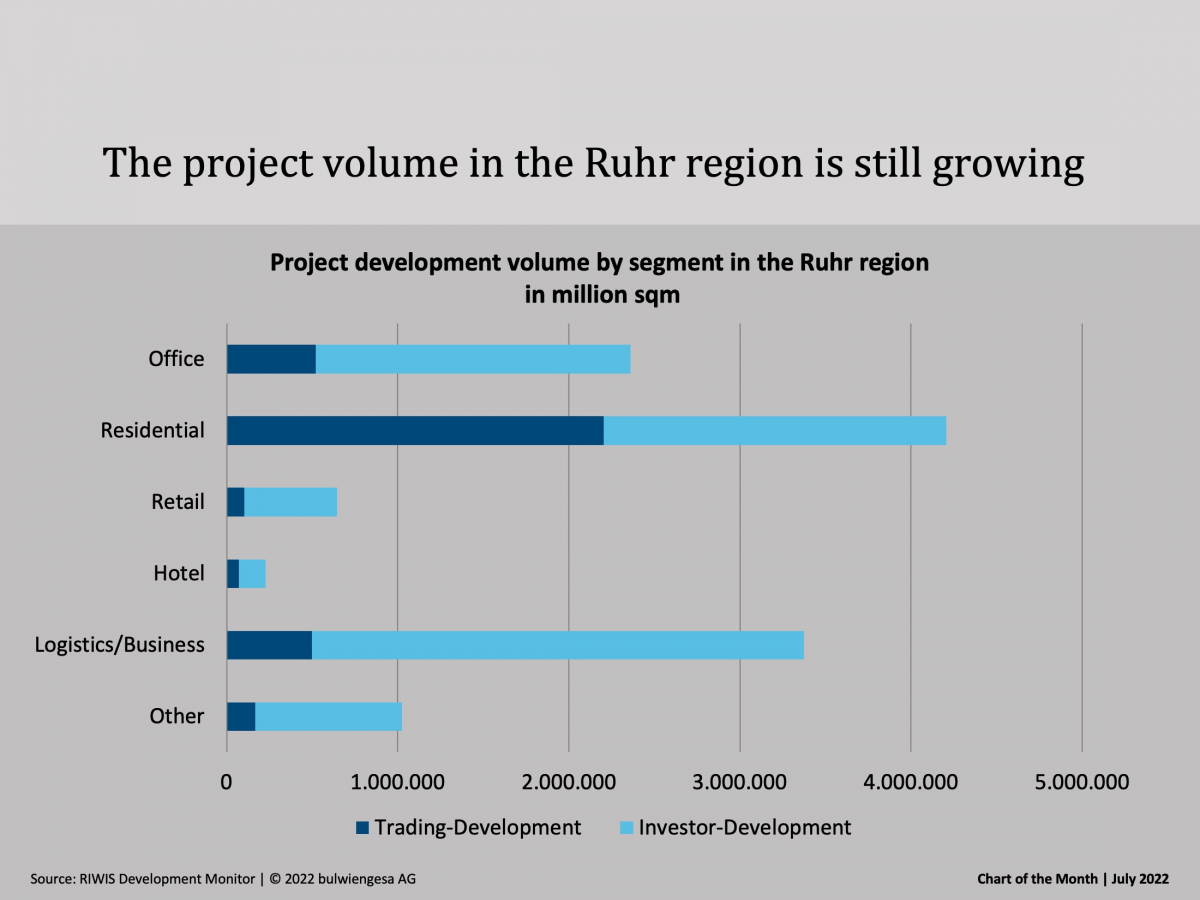

Chart of the Month July: Ruhr Area bucks the trend

Across Germany, the market for project developments is under scrutiny. Nevertheless, the project development volume in the Ruhr region will increase by around 7 % between 2020 and 2022 - and the pipelines are still full.

Chart of the Month

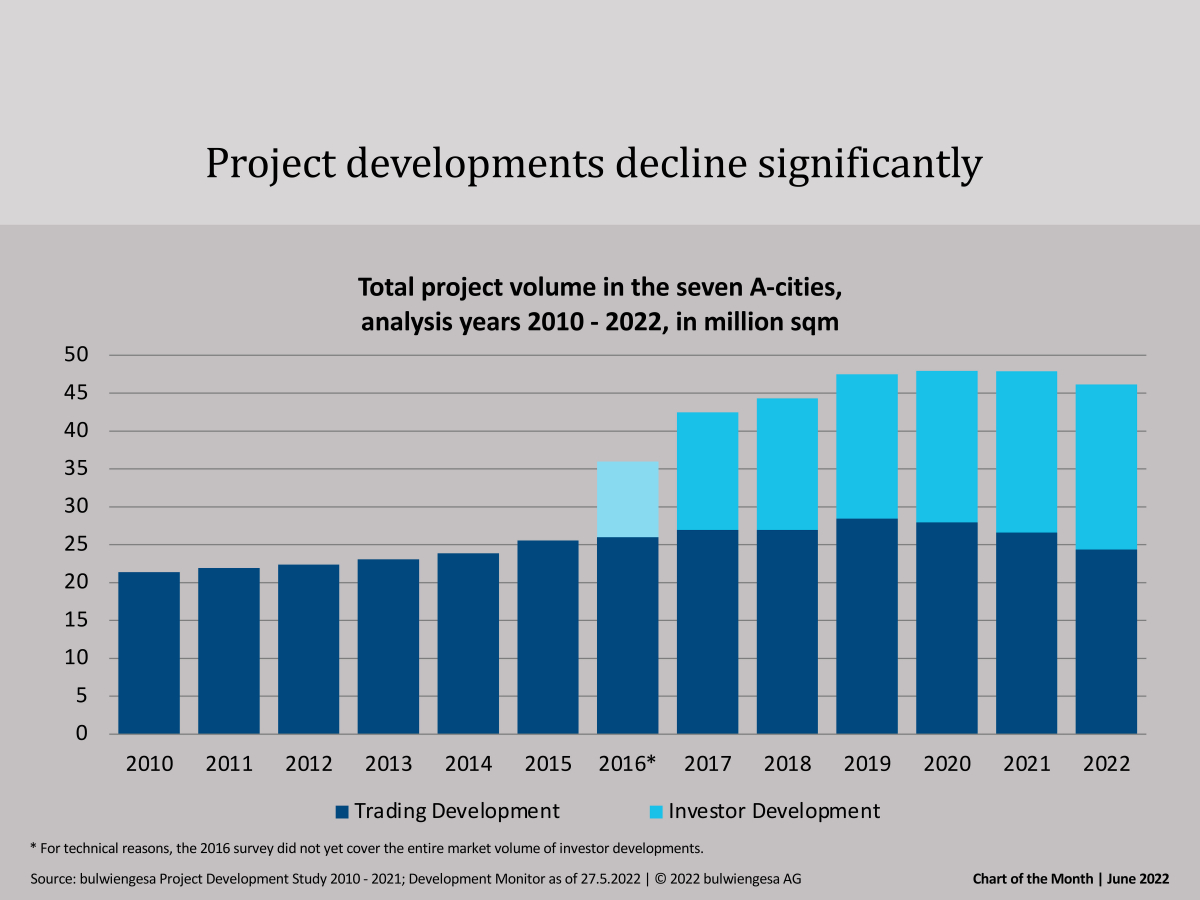

Chart of the Month June: Fewer Project Developments

In the seven class A cities, the project volume now amounts to only 46.2 million sqm. This corresponds to a decline of 3.6 per cent compared to the first Corona year 2020. Trading development in particular is on the decline, while portfolio holders continue to build and plan diligently.

Chart of the Month

Chart of the Month May: Retail vacancy rates in German cities

How are retail vacancies developing? We have looked at the established retail locations in the metropolises of Berlin, Hamburg, Frankfurt, Munich and Cologne. We regularly survey the retail stock there and thus also the vacancy rate. The analysis shows: Vacancy rates have increased most significantly in the top retail locations.

Chart of the Month