Market Report No. 14 by the Initiative Unternehmensimmobilien

The Corona crisis has had a significant impact on the letting and investment market for corporate real estate. The results of the first half of 2020 initially suggested an increased investment volume for 2020 as a whole. However, with a volume of just under 900 million euros, the result in the second half of the year was considerably weaker than in the previous half-year with 1,244 million euros. The reason for this was an increasingly wait-and-see attitude on the part of investors.

The focus of investment demand in the second half of the year was on commercial parks and warehouse properties. The investment volume for both increased compared to the previous year. Overall, commercial parks accounted for almost 65% of the turnover in the second half of the year with around 490 million. The increase in the volume of warehouse properties may have been primarily due to the increased demand for storage capacity during the crisis.

What are corporate properties?

Corporate real estate is mixed-use commercial property with a typical tenant structure of medium-sized companies. The mix includes office, warehouse, manufacturing, research, service and/or wholesale space as well as open space. Corporate real estate includes the four real estate categories of transformation properties, business parks, production properties and smaller warehouse and logistics properties. All four categories are characterised by the features of third-party usability, reversibility of use and a fundamental suitability for multi-party structures.

About the INITIATIVE UNTERNEHMENSIMMOBILIEN

The INITIATIVE UNTERNEHMENSIMMOBILIEN currently comprises eleven companies active in the German market for corporate real estate: Aurelis, BEOS, Corestate Capital Group, Cromwell Property Group, Deutsche Industrie REIT-AG, Frasers Property, Garbe Industrial Real Estate, Investa, Palmira Capital Partners, Siemens and Sirius. The common goal is to improve transparency in this market segment in order to facilitate access to this asset class. To this end, a reporting system has been set up in cooperation with bulwiengesa, in which all transaction and letting data of the participants are evaluated. Investors and market observers are regularly informed about the volume and performance of the sector. This is done primarily in the form of the market report, which is published every six months.

Contact: Daniel Sopka

sopka@bulwiengesa.de

Tel. +49 40 42 32 22 29

und

Oliver Rohr

rohr@bulwiengesa.de

Tel. +49 89 23 23 76 46

Image: Munich Nordring

Source: Aurelis/Cooper Copter

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

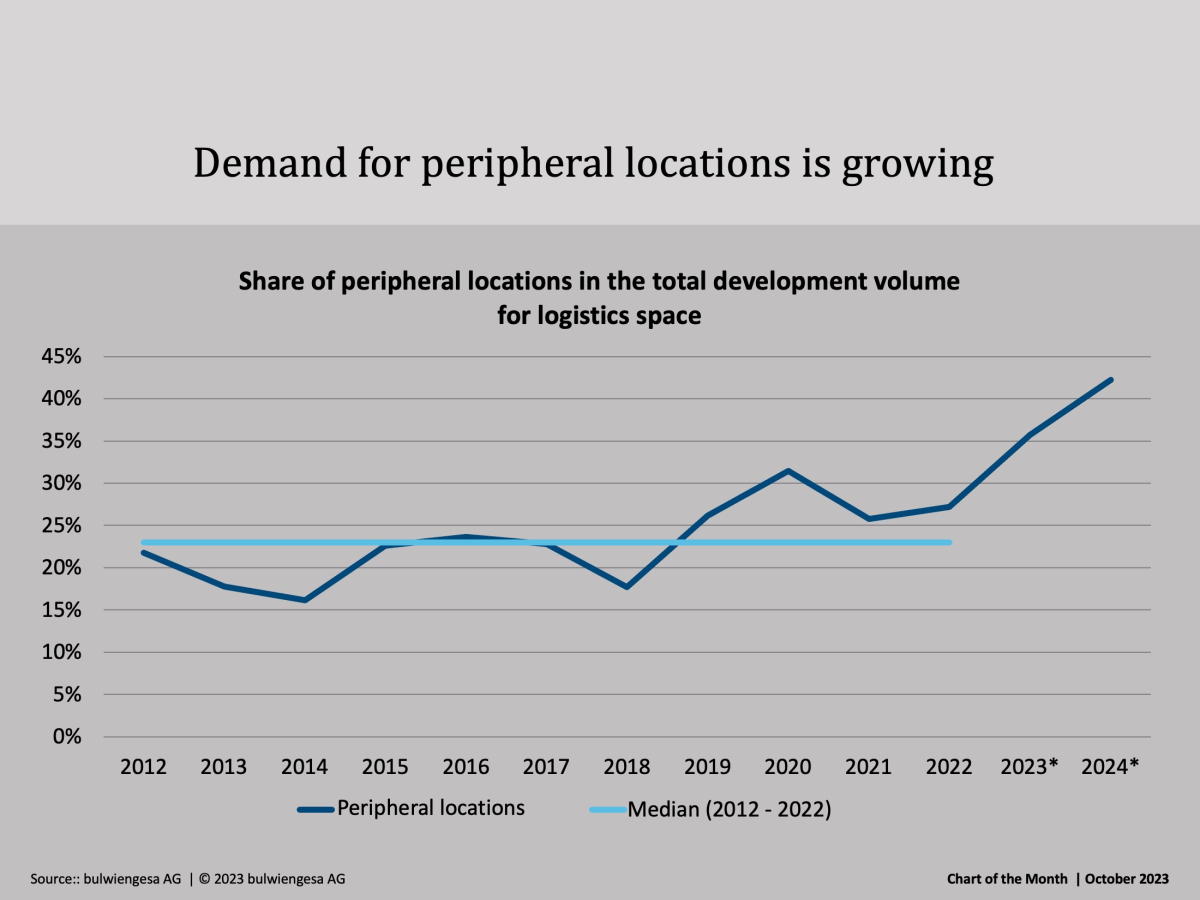

Chart of the Month October: Boom in the peripheral locations

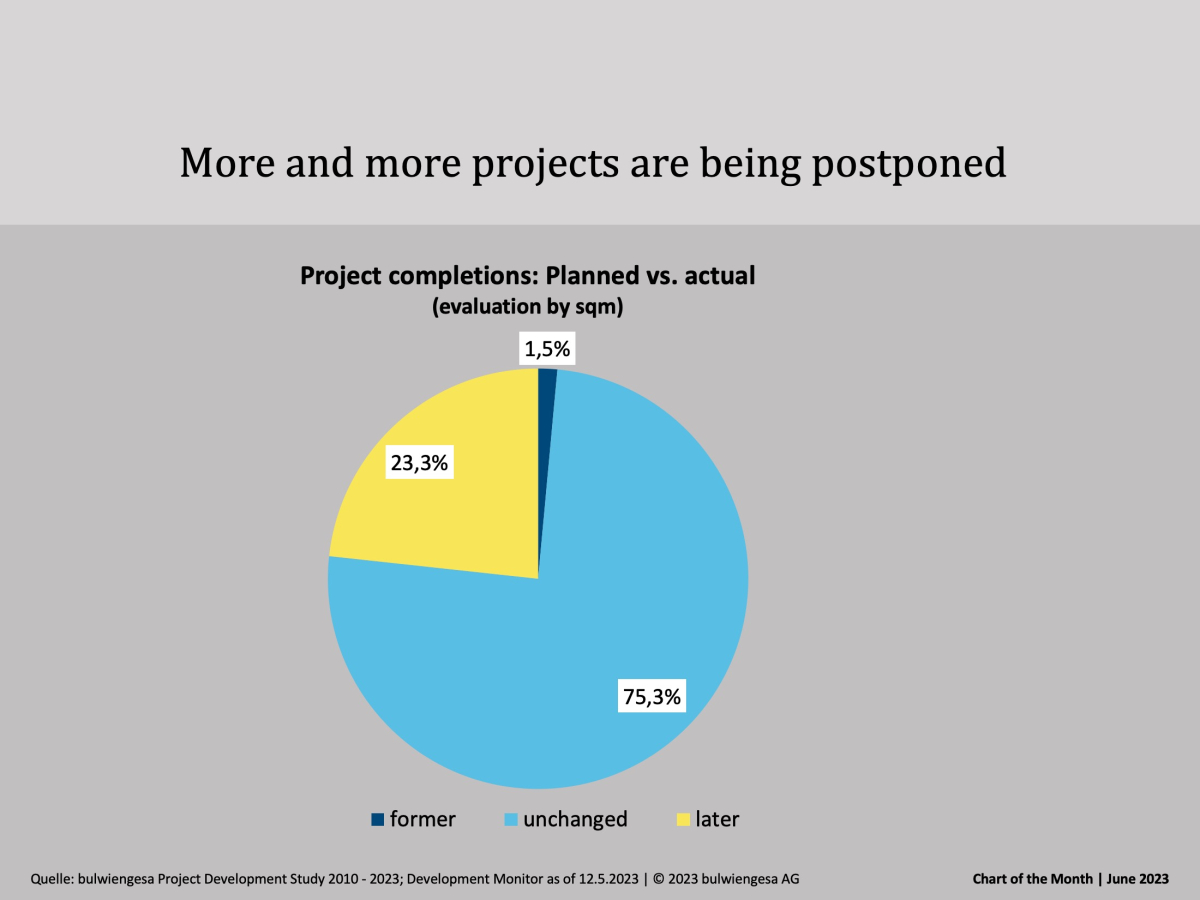

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingChart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedMixed risks

Twice a year we prepare economic forecasts and derive key figures for the various real estate segments. According to this, the caesuras in the economy affect the logistics, residential, office and retail segments very differently. In general, the picture is not as gloomy as it is often conveyed. A summaryInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.