bulwiengesa real estate index 2026

After several difficult years, the bulwiengesa Real Estate Index has recovered with a nominal increase of 1.8%. However, the real estate industry remains in a phase of cautious restraint. Persistently low completion figures, continuing high construction costs, and hesitant investment decisions by commercial and private players are shaping a fragile market environment with high demands on the industry, which is hoping for further economic stimulus. Forward deals and pre-letting are showing initial signs of recovery in 2025, but cannot yet provide project developers with the necessary planning security.

The most important results for 2025:

- Real estate index rises by 1.8% in nominal terms

- Housing market back in clear positive territory: rents rise sharply

- Office rents increase in central locations, while retail remains under pressure

- B cities show the strongest growth nationwide

More detailed information is available in the brochure. Please contact us for individual evaluations and time series, e.g. of individual locations and asset classes.

Contact person: Jan Finke, jan.finke@bulwiengesa.de, phone 0201-8746 96-63

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

Senior Living – the ideal location

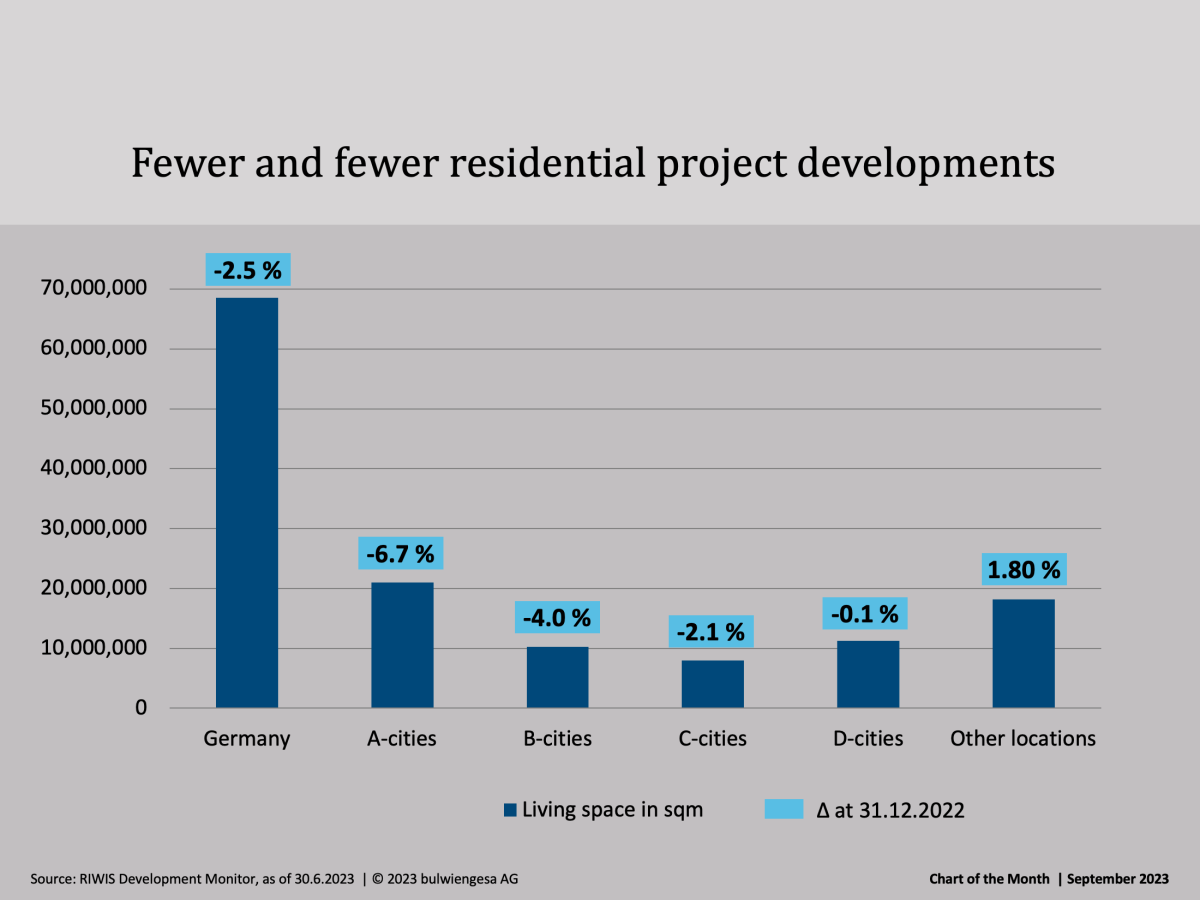

The location is particularly important for properties for seniors. Acceptance by the residents stands and falls with the location of a new building. What should be considered when choosing a location?Chart of the Month September: Residential Project Area Continues to Decline

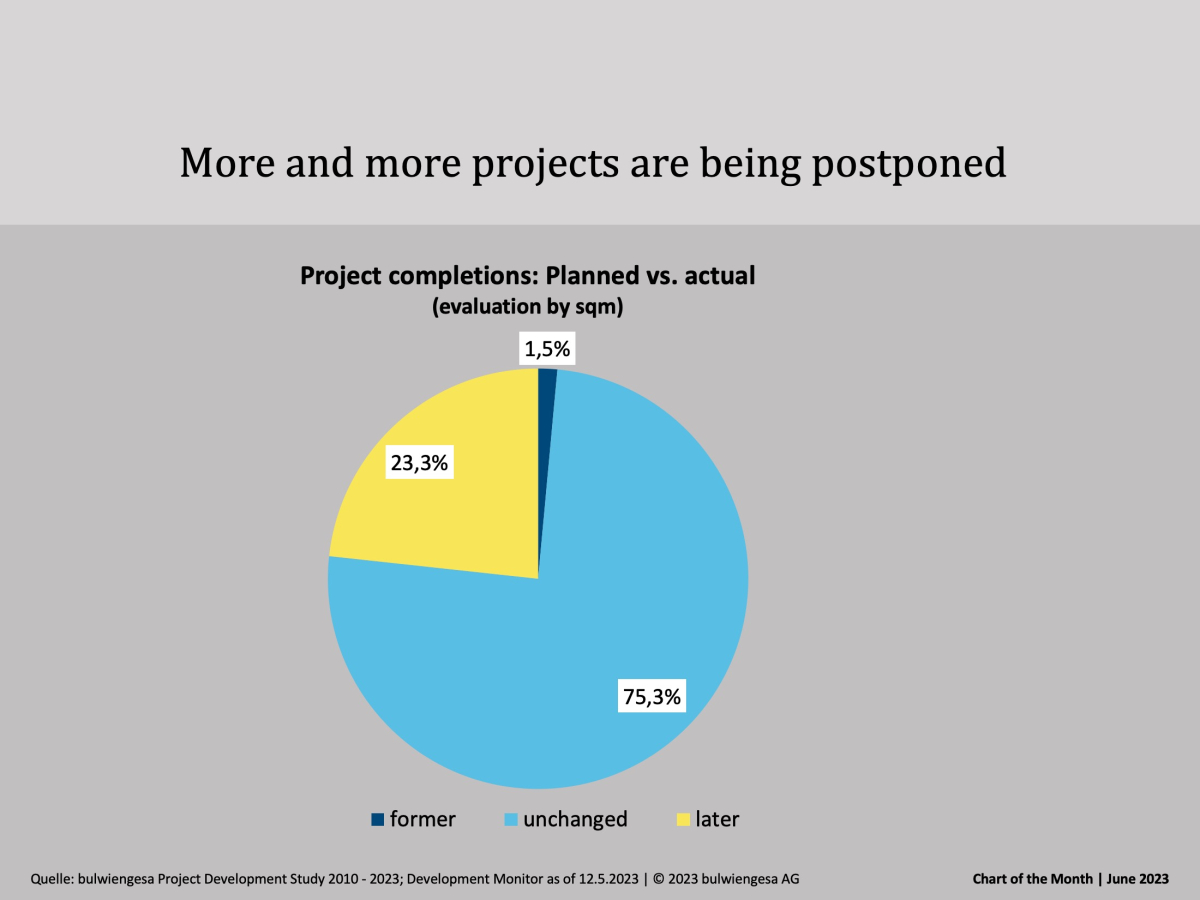

The insolvencies of large and small project developers illustrate the extremely tense market situation. And the number of residential projects planned and under construction is falling - most sharply in the metropolises, of all places, where the housing shortage is greatestChart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.