Study Office Investments in Secondary Locations

For Demire, we examined 35 secondary locations across Germany. Medium-sized economic structures make office markets more stable - one reason why markets in smaller cities are less susceptible to economic fluctuations. Compared to A-cities, they also have a higher yield potential.

When considering the German market for office properties, attention is mostly focused on the seven well-known A-locations of Berlin, Hamburg, Frankfurt, Munich, Cologne, Düsseldorf and Stuttgart. However, Germany is characterised by a decentralised economic structure with relevant secondary locations. The office locations there, however, have received rather less attention so far. In the study, DEMIRE and bulwiengesa explore the question of how secondary locations have reacted to the corona pandemic compared to A-locations and what prospects may arise for the future of these investment markets. The study examines a total of 35 locations. In addition to smaller communities such as Aschheim in Upper Bavaria, major cities such as Leipzig and Dortmund are also included in the analysis.

Contact:

Nicole Tietze

tietze@bulwiengesa.de

Ph. +49 30 27 87 68 27

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

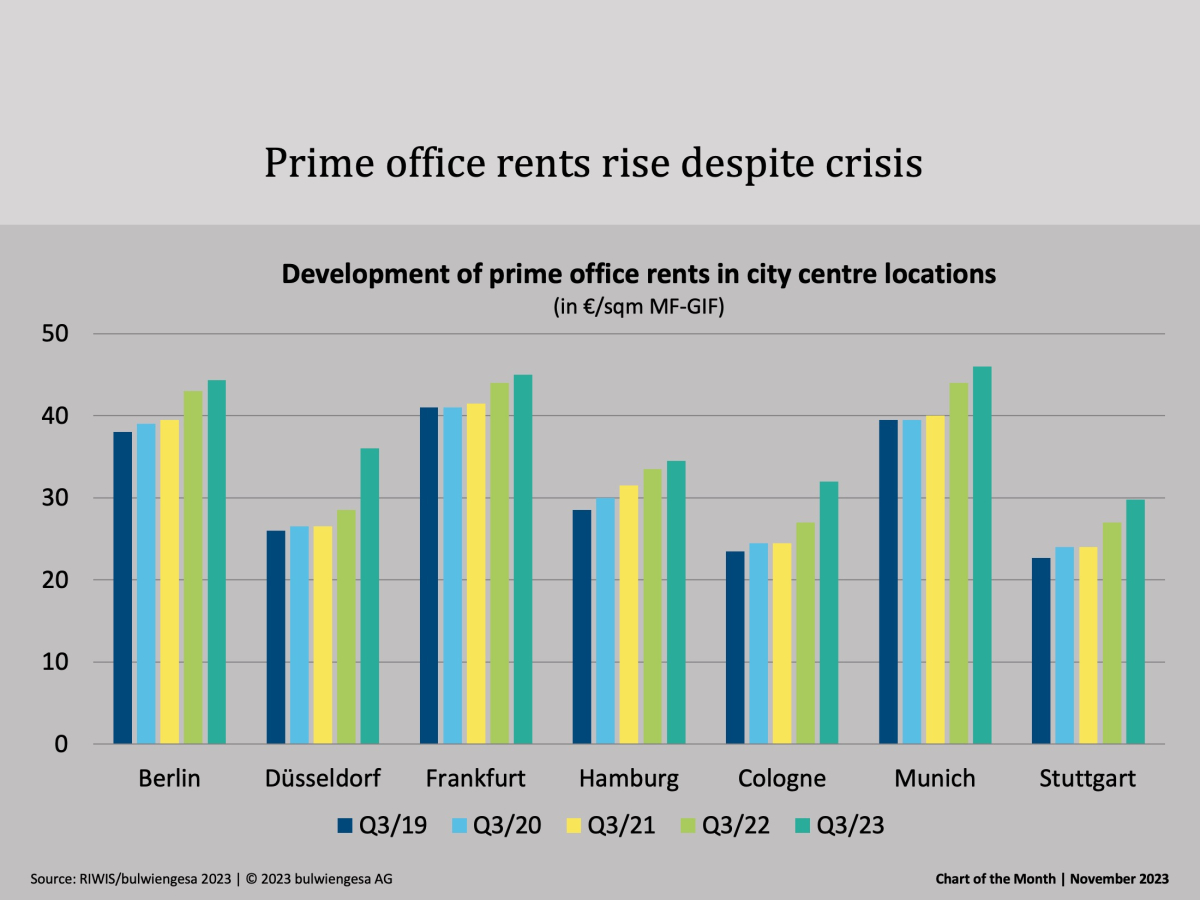

Chart of the month November: Top offices are still in demand

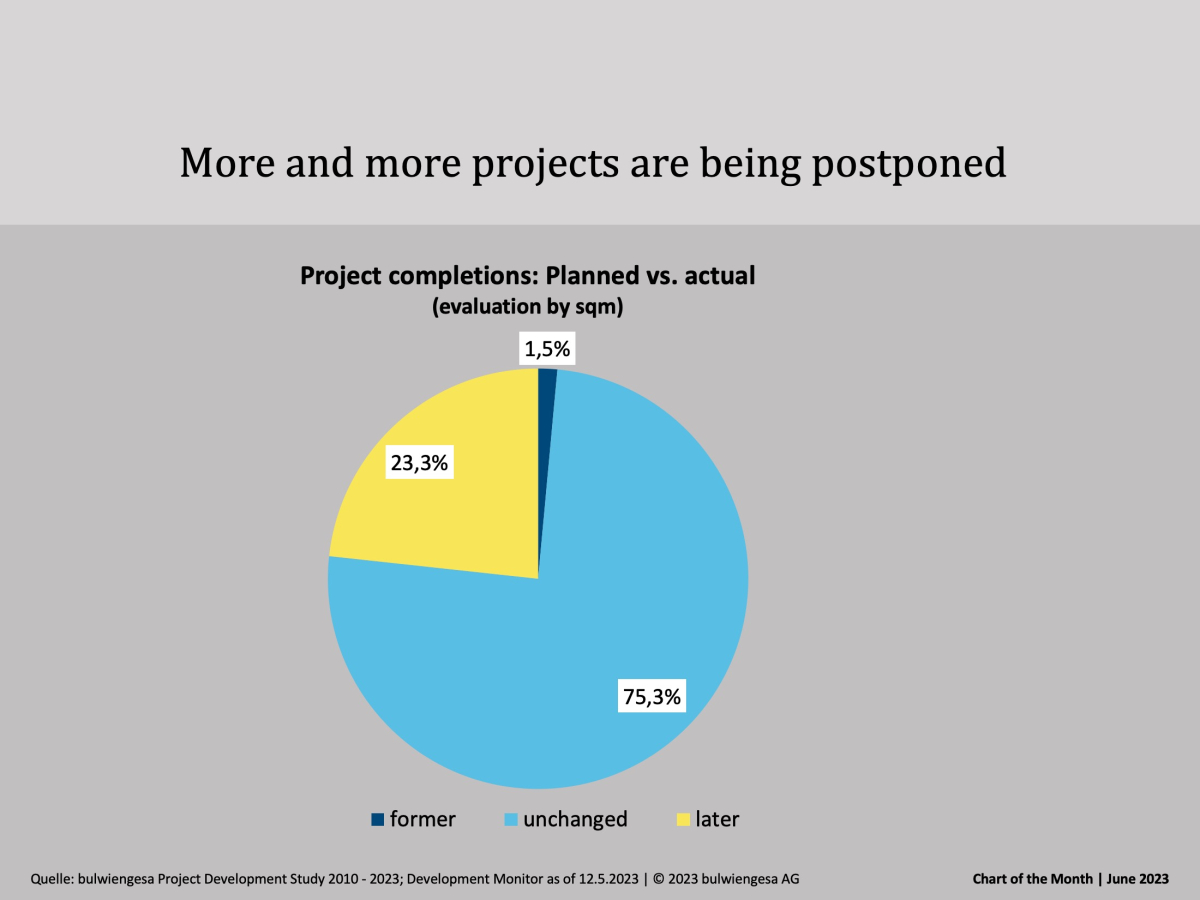

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month June: Every Fourth Project Development Postponed

Project developments in the A-cities have not only declined rapidly. Many projects are also postponedProject developments: Few in planning, many postponed

The crisis is now clearly visible among project developers. The market in the seven class A cities is declining, and the traditional project developers in particular are withdrawing from the market. Residential projects, of all things, are significantly affected. And: Many projects are being completed later than plannedInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.