Chart of the Month March: Increased rents and operating costs burden office tenants

The increase in rents and operating costs affects all real estate segments. For example, the operating costs for offices in A-cities alone have increased by 63 % since 2021. This is the result of the first joint study "Overall Rental Analysis - Office Market Germany" with BAUAKADEMIE.

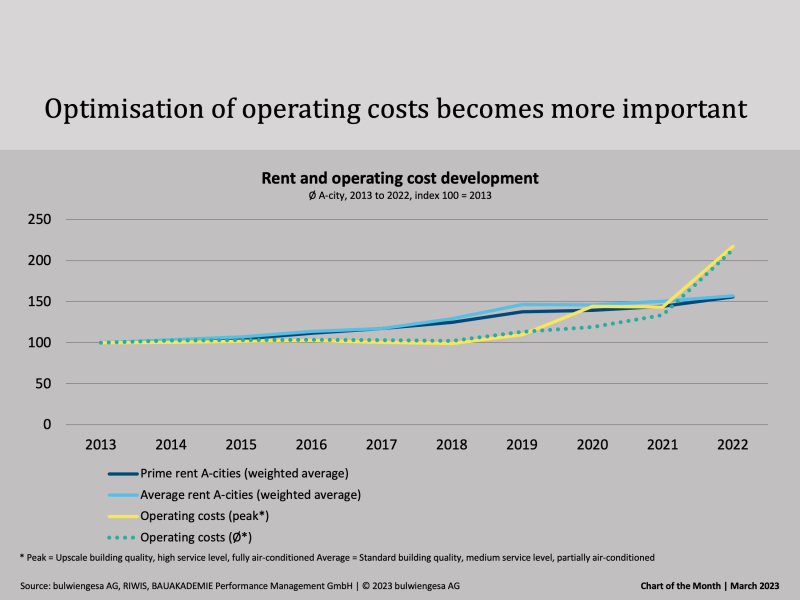

The year 2022 was characterised by rising office rents across Germany, particularly in the area of prime rents. The reasons for this were primarily the passing on of higher costs by landlords, driven by high construction costs and inflation, as well as the willingness of tenants to accept correspondingly higher prices as a result of the focus on central locations. In addition, tenants' increased demands on space quality and sustainability are giving rents a further boost. However, it is also important to note that the prices mentioned below are nominal rents. The growing importance of incentives in the form of rent-free periods and development cost subsidies is not taken into account here. Their influence will continue to have a noticeable impact on effective rents in the future. The increases in rents are particularly strong in the A-cities. Here the weighted average of prime rents rose from 35.70 to 38.60 euros/m² MF-GIF. There were noticeable increases in all cities. The highest prices continue to be achieved in Frankfurt (45.00 euros/m² MF-GIF), Munich (44.50 euros/m²) and Berlin (43.50 euros/m² MF-GIF).

The price increases in the operating costs of office buildings are even more pronounced than the price increases in nominal rents. The example of the A-cities shows that the average operating costs have increased by 63 % since 2021; at the peak it is even 67 %.

After a long period of insignificant cost changes, the pandemic, the Ukraine war and the wage-price spiral have triggered an unprecedented increase in costs. In the past two years, the increase has been particularly strong, amounting to 117% over a ten-year period. This means that the influence of operating costs on the total rent is increasing considerably. The share of operating costs in total costs is now up to approx. 21 % (in peak/new construction) and around 24 % in the existing stock.

The main cost drivers are heating and electricity, triggered by the war in Ukraine and the resulting realignment of energy prices on the world market. The extent to which these cost increases will affect operating costs depends on the prices and terms at which landlords have concluded their energy supply contracts and the effect of the electricity and gas price brakes. In addition, wage costs have risen successively, which have a significant impact on all personnel-intensive services such as maintenance/inspection, cleaning, security and caretaking. The increase in the minimum wage on 1.10.2022 will only have been a foretaste, given the current wage demands of the trade unions to achieve a real wage increase for all employees in the sector. Only the costs for water and sewage have decreased in view of the decline in office occupancy due to the increasing importance of remote work.

Overall, a movement from a landlord to a tenant market is unmistakable. Incidental rental costs in particular are having an increasingly negative impact on the performance of many tenants. Decisions to rent or even to remain in existing space depend more and more on the analysis of the two cost items of cold rent and operating costs. For investors and landlords, in turn, optimising operating costs is becoming increasingly important in order to compete in a more difficult market environment.

You can also find the short study and press release on our website.

More in-depth information on the office property market can be found in the recently published spring report of the ZIA, for which we analysed the office, hotel, logistics and corporate property segments.

Contact: Jakob Heilek, Consultant and author of the short study, heilek@bulwiengesa.de, as well as Alexander Fieback, Team Leader Office, fieback@bulwiengesa.de and Oliver Rohr, Team Leader Office, rohr@bulwiengesa.de, authors of the office chapter in the Spring Report.

You might also be interested in

For our magazine, we have summarized relevant topics, often based on our studies, analyses and projects, and prepared them in a reader-friendly way. This guarantees a quick overview of the latest news from the real estate industry.

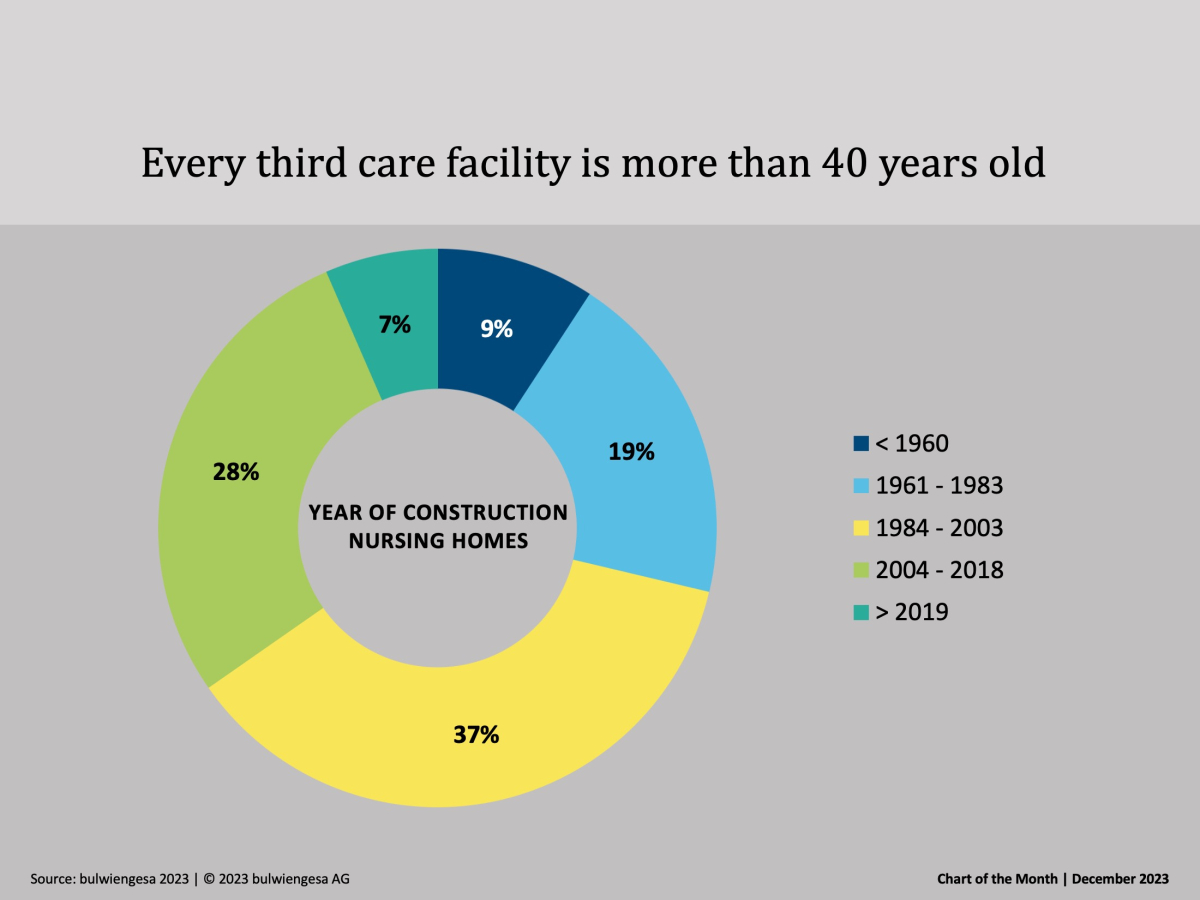

Chart of the month December: The country needs new care properties

Many care homes are no longer up to date - no one wants "care centres" any more, and building standards have changed fundamentally. Therefore, when planning the care infrastructure, not only the additional need for care places, but also the need for substitution must be taken into account.Chart of the month November: Top offices are still in demand

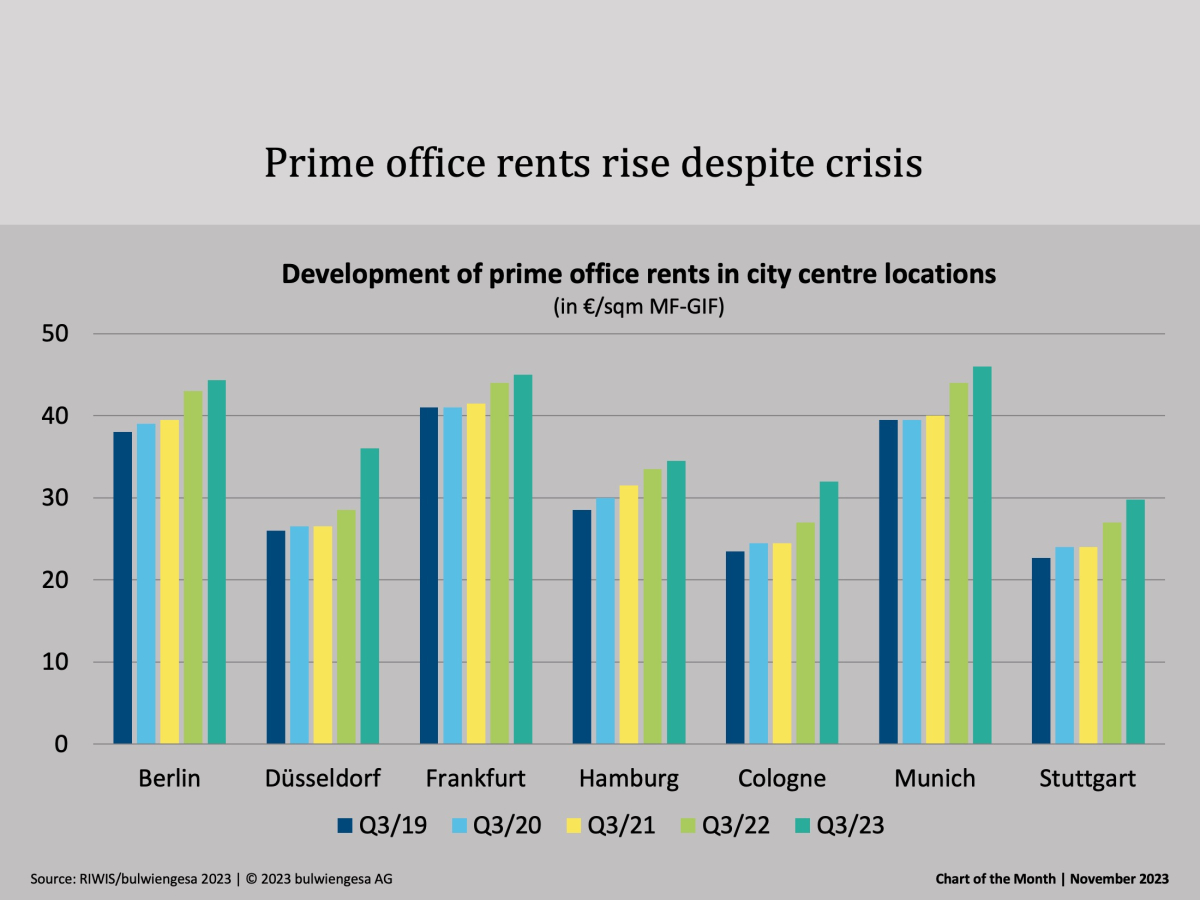

Office vacancies are increasing in the seven class A cities. According to classic economic theory, rents should therefore be falling. But our quarterly figures show: Prime rents are still risingChart of the Month October: Boom in the peripheral locations

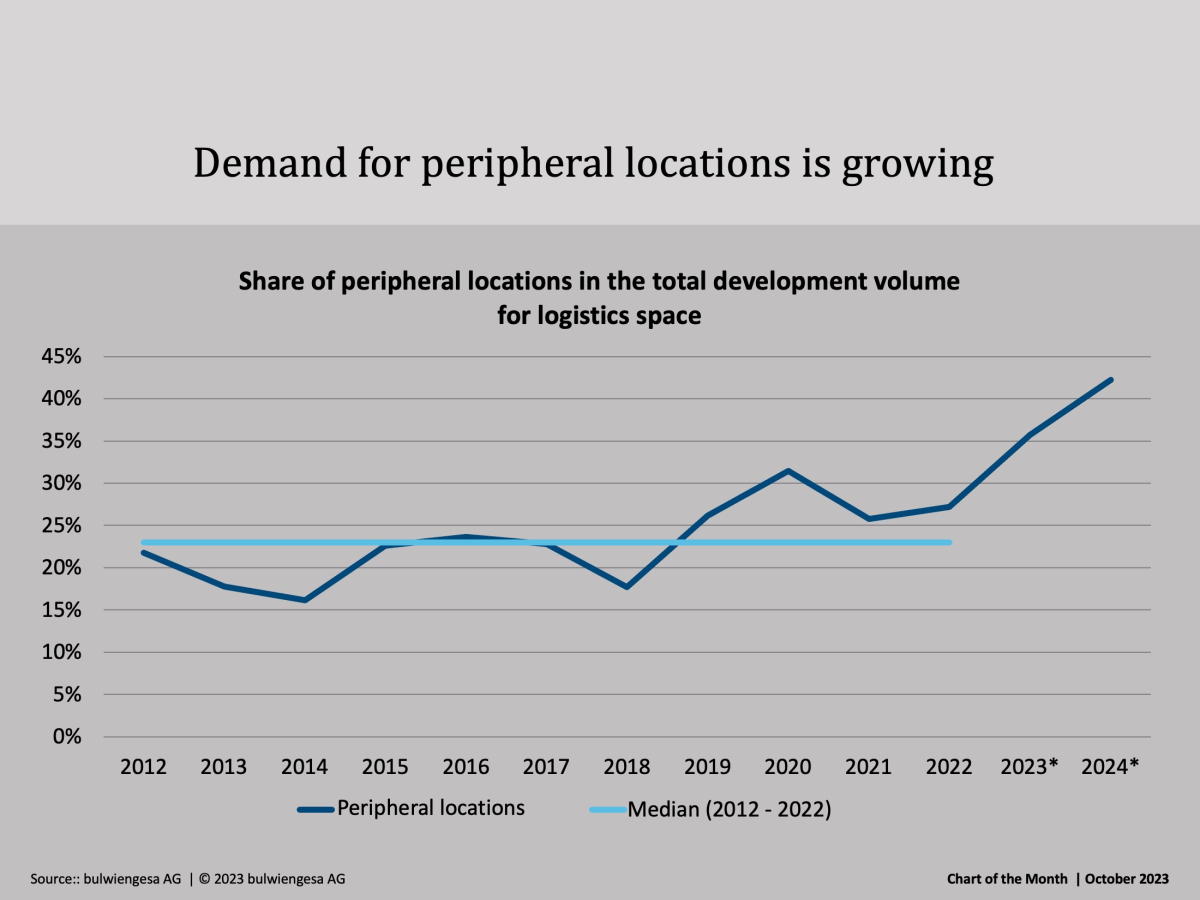

The recently published study "Logistics and Real Estate 2023" shows: former "second-tier" regions are increasingly in demand - even those outside the classic logistics regions. And the trend is continuingInteresting publications

Here you will find studies and analyses, some of which we have prepared on behalf of customers or on our own initiative based on our data and market expertise. You can download and read many of them free of charge here.